ES Daily Plan | December 24/25/26, 2025

Market Context & Key Levels for the Day Ahead

— For new subscribers

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the Weekly Plan for a broader perspective, key levels, and market expectations for the week ahead.

Merry Christmas to those that celebrate! 🎄

Contextual Analysis & Plan

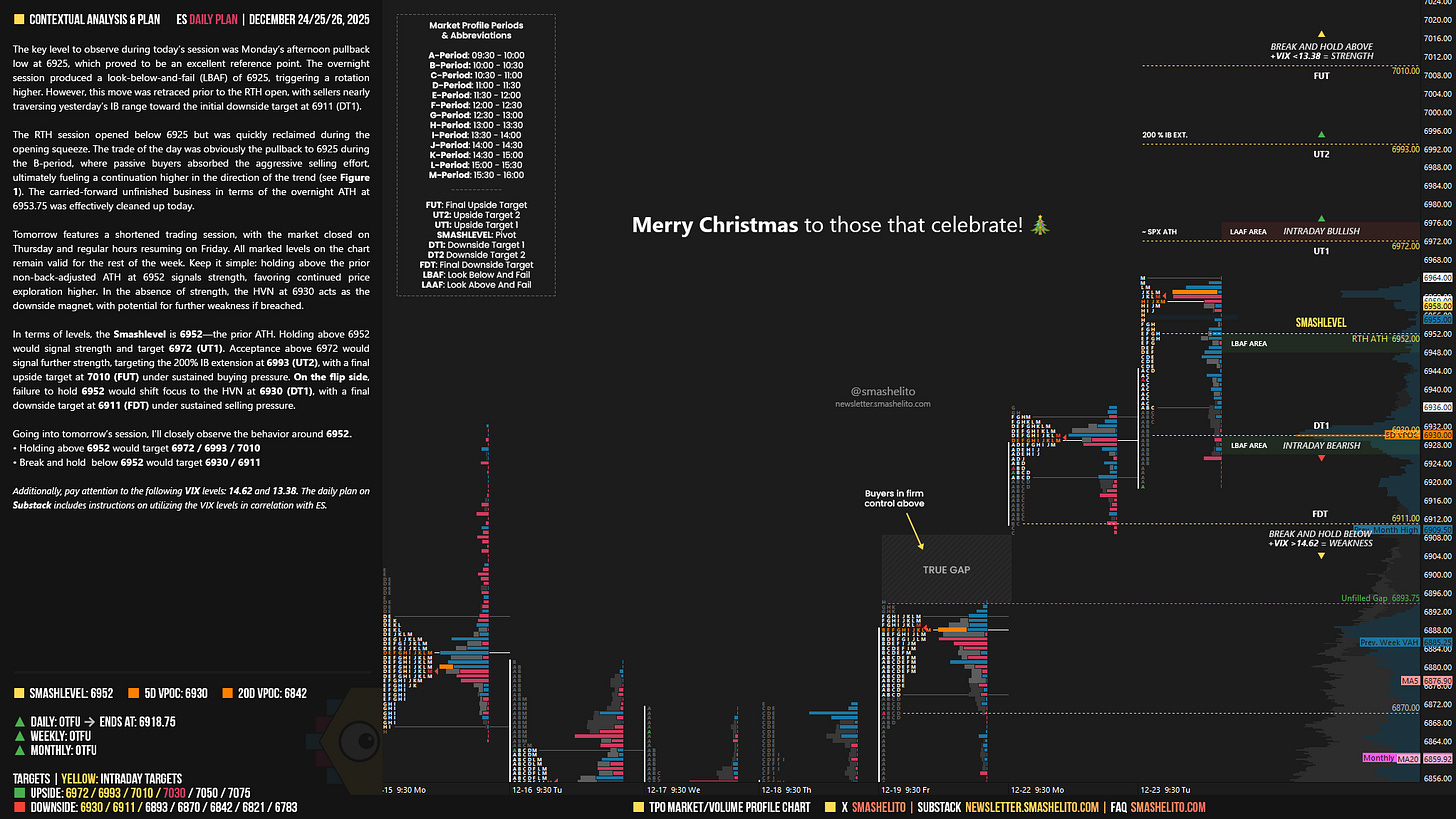

The key level to observe during today’s session was Monday’s afternoon pullback low at 6925, which proved to be an excellent reference point. The overnight session produced a look-below-and-fail (LBAF) of 6925, triggering a rotation higher. However, this move was retraced prior to the RTH open, with sellers nearly traversing yesterday’s IB range toward the initial downside target at 6911 (DT1).

The RTH session opened below 6925 but was quickly reclaimed during the opening squeeze. The trade of the day was obviously the pullback to 6925 during the B-period, where passive buyers absorbed the aggressive selling effort, ultimately fueling a continuation higher in the direction of the trend (see Figure 1). The carried-forward unfinished business in terms of the overnight ATH at 6953.75 was effectively cleaned up today.

Tomorrow features a shortened trading session, with the market closed on Thursday and regular hours resuming on Friday. All marked levels on the chart remain valid for the rest of the week. Keep it simple: holding above the prior non-back-adjusted ATH at 6952 signals strength, favoring continued price exploration higher. In the absence of strength, the HVN at 6930 acts as the downside magnet, with potential for further weakness if breached.

In terms of levels, the Smashlevel is 6952—the prior ATH. Holding above 6952 would signal strength and target 6972 (UT1). Acceptance above 6972 would signal further strength, targeting the 200% IB extension at 6993 (UT2), with a final upside target at 7010 (FUT) under sustained buying pressure.

On the flip side, failure to hold 6952 would shift focus to the HVN at 6930 (DT1), with a final downside target at 6911 (FDT) under sustained selling pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6952.

Holding above 6952 would target 6972 / 6993 / 7010

Break and hold below 6952 would target 6930 / 6911

Additionally, pay attention to the following VIX levels: 14.62 and 13.38. These levels can provide confirmation of strength or weakness.

Break and hold above 7010 with VIX below 13.38 would confirm strength.

Break and hold below 6911 with VIX above 14.62 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Merry Christmas Smash!

Feliz Navidad y que tengas unas Felices Fiestas, Signor Smashelito!