ES Daily Plan | December 4, 2025

Market Context & Key Levels for the Day Ahead

— For new subscribers

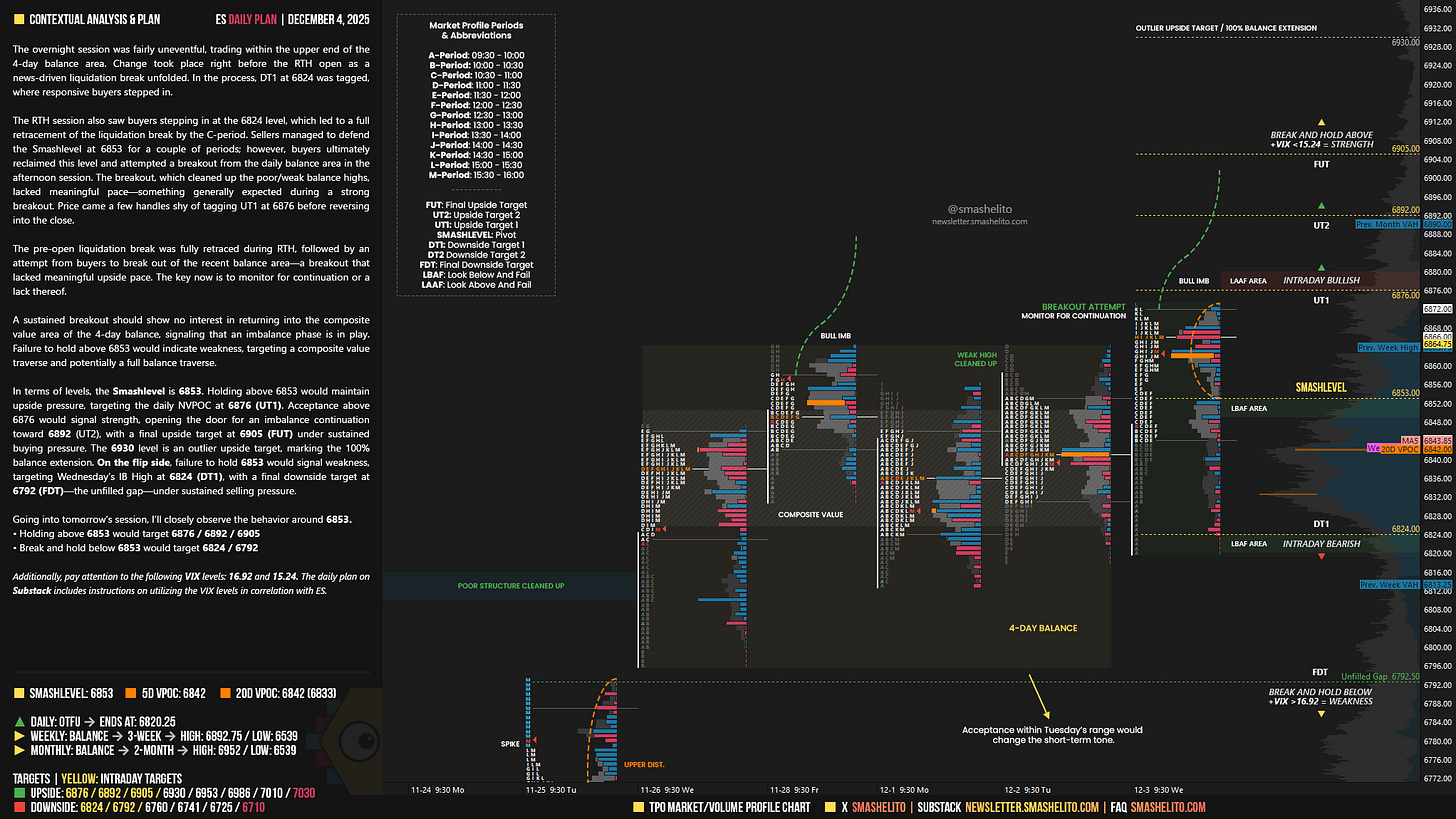

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the Weekly Plan for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

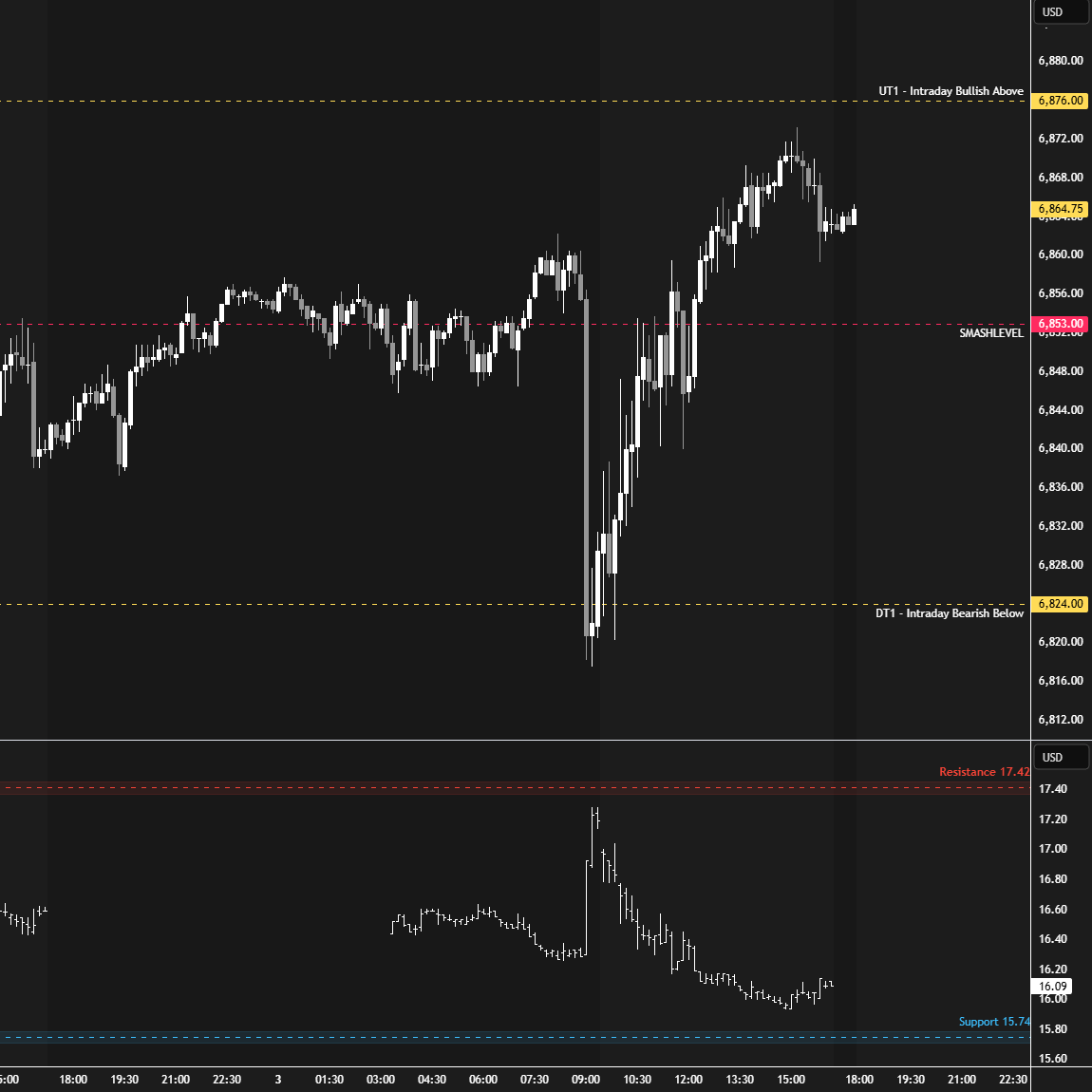

The overnight session was fairly uneventful, trading within the upper end of the 4-day balance area. Change took place right before the RTH open as a news-driven liquidation break unfolded. In the process, DT1 at 6824 was tagged, where responsive buyers stepped in.

The RTH session also saw buyers stepping in at the 6824 level, which led to a full retracement of the liquidation break by the C-period. Sellers managed to defend the Smashlevel at 6853 for a couple of periods; however, buyers ultimately reclaimed this level and attempted a breakout from the daily balance area in the afternoon session. The breakout, which cleaned up the poor/weak balance highs, lacked meaningful pace—something generally expected during a strong breakout. Price came a few handles shy of tagging UT1 at 6876 before reversing into the close.

The pre-open liquidation break was fully retraced during RTH, followed by an attempt from buyers to break out of the recent balance area—a breakout that lacked meaningful upside pace. The key now is to monitor for continuation or a lack thereof.

A sustained breakout should show no interest in returning into the composite value area of the 4-day balance, signaling that an imbalance phase is in play. Failure to hold above 6853 would indicate weakness, targeting a composite value traverse and potentially a full balance traverse.

In terms of levels, the Smashlevel is 6853. Holding above 6853 would maintain upside pressure, targeting the daily NVPOC at 6876 (UT1). Acceptance above 6876 would signal strength, opening the door for an imbalance continuation toward 6892 (UT2), with a final upside target at 6905 (FUT) under sustained buying pressure. The 6930 level is an outlier upside target, marking the 100% balance extension.

On the flip side, failure to hold 6853 would signal weakness, targeting Wednesday’s IB High at 6824 (DT1), with a final downside target at 6792 (FDT)—the unfilled gap—under sustained selling pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6853.

Holding above 6853 would target 6876 / 6892 / 6905

Break and hold below 6853 would target 6824 / 6792

Additionally, pay attention to the following VIX levels: 16.92 and 15.24. These levels can provide confirmation of strength or weakness.

Break and hold above 6905 with VIX below 15.24 would confirm strength.

Break and hold below 6792 with VIX above 16.92 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Thanks Smash!

wow. today was fun.