ES Daily Plan | February 26, 2025

Key Levels & Market Context for the Upcoming Session.

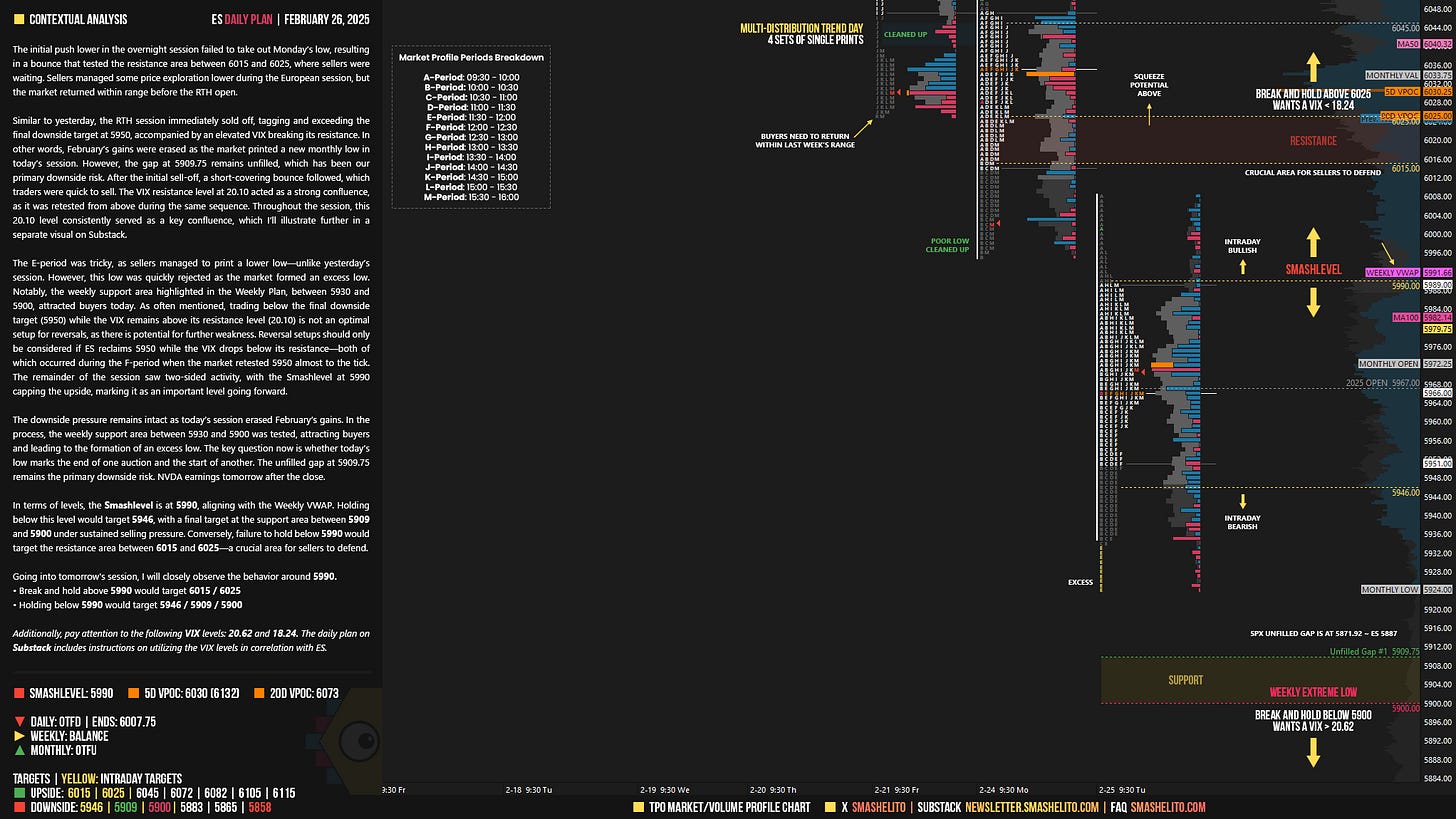

For new followers: The yellow levels highlighted at the bottom left of the chart are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final yellow upside target and shorts below the final yellow downside target. It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Visual Representation

Contextual Analysis

The initial push lower in the overnight session failed to take out Monday’s low, resulting in a bounce that tested the resistance area between 6015 and 6025, where sellers were waiting. Sellers managed some price exploration lower during the European session, but the market returned within range before the RTH open.

Similar to yesterday, the RTH session immediately sold off, tagging and exceeding the final downside target at 5950, accompanied by an elevated VIX breaking its resistance. In other words, February’s gains were erased as the market printed a new monthly low in today’s session. However, the gap at 5909.75 remains unfilled, which has been our primary downside risk. After the initial sell-off, a short-covering bounce followed, which traders were quick to sell. The VIX resistance level at 20.10 acted as a strong confluence, as it was retested from above during the same sequence. Throughout the session, this 20.10 level consistently served as a key confluence, which I’ll illustrate further in a separate visual on Substack.

The E-period was tricky, as sellers managed to print a lower low—unlike yesterday’s session. However, this low was quickly rejected as the market formed an excess low. Notably, the weekly support area highlighted in the Weekly Plan, between 5930 and 5900, attracted buyers today. As often mentioned, trading below the final downside target (5950) while the VIX remains above its resistance level (20.10) is not an optimal setup for reversals, as there is potential for further weakness. Reversal setups should only be considered if ES reclaims 5950 while the VIX drops below its resistance—both of which occurred during the F-period when the market retested 5950 almost to the tick. The remainder of the session saw two-sided activity, with the Smashlevel at 5990 capping the upside, marking it as an important level going forward.

The downside pressure remains intact as today’s session erased February’s gains. In the process, the weekly support area between 5930 and 5900 was tested, attracting buyers and leading to the formation of an excess low. The key question now is whether today’s low marks the end of one auction and the start of another. The unfilled gap at 5909.75 remains the primary downside risk. NVDA earnings tomorrow after the close.

In terms of levels, the Smashlevel is at 5990, aligning with the Weekly VWAP. Holding below this level would target 5946, with a final target at the support area between 5909 and 5900 under sustained selling pressure. Conversely, failure to hold below 5990 would target the resistance area between 6015 and 6025—a crucial area for sellers to defend.

Levels of Interest

Going into tomorrow's session, I will closely observe the behavior around 5990.

Break and hold above 5990 would target 6015 / 6025

Holding below 5990 would target 5946 / 5909 / 5900

Additionally, pay attention to the following VIX levels: 20.62 and 18.24. These levels can provide confirmation of strength or weakness.

Break and hold above 6025 with VIX below 18.24 would confirm strength.

Break and hold below 5900 with VIX above 20.62 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Weekly Plan

Make sure to review the Weekly Plan, which provides a broader perspective and highlights key levels of interest to observe in the upcoming week.

Marvelous work, brother. Interesting times ahead👀

Thanks Smash!