ES Daily Plan | December 31, 2024

My preparations and expectations for the upcoming session.

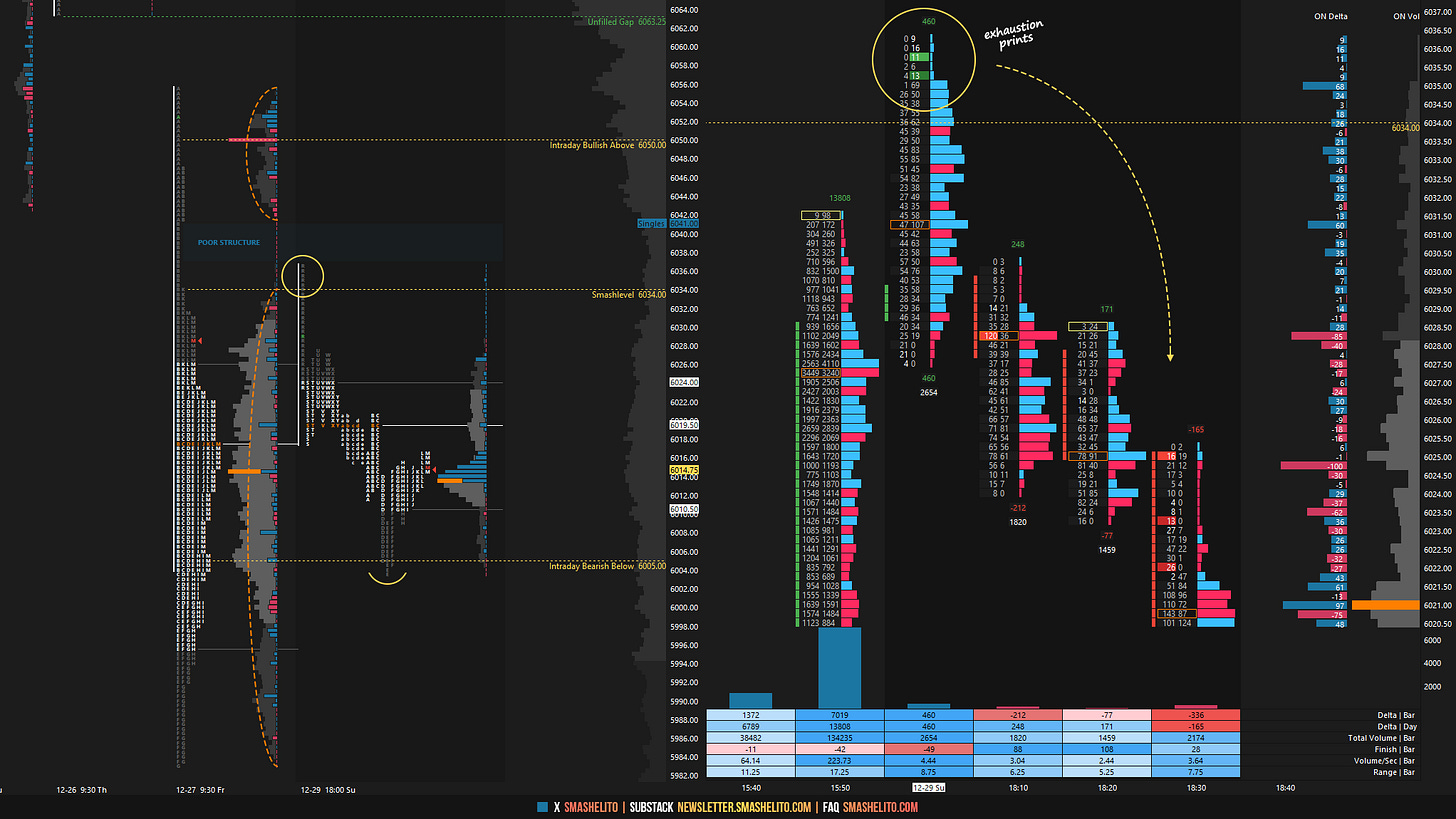

For new followers: The yellow levels highlighted at the bottom left of the chart are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final yellow upside target and shorts below the final yellow downside target. It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Visual Representation

Contextual Analysis

The overnight session kicked off in favor of sellers, following an immediate push higher to test and reject the 6034 level—an inflection point highlighted in both the weekly and daily plans. A visual of the exhaustive look above 6034 and fail was shared on X for reference. Remaining within Friday’s lower distribution signaled weakness, and the initial downside target of 6005 was tagged before the European session opened. While the 6005 level provided a solid bounce, the second test failed to hold, triggering a nasty liquidation pre-open.

The overnight weakness led the RTH session to open on a significant true gap to the downside, with all intraday downside targets already met and exceeded (5980). The VIX confirmed the weakness by holding well above its resistance level of 16.76—a scenario that makes fading and seeking reversals particularly challenging as there is potential for further weakness. There was no inventory correction at the open, with sellers breaking and holding below the overnight low, a development that typically signals the most bearish outcome in a gap-down scenario. The market came down and tested the weekly support area between 5930 and 5900 during the initial balance, effectively cleaning up the poor structure from the 12/20 session in the process. Given that it’s only Monday, this was an area for taking profits on shorts rather than initiating new short positions. Unsurprisingly, the market bounced from this support, returned within last week’s range and filled the gap. However, the struggle to gain traction within Friday’s range led to weakness in the closing session, with a close below the inside week.

Today’s session saw an inside week breakdown after opening with another true gap down. While the gap was eventually filled, buyers struggled to gain traction within Friday’s range, leading to weakness into the close. Immediate attention is on the previous week’s low of 5965, with sellers maintaining short-term control below. Buyers' primary objective is to return within the previous week’s range and break the pattern of lower highs and lower lows on the daily.

In terms of levels, the Smashlevel is at 5965, marking last week’s low. Holding below this level signals weakness, targeting 5932, with a final target at 5900 under sustained selling pressure. Failure to hold below 5965 would target the HVN at 5980, with a final target at 6005 under sustained buying pressure.

Levels of Interest

Going into tomorrow's session, I will closely observe the behavior around 5965.

Break and hold above 5965 would target 5980 / 6005

Holding below 5965 would target 5932 / 5900

Additionally, pay attention to the following VIX levels: 18.28 and 16.52. These levels can provide confirmation of strength or weakness.

Break and hold above 6005 with VIX below 16.52 would confirm strength.

Break and hold below 5900 with VIX above 18.28 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Weekly Plan

Make sure to review the Weekly Plan, which provides a broader perspective and highlights key levels of interest to observe in the upcoming week.

Thank you! 6034 was smashed!

Hey Smash. I hope you have a reasonably and prosperous new year. I just wanted to say thank you for your effort. I have to work on my emotions and discipline. I'm very impressed and in awe really that every single one of your forecasts around your line in the sand holds true. I need to stop doubting and stick with what you say. Above, long. Below, short. Period.

I'm very grateful for you doing this for free. Right now I can't afford expensive subscriptions.