ES Daily Plan | February 12, 2026

Market Context & Key Levels for the Day Ahead

— For new subscribers

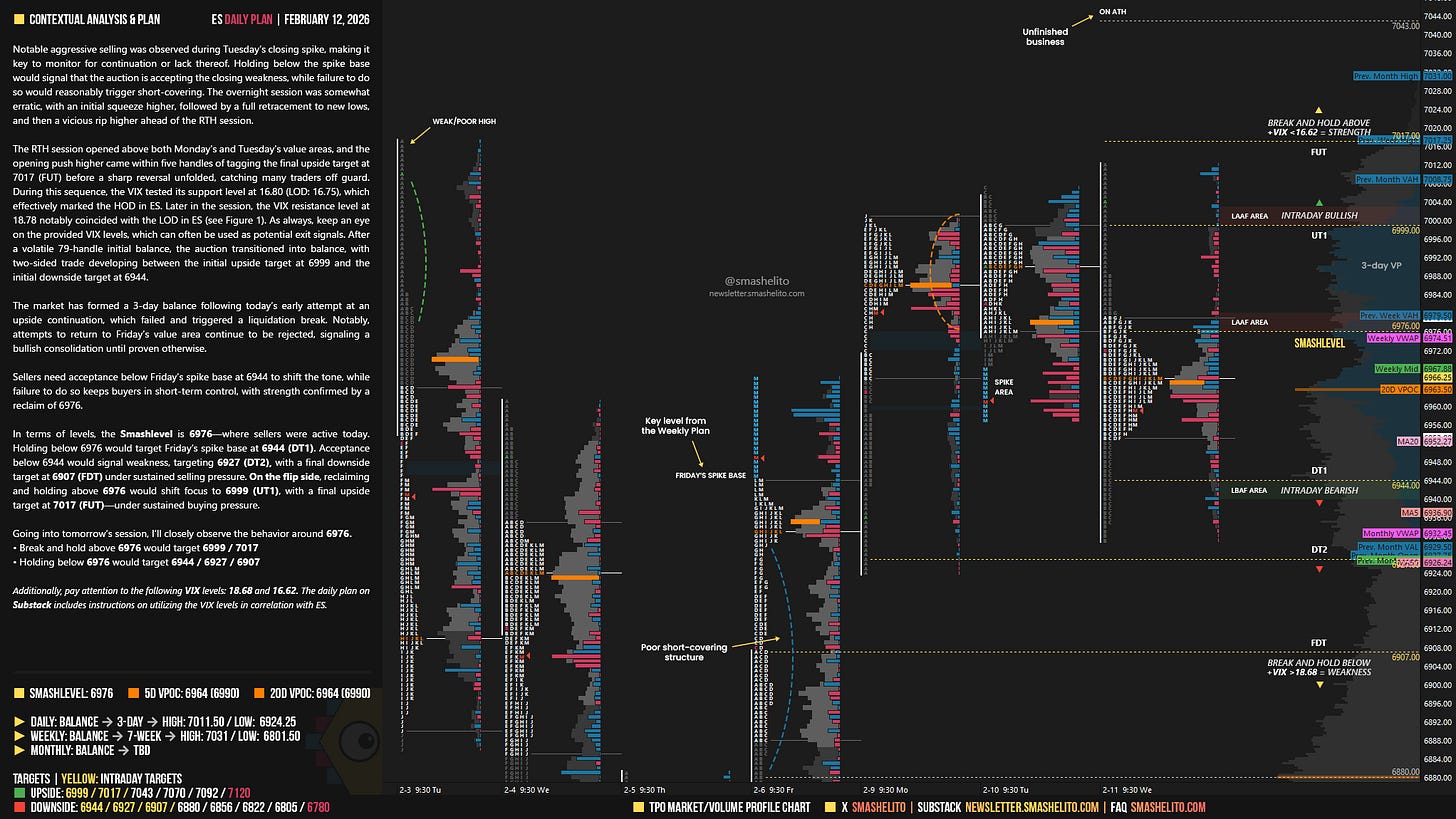

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the Weekly Plan for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

Notable aggressive selling was observed during Tuesday’s closing spike, making it key to monitor for continuation or lack thereof. Holding below the spike base would signal that the auction is accepting the closing weakness, while failure to do so would reasonably trigger short-covering. The overnight session was somewhat erratic, with an initial squeeze higher, followed by a full retracement to new lows, and then a vicious rip higher ahead of the RTH session.

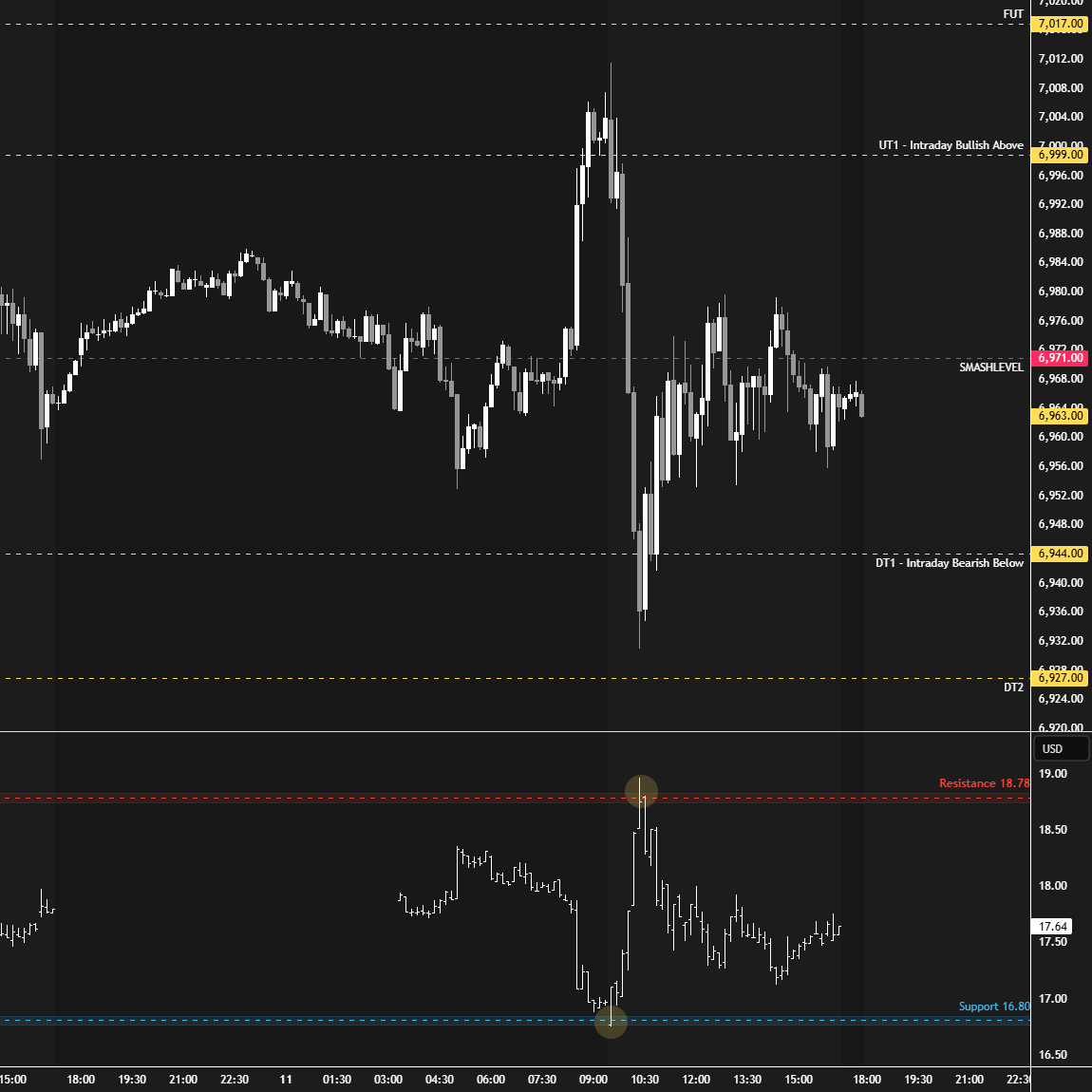

The RTH session opened above both Monday’s and Tuesday’s value areas, and the opening push higher came within five handles of tagging the final upside target at 7017 (FUT) before a sharp reversal unfolded, catching many traders off guard. During this sequence, the VIX tested its support level at 16.80 (LOD: 16.75), which effectively marked the HOD in ES. Later in the session, the VIX resistance level at 18.78 notably coincided with the LOD in ES (see Figure 1).

As always, keep an eye on the provided VIX levels, which can often be used as potential exit signals. After a volatile 79-handle initial balance, the auction transitioned into balance, with two-sided trade developing between the initial upside target at 6999 and the initial downside target at 6944.

The market has formed a 3-day balance following today’s early attempt at an upside continuation, which failed and triggered a liquidation break. Notably, attempts to return to Friday’s value area continue to be rejected, signaling a bullish consolidation until proven otherwise.

Sellers need acceptance below Friday’s spike base at 6944 to shift the tone, while failure to do so keeps buyers in short-term control, with strength confirmed by a reclaim of 6976.

In terms of levels, the Smashlevel is 6976—where sellers were active today. Holding below 6976 would target Friday’s spike base at 6944 (DT1). Acceptance below 6944 would signal weakness, targeting 6927 (DT2), with a final downside target at 6907 (FDT) under sustained selling pressure.

On the flip side, reclaiming and holding above 6976 would shift focus to 6999 (UT1), with a final upside target at 7017 (FUT)—under sustained buying pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6976.

Break and hold above 6976 would target 6999 / 7017

Holding below 6976 would target 6944 / 6927 / 6907

Additionally, pay attention to the following VIX levels: 18.68 and 16.62. These levels can provide confirmation of strength or weakness.

Break and hold above 7017 with VIX below 16.62 would confirm strength.

Break and hold below 6907 with VIX above 18.68 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

appreciate you

Thank you!