ES Weekly Plan | December 26-29, 2023

My expectations for the upcoming week.

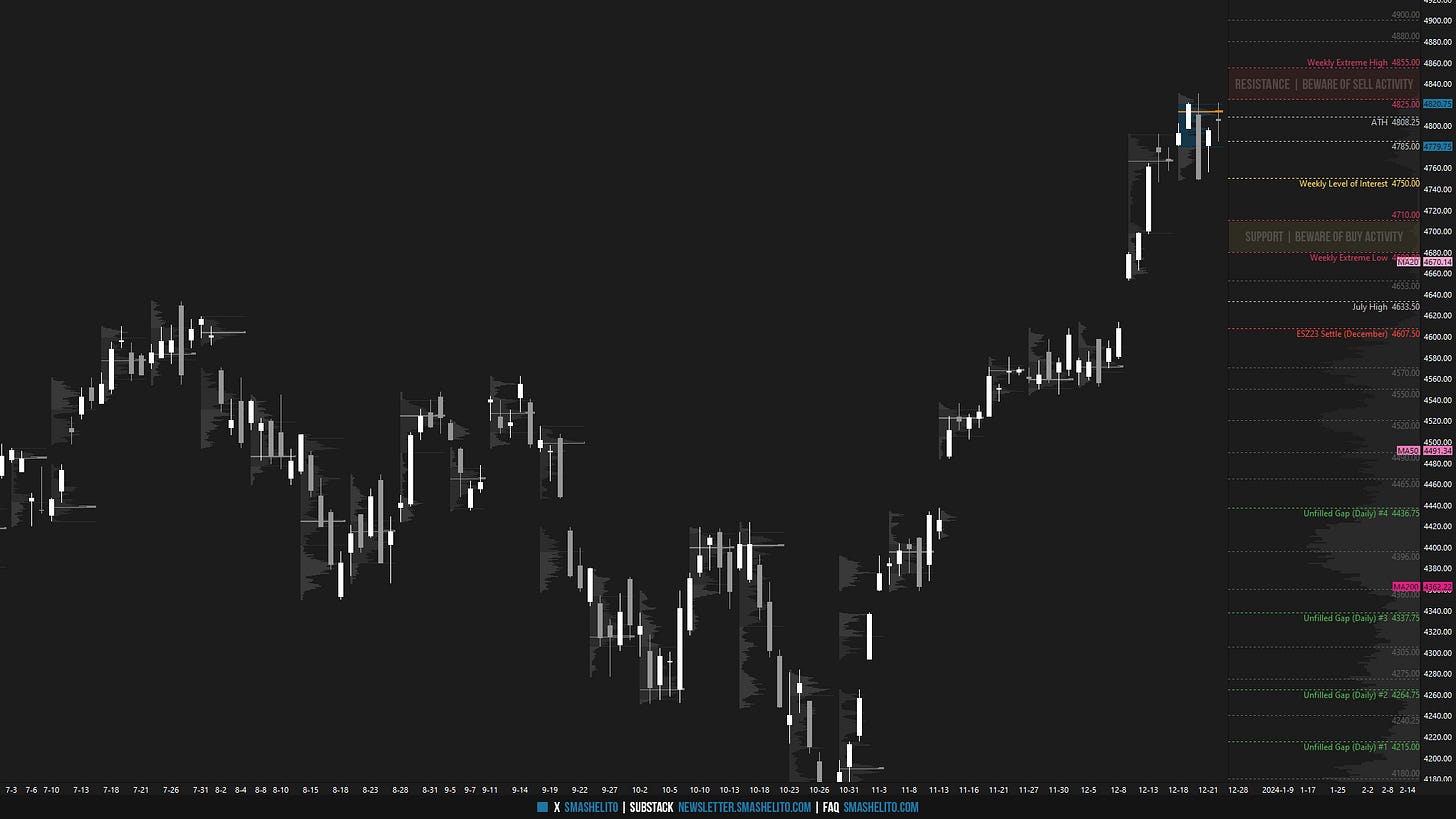

Visual Representation

Market Structure

🟨 DAILY: BALANCE | 7D | H: 4830.75 L: 4746.25

🟩 WEEKLY: OTFU | ENDS: 4748

🟩 MONTHLY: OTFU

Contextual Analysis

During the previous week, the market opened strong early on, achieving a new all-time high (4830.75). On Wednesday, a liquidation break unfolded, prompting a test of the weekly level of interest at 4750, where buyers held their ground. Subsequently, on Thursday and Friday, the market efficiently cleaned up the poor structure resulting from the liquidation break, due to the absence of initiative sellers required for a downside continuation.

For this shortened week, our main attention will be on current 7-day balance area, ranging from 4746.25 to current all-time high (ATH) at 4830.75. The general guideline suggests going with the break of the daily balance area and monitoring for continuation (Acceptance) or lack thereof (Rejection). If there's a lack of continuation following a breakout attempt, it can trigger moves in the opposite direction. Remaining within the multi-day balance area increases the odds of sustained responsive activity, emphasizing the importance of staying nimble. Take note of the included 2-week volume profile and observe its shape. The market has essentially formed a P-shaped profile in a prevailing uptrend, suggesting that the upward auction is not yet complete, given the lack of excess to the upside. Sellers, with their main objective to stop the weekly one-time framing up, would prefer an immediate upside continuation that fails, potentially triggering a strong counter-move. An immediate pullback without a failed breakout is likely to encounter reloading buyers.

The weekly level of interest is 4808.25, which represents the previous all-time high (ATH). Break and hold above 4808.25, would target the current ATH and multi-day balance high at 4830.75. Break and hold above 4830.75, indicating a successful breakout, would target the resistance area from 4865 to the Weekly Extreme High of 4890, where selling activity can be expected. It's worth noting that the SPX has not yet reached its ATH, situated at 4818.62, which roughly corresponds to 4869 for ES, and is situated within the mentioned resistance area.

Holding below 4808.25 would target the most traded price by volume over the past two weeks, situated at 4767. Break and hold below 4767, would target a breakdown from the multi-day balance area, targeting the support area from 4735 to the Weekly Extreme Low of 4710, where buying activity can be expected. As I've mentioned in the past weeks, for any significant change to occur in the bigger picture, the sellers would need to break and hold below the Weekly Extreme Low. A preference is placed on achieving a weekly close below this level, as it would indicate the potential for a more profound decline.

As usual, a detailed daily plan will be published tomorrow. In the meantime, Happy Holidays!

Levels of Interest

In the upcoming week, I will observe 4808.25.

Break and hold above 4808.25 would target 4830 / 4865 / 4890* / 4920 / 4940

Holding below 4808.25 would target 4767 / 4735 / 4710* / 4680 / 4660

*Weekly Extremes. I exercise caution when initiating trades outside the Weekly Extremes to avoid making impulsive decisions at unfavorable locations. Essentially, the Weekly Extremes serve as a safeguard against emotionally-driven trades, a state that is less than ideal for making well-informed trading decisions.

Economic Calendar

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Merry Christmas. Thank you for all the work you do.

Thank you for your outstanding work, for you and all your loved ones Merry Christmas