ES Daily Plan | December 9, 2024

My preparations and expectations for the upcoming session.

For new followers: The yellow levels highlighted at the bottom left of the chart are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final yellow upside target and shorts below the final yellow downside target. It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Visual Representation

Contextual Analysis

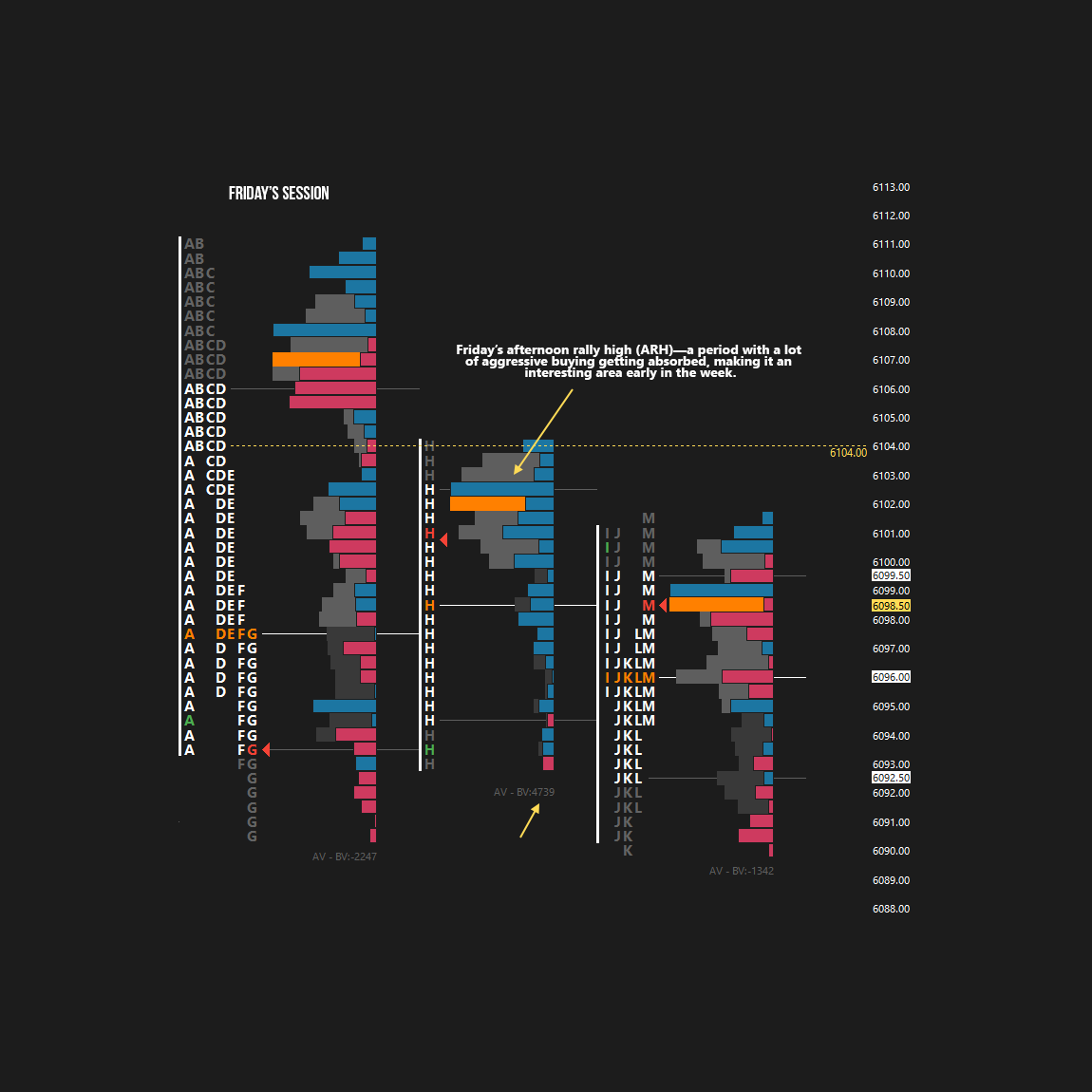

Wednesday’s session opened with a true gap up, breaking out from the short-term balance established after the 3-day balance breakout. The price exploration to the upside continued on Thursday and Friday, successfully shifting the 5-day VPOC higher from 6062 to 6098—a bullish indication within the context of the upside gap. Value continues to follow price. However, there are potential signs of exhaustion, given the formation of two consecutive poor highs.

Sometimes, the market must break to flush out weak-handed longs and attract stronger buyers at lower prices. This suggests that any liquidation break failing to establish acceptance within last week’s lower distribution could provide a potential opportunity for new buyers to enter. As a result, the lower end of the upper distribution and the upper end of the lower distribution remain key areas of interest. Immediate weakness is particularly interesting, provided the poor high remains unresolved. Should the market clean up the poor high early on, form excess, and return within last week’s range, any subsequent weakness could have legs, as excess often marks the end of one auction and the beginning of another.

As discussed in the Weekly Plan, higher prices continue to be accepted, keeping buyers in control of the auction. The current ATH at 6111 is poor and lacks excess, suggesting it is not a well-auctioned high and should be carried forward.

In terms of levels, the Smashlevel is at 6104, marking Friday’s afternoon rally high (ARH). Holding below this level would target Friday’s poor low of 6090. Acceptance below 6090 would then target 6078, with a final target at the unfilled gap at 6066 under sustained selling pressure. Failure to hold below 6104 would target 6117, with a final target at 6135 under sustained buying pressure.

Levels of Interest

Going into tomorrow's session, I will closely observe the behavior around 6104.

Break and hold above 6104 would target 6117 / 6135

Holding below 6104 would target 6090 / 6078 / 6066

Additionally, pay attention to the following VIX levels: 13.46 and 12.06. These levels can provide confirmation of strength or weakness.

Break and hold above 6135 with VIX below 12.06 would confirm strength.

Break and hold below 6066 with VIX above 13.46 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Weekly Plan

Make sure to review the Weekly Plan, which provides a broader perspective and highlights key levels of interest to observe in the upcoming week.

NOTE: VIX levels corrected (13.46 & 12.06).

Thank you, buddy! Let's have a tremendous week!