ES Daily Plan | December 20, 2024

My preparations and expectations for the upcoming session.

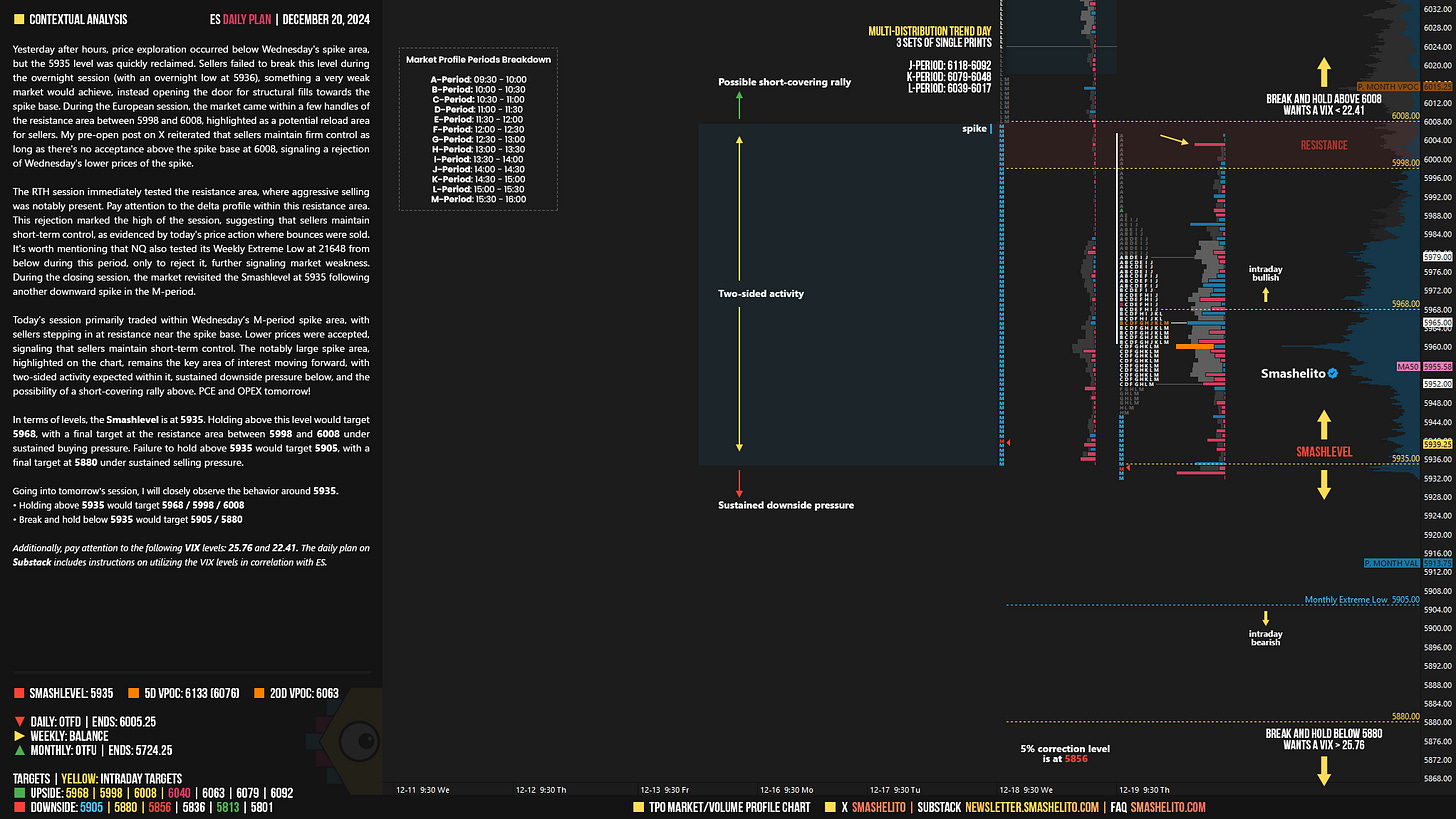

For new followers: The yellow levels highlighted at the bottom left of the chart are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final yellow upside target and shorts below the final yellow downside target. It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Visual Representation

Contextual Analysis

Yesterday after hours, price exploration occurred below Wednesday's spike area, but the 5935 level was quickly reclaimed. Sellers failed to break this level during the overnight session (with an overnight low at 5936), something a very weak market would achieve, instead opening the door for structural fills towards the spike base. During the European session, the market came within a few handles of the resistance area between 5998 and 6008, highlighted as a potential reload area for sellers. My pre-open post on X reiterated that sellers maintain firm control as long as there's no acceptance above the spike base at 6008, signaling a rejection of Wednesday's lower prices of the spike.

The RTH session immediately tested the resistance area, where aggressive selling was notably present. Pay attention to the delta profile within this resistance area. This rejection marked the high of the session, suggesting that sellers maintain short-term control, as evidenced by today's price action where bounces were sold. It's worth mentioning that NQ also tested its Weekly Extreme Low at 21648 from below during this period, only to reject it, further signaling market weakness. During the closing session, the market revisited the Smashlevel at 5935 following another downward spike in the M-period.

Today’s session primarily traded within Wednesday’s M-period spike area, with sellers stepping in at resistance near the spike base. Lower prices were accepted, signaling that sellers maintain short-term control. The notably large spike area, highlighted on the chart, remains the key area of interest moving forward, with two-sided activity expected within it, sustained downside pressure below, and the possibility of a short-covering rally above. PCE and OPEX tomorrow!

In terms of levels, the Smashlevel is at 5935. Holding above this level would target 5968, with a final target at the resistance area between 5998 and 6008 under sustained buying pressure. Failure to hold above 5935 would target 5905, with a final target at 5880 under sustained selling pressure.

Levels of Interest

Going into tomorrow's session, I will closely observe the behavior around 5935.

Holding above 5935 would target 5968 / 5998 / 6008

Break and hold below 5935 would target 5905 / 5880

Additionally, pay attention to the following VIX levels: 25.76 and 22.41. These levels can provide confirmation of strength or weakness.

Break and hold above 6008 with VIX below 22.41 would confirm strength.

Break and hold below 5880 with VIX above 25.76 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Weekly Plan

Make sure to review the Weekly Plan, which provides a broader perspective and highlights key levels of interest to observe in the upcoming week.

Thank you buddy! Had a few losses but then recovered with shorts.

Thank you always.