ES Daily Plan | December 5, 2025

Market Context & Key Levels for the Day Ahead

— For new subscribers

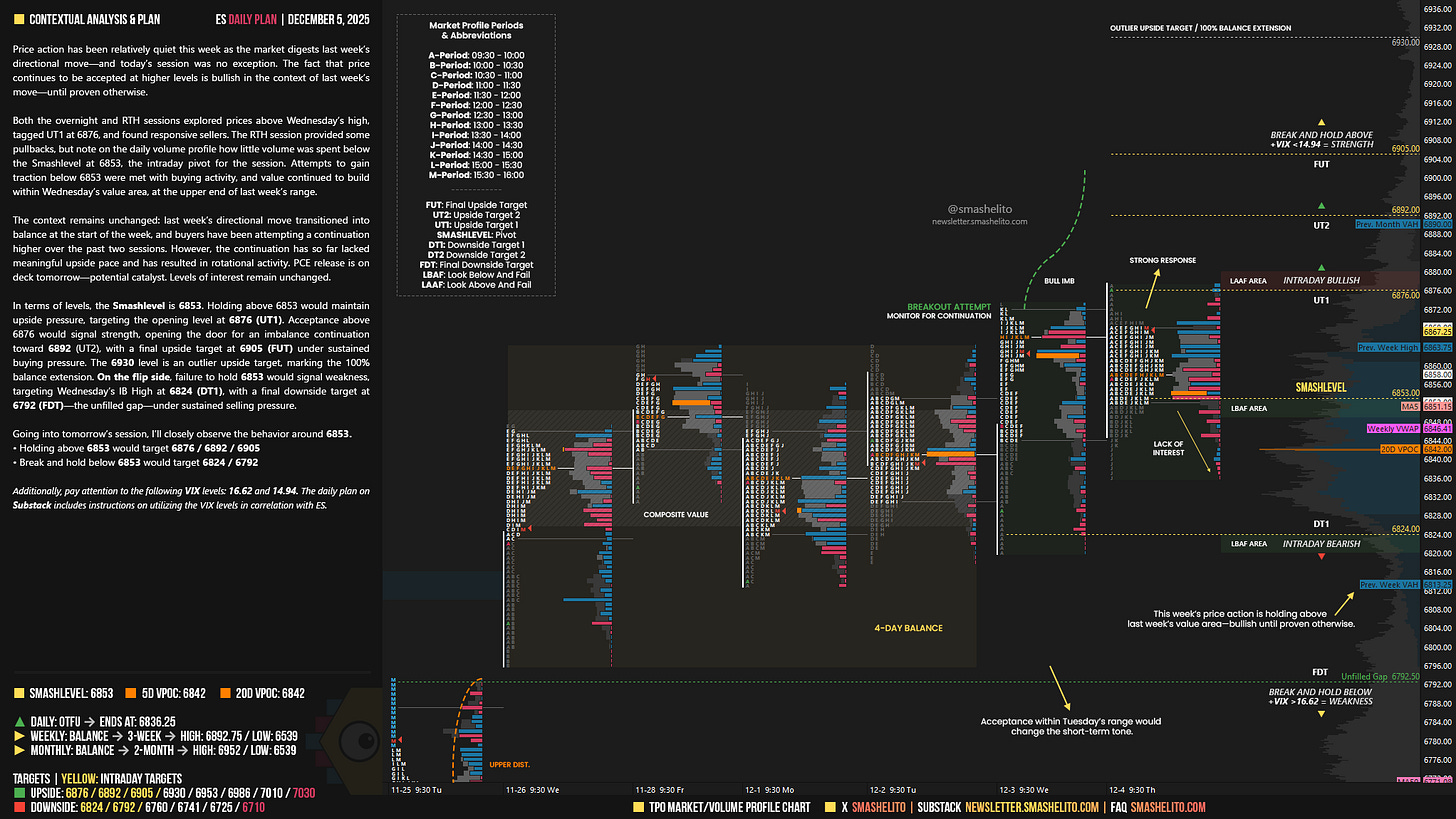

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the Weekly Plan for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

Price action has been relatively quiet this week as the market digests last week’s directional move—and today’s session was no exception. The fact that price continues to be accepted at higher levels is bullish in the context of last week’s move—until proven otherwise.

Both the overnight and RTH sessions explored prices above Wednesday’s high, tagged UT1 at 6876, and found responsive sellers. The RTH session provided some pullbacks, but note on the daily volume profile how little volume was spent below the Smashlevel at 6853, the intraday pivot for the session. Attempts to gain traction below 6853 were met with buying activity, and value continued to build within Wednesday’s value area, at the upper end of last week’s range.

The context remains unchanged: last week’s directional move transitioned into balance at the start of the week, and buyers have been attempting a continuation higher over the past two sessions. However, the continuation has so far lacked meaningful upside pace and has resulted in rotational activity. NFP* and PCE releases are on deck tomorrow—potential catalysts. Levels of interest remain unchanged.

*Correction: NFP is not scheduled for tomorrow!

In terms of levels, the Smashlevel is 6853. Holding above 6853 would maintain upside pressure, targeting the opening level at 6876 (UT1). Acceptance above 6876 would signal strength, opening the door for an imbalance continuation toward 6892 (UT2), with a final upside target at 6905 (FUT) under sustained buying pressure. The 6930 level is an outlier upside target, marking the 100% balance extension.

On the flip side, failure to hold 6853 would signal weakness, targeting Wednesday’s IB High at 6824 (DT1), with a final downside target at 6792 (FDT)—the unfilled gap—under sustained selling pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6853.

Holding above 6853 would target 6876 / 6892 / 6905

Break and hold below 6853 would target 6824 / 6792

Additionally, pay attention to the following VIX levels: 16.62 and 14.94. These levels can provide confirmation of strength or weakness.

Break and hold above 6905 with VIX below 14.94 would confirm strength.

Break and hold below 6792 with VIX above 16.62 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Correction: NFP is not scheduled for tomorrow!

Thanks Smash!