ES Daily Plan | December 28, 2023

I will maintain my short-term focus on the recent multi-day balance high at 4830.75. In contrast to yesterday, buyers successfully closed today's session above this level.

Visual Representation

For new followers, the yellow levels highlighted at the bottom are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final yellow upside target and shorts below the final yellow downside target. It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Contextual Analysis

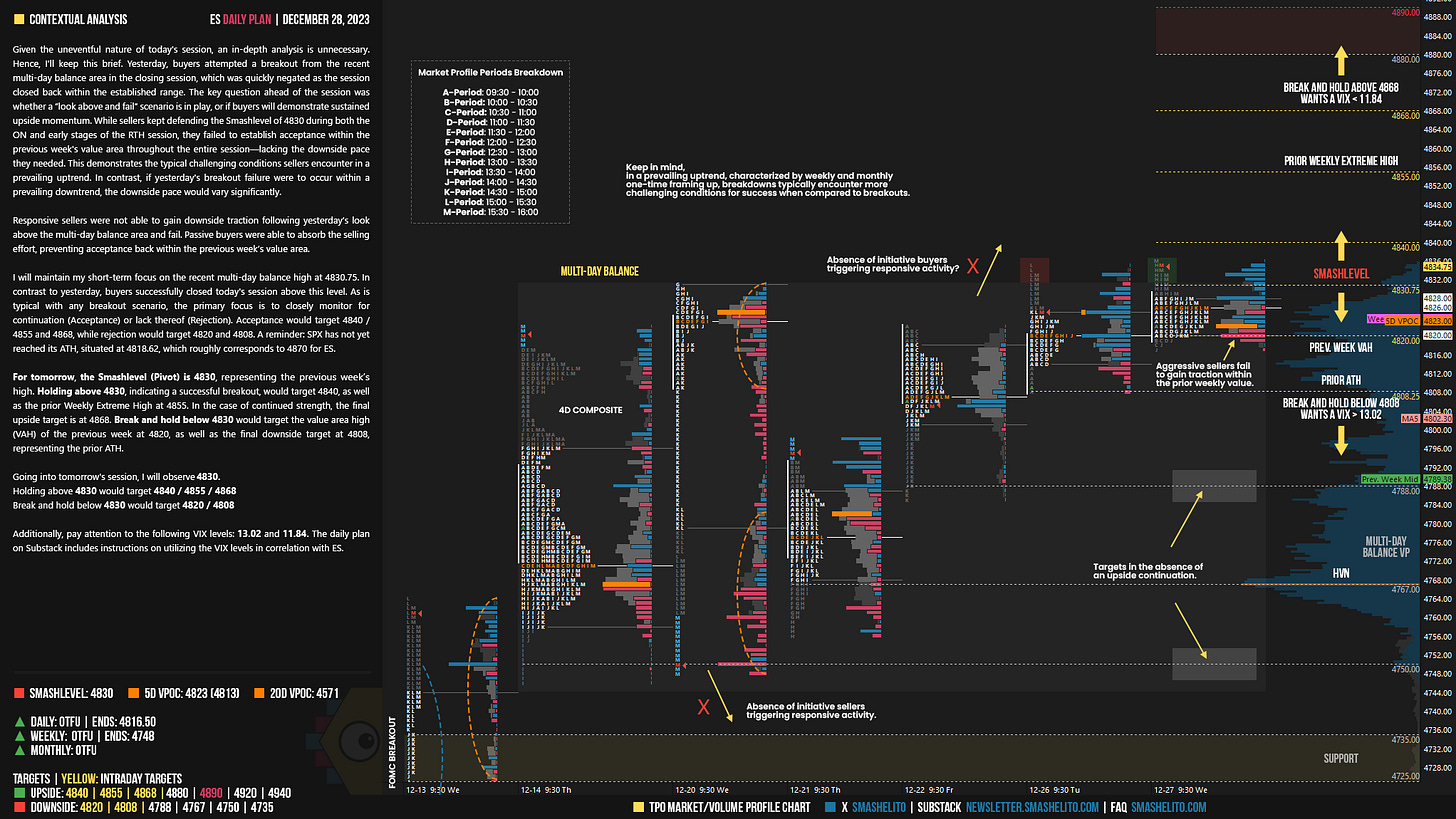

Given the uneventful nature of today's session, an in-depth analysis is unnecessary. Hence, I'll keep this brief. Yesterday, buyers attempted a breakout from the recent multi-day balance area in the closing session, which was quickly negated as the session closed back within the established range. The key question ahead of the session was whether a “look above and fail” scenario is in play, or if buyers will demonstrate sustained upside momentum. While sellers kept defending the Smashlevel of 4830 during both the ON and early stages of the RTH session, they failed to establish acceptance within the previous week's value area throughout the entire session—lacking the downside pace they needed. This demonstrates the typical challenging conditions sellers encounter in a prevailing uptrend. In contrast, if yesterday's breakout failure were to occur within a prevailing downtrend, the downside pace would vary significantly.

Responsive sellers were unable gain downside traction following yesterday’s look above the multi-day balance area and fail. Passive buyers were able to absorb the selling effort, preventing acceptance back within the previous week’s value area.

I will maintain my short-term focus on the recent multi-day balance high at 4830.75. In contrast to yesterday, buyers successfully closed today's session above this level. As is typical with any breakout scenario, the primary focus is to closely monitor for continuation (Acceptance) or lack thereof (Rejection). Acceptance would target 4840 / 4855 and 4868, while rejection would target 4820 and 4808. A reminder: SPX has not yet reached its ATH, situated at 4818.62, which roughly corresponds to 4870 for ES.

For tomorrow, the Smashlevel (Pivot) is 4830, representing the previous week’s high. Holding above 4830, indicating a successful breakout, would target 4840, as well as the prior Weekly Extreme High at 4855. In the case of continued strength, the final upside target is at 4868. Break and hold below 4830 would target the value area high (VAH) of the previous week at 4820, as well as the final downside target at 4808, representing the prior ATH.

Levels of Interest

Going into tomorrow's session, I will observe 4830.

Holding above 4830 would target 4840 / 4855 / 4868

Break and hold below 4830 would target 4820 / 4808

Additionally, pay attention to the following VIX levels: 13.02 and 11.84. These levels can provide confirmation of strength or weakness.

Break and hold above 4868 with VIX below 11.84 would confirm strength.

Break and hold below 4808 with VIX above 13.02 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Weekly Plan

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Thank you buddy! Great scalpers day, ended up green.