ES Daily Plan | February 19, 2025

My preparations and expectations for the upcoming session.

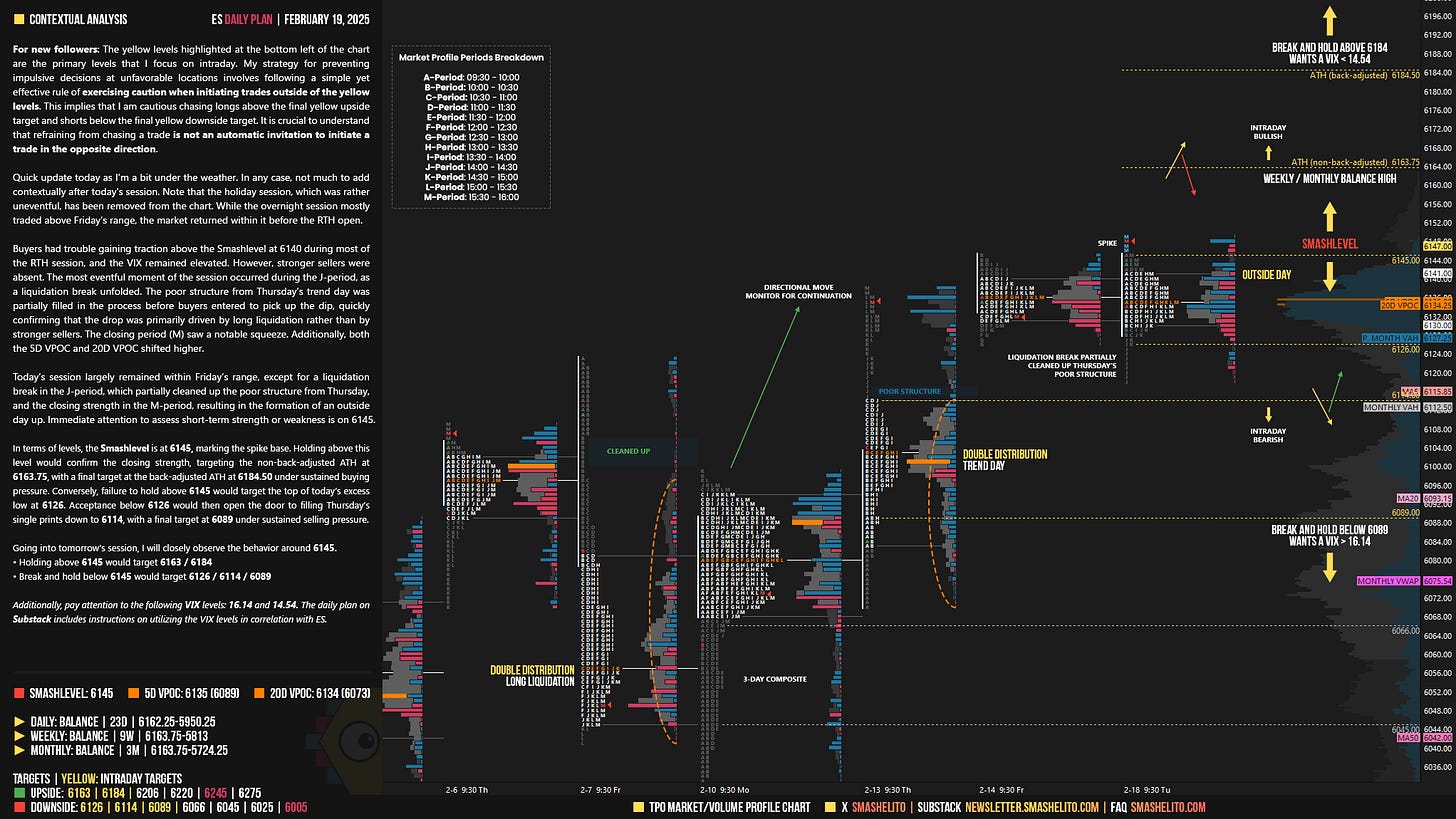

For new followers: The yellow levels highlighted at the bottom left of the chart are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final yellow upside target and shorts below the final yellow downside target. It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Visual Representation

Contextual Analysis

Quick update today as I'm a bit under the weather. In any case, not much to add contextually after today's session. Note that the holiday session, which was rather uneventful, has been removed from the chart. While the overnight session mostly traded above Friday’s range, the market returned within it before the RTH open.

Buyers had trouble gaining traction above the Smashlevel at 6140 during most of the RTH session, and the VIX remained elevated. However, stronger sellers were absent. The most eventful moment of the session occurred during the J-period, as a liquidation break unfolded. The poor structure from Thursday’s trend day was partially filled in the process before buyers entered to pick up the dip, quickly confirming that the drop was primarily driven by long liquidation rather than by stronger sellers. The closing period (M) saw a notable squeeze. Additionally, both the 5D VPOC and 20D VPOC shifted higher.

Today’s session largely remained within Friday’s range, except for a liquidation break in the J-period, which partially cleaned up the poor structure from Thursday, and the closing strength in the M-period, resulting in the formation of an outside day up. Immediate attention to assess short-term strength or weakness is on 6145.

In terms of levels, the Smashlevel is at 6145, marking the spike base. Holding above this level would confirm the closing strength, targeting the non-back-adjusted ATH at 6163.75, with a final target at the back-adjusted ATH at 6184.50 under sustained buying pressure. Conversely, failure to hold above 6145 would target the top of today’s excess low at 6126. Acceptance below 6126 would then open the door to filling Thursday’s single prints down to 6114, with a final target at 6089 under sustained selling pressure.

Levels of Interest

Going into tomorrow's session, I will closely observe the behavior around 6145.

Holding above 6145 would target 6163 / 6184

Break and hold below 6145 would target 6126 / 6114 / 6089

Additionally, pay attention to the following VIX levels: 16.14 and 14.54. These levels can provide confirmation of strength or weakness.

Break and hold above 6184 with VIX below 14.54 would confirm strength.

Break and hold below 6089 with VIX above 16.14 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Weekly Plan

Make sure to review the Weekly Plan, which provides a broader perspective and highlights key levels of interest to observe in the upcoming week.

EXCELLENT as always - yep you are the real deal Smash - i have been back watching and you are soooo on point. Sending out healthy vibes to you.

Thank you!