ES Daily Plan | December 8, 2025

Market Context & Key Levels for the Day Ahead

— For new subscribers

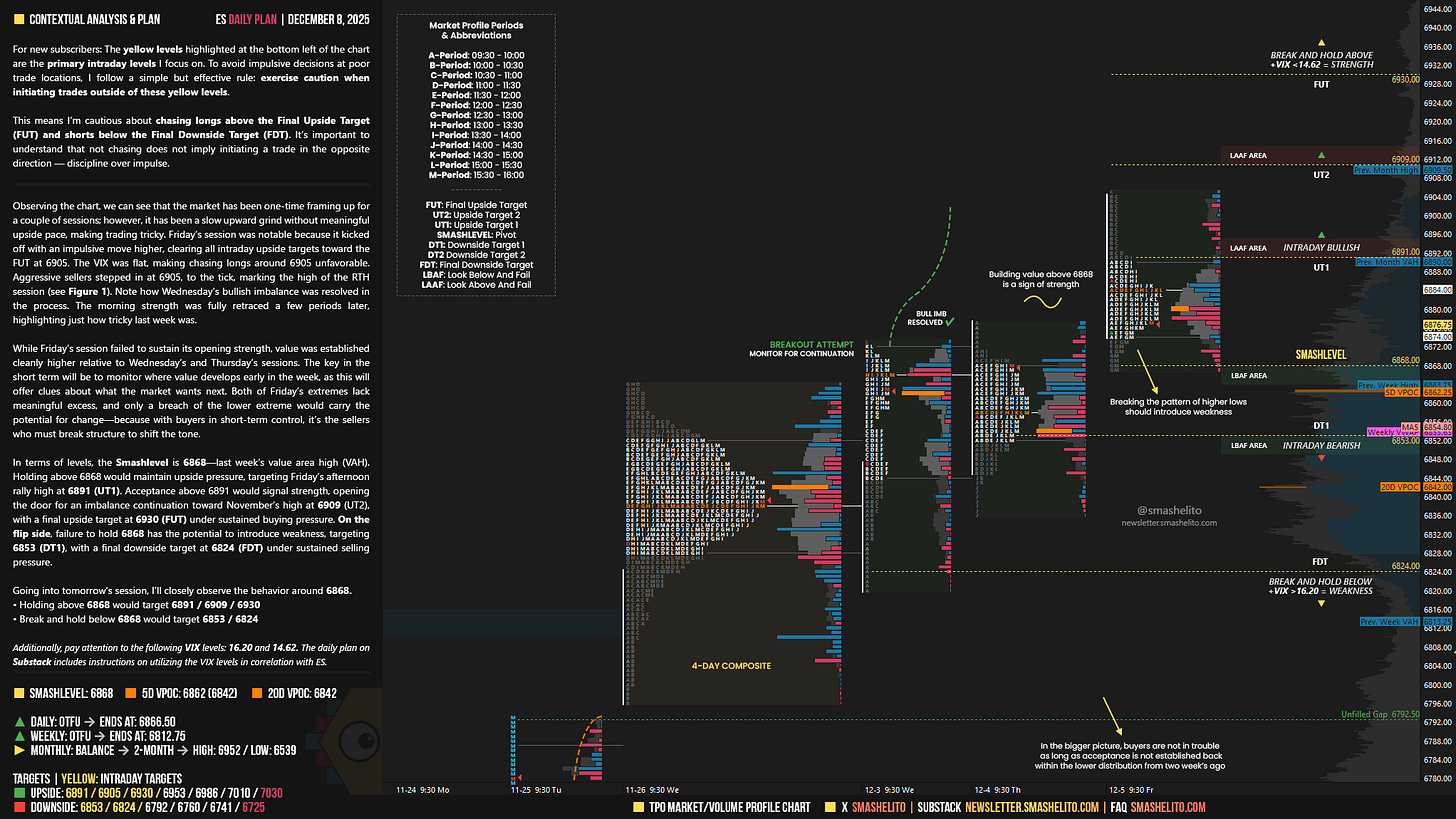

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the Weekly Plan for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

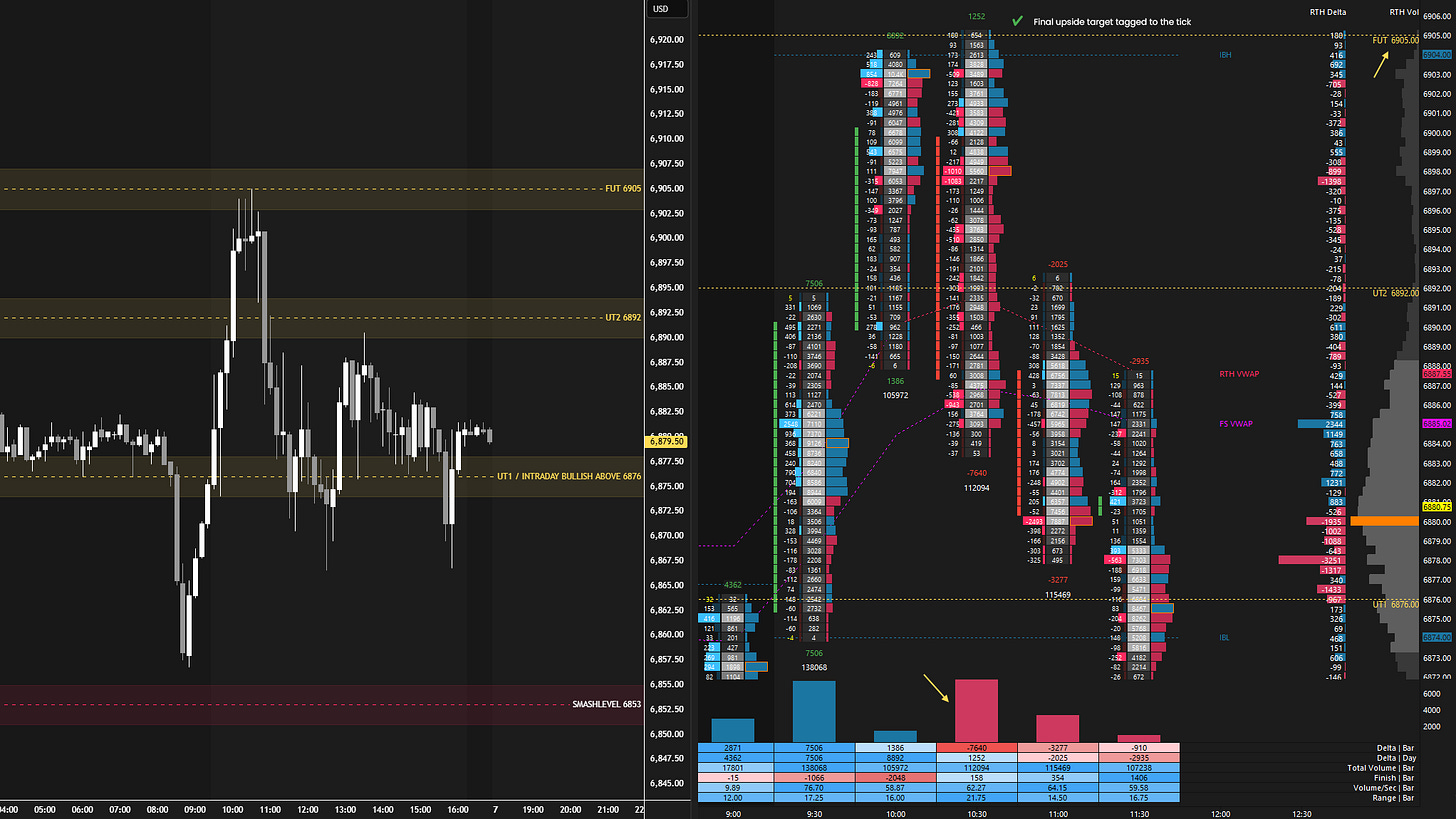

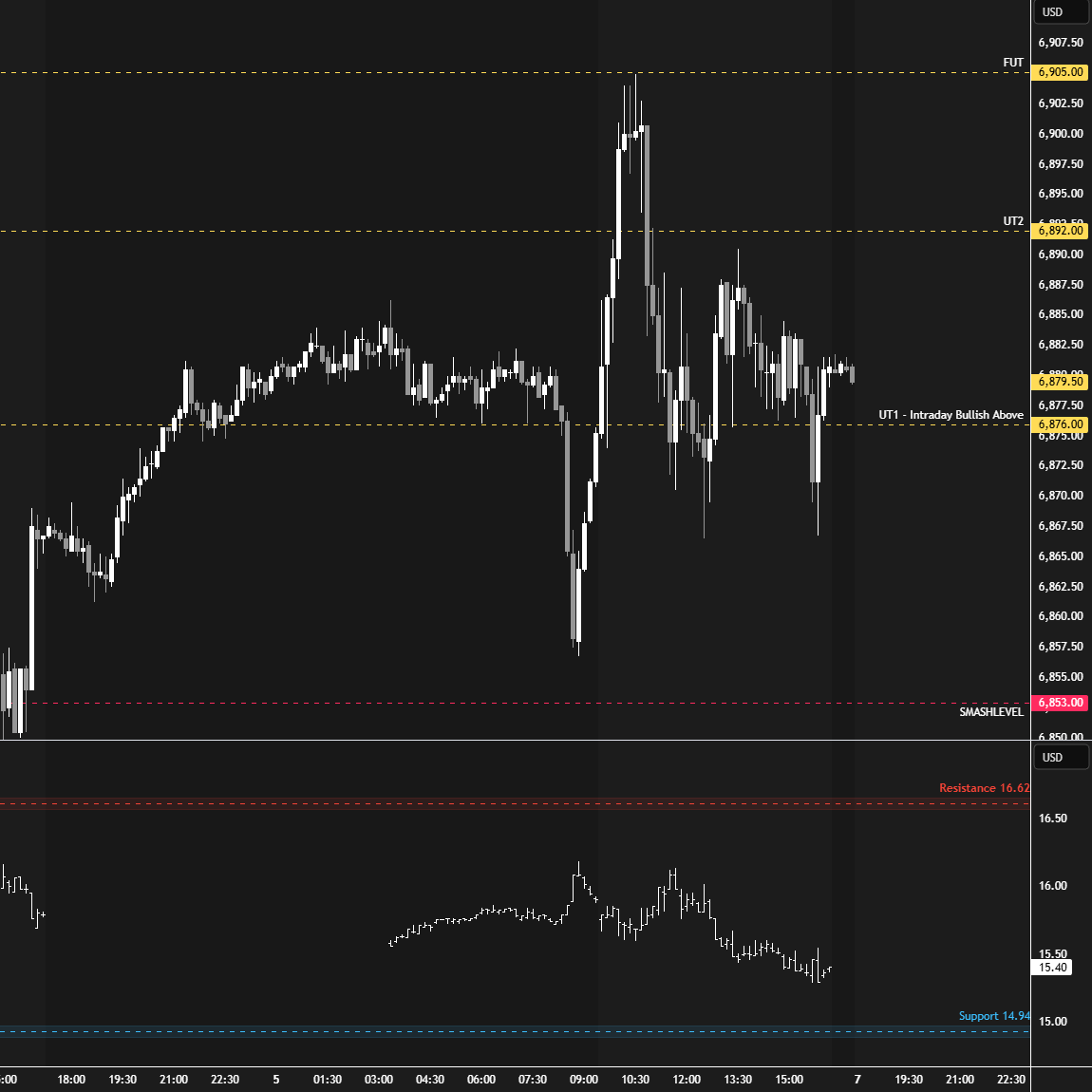

Observing the chart, we can see that the market has been one-time framing up for a couple of sessions; however, it has been a slow upward grind without meaningful upside pace, making trading tricky. Friday’s session was notable because it kicked off with an impulsive move higher, clearing all intraday upside targets toward the FUT at 6905. The VIX was flat, making chasing longs around 6905 unfavorable. Aggressive sellers stepped in at 6905, to the tick, marking the high of the RTH session (see Figure 1). Note how Wednesday’s bullish imbalance was resolved in the process. The morning strength was fully retraced a few periods later, highlighting just how tricky last week was.

While Friday’s session failed to sustain its opening strength, value was established cleanly higher relative to Wednesday’s and Thursday’s sessions. The key in the short term will be to monitor where value develops early in the week, as this will offer clues about what the market wants next. Both of Friday’s extremes lack meaningful excess, and only a breach of the lower extreme would carry the potential for change—because with buyers in short-term control, it’s the sellers who must break structure to shift the tone.

In terms of levels, the Smashlevel is 6868—last week’s value area high (VAH). Holding above 6868 would maintain upside pressure, targeting Friday’s afternoon rally high at 6891 (UT1). Acceptance above 6891 would signal strength, opening the door for an imbalance continuation toward November’s high at 6909 (UT2), with a final upside target at 6930 (FUT) under sustained buying pressure.

On the flip side, failure to hold 6868 has the potential to introduce weakness, targeting 6853 (DT1), with a final downside target at 6824 (FDT) under sustained selling pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6868.

Holding above 6868 would target 6891 / 6909 / 6930

Break and hold below 6868 would target 6853 / 6824

Additionally, pay attention to the following VIX levels: 16.20 and 14.62. These levels can provide confirmation of strength or weakness.

Break and hold above 6930 with VIX below 14.62 would confirm strength.

Break and hold below 6824 with VIX above 16.20 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Have a great start to your session and a great week, thanks for everything

Buenas tardes, Smashelito. Thank you for all your comments in your newsletter. Furthermore, I find very useful the comments you write on the chart too. Gracias, que tengas una buena semana. Cordiali Saluti da Helsinki.