ES Daily Plan | December 2, 2025

Market Context & Key Levels for the Day Ahead

— For new subscribers

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the Weekly Plan for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

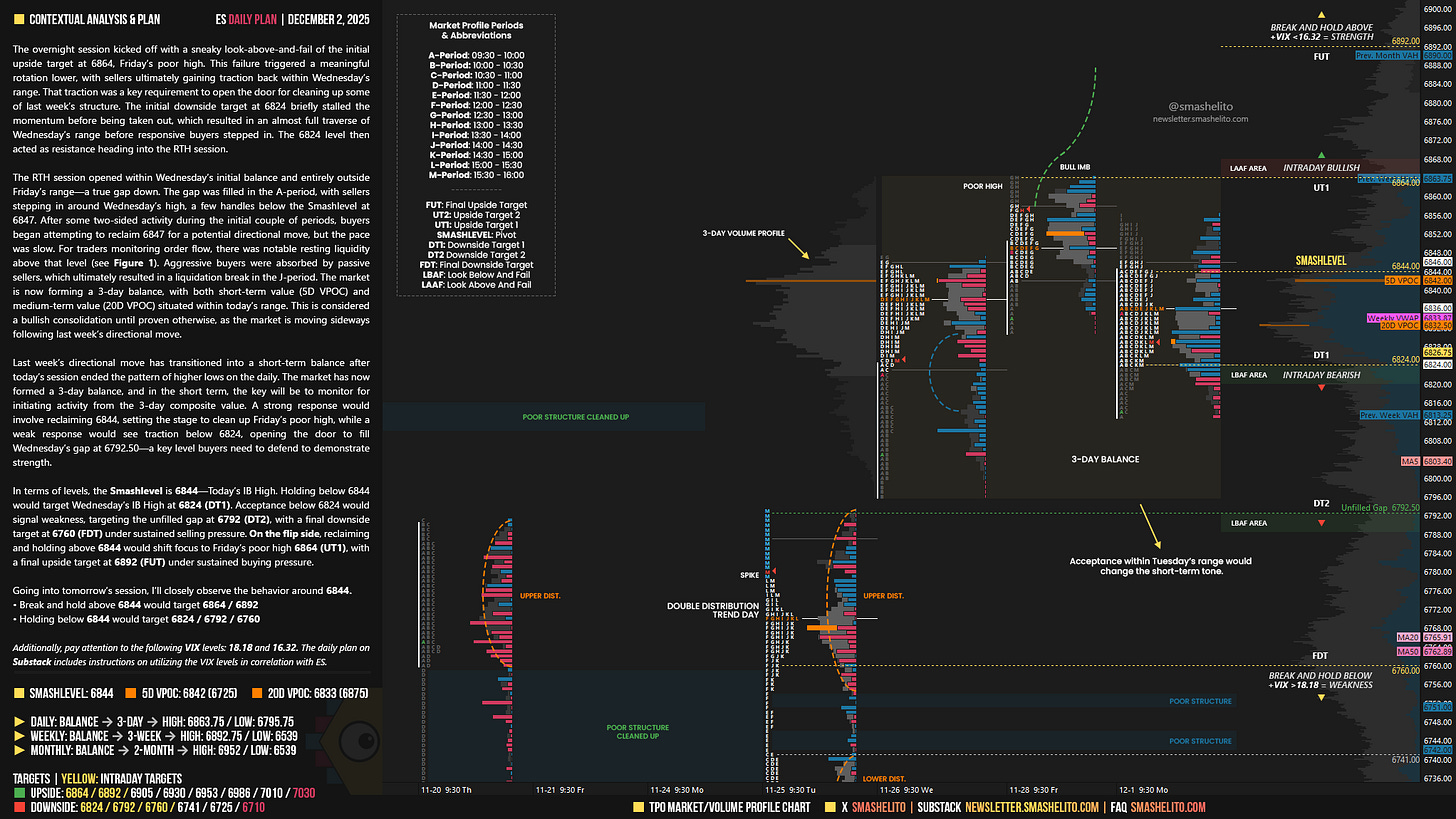

The overnight session kicked off with a sneaky look-above-and-fail of the initial upside target at 6864, Friday’s poor high. This failure triggered a meaningful rotation lower, with sellers ultimately gaining traction back within Wednesday’s range. That traction was a key requirement to open the door for cleaning up some of last week’s structure. The initial downside target at 6824 briefly stalled the momentum before being taken out, which resulted in an almost full traverse of Wednesday’s range before responsive buyers stepped in. The 6824 level then acted as resistance heading into the RTH session.

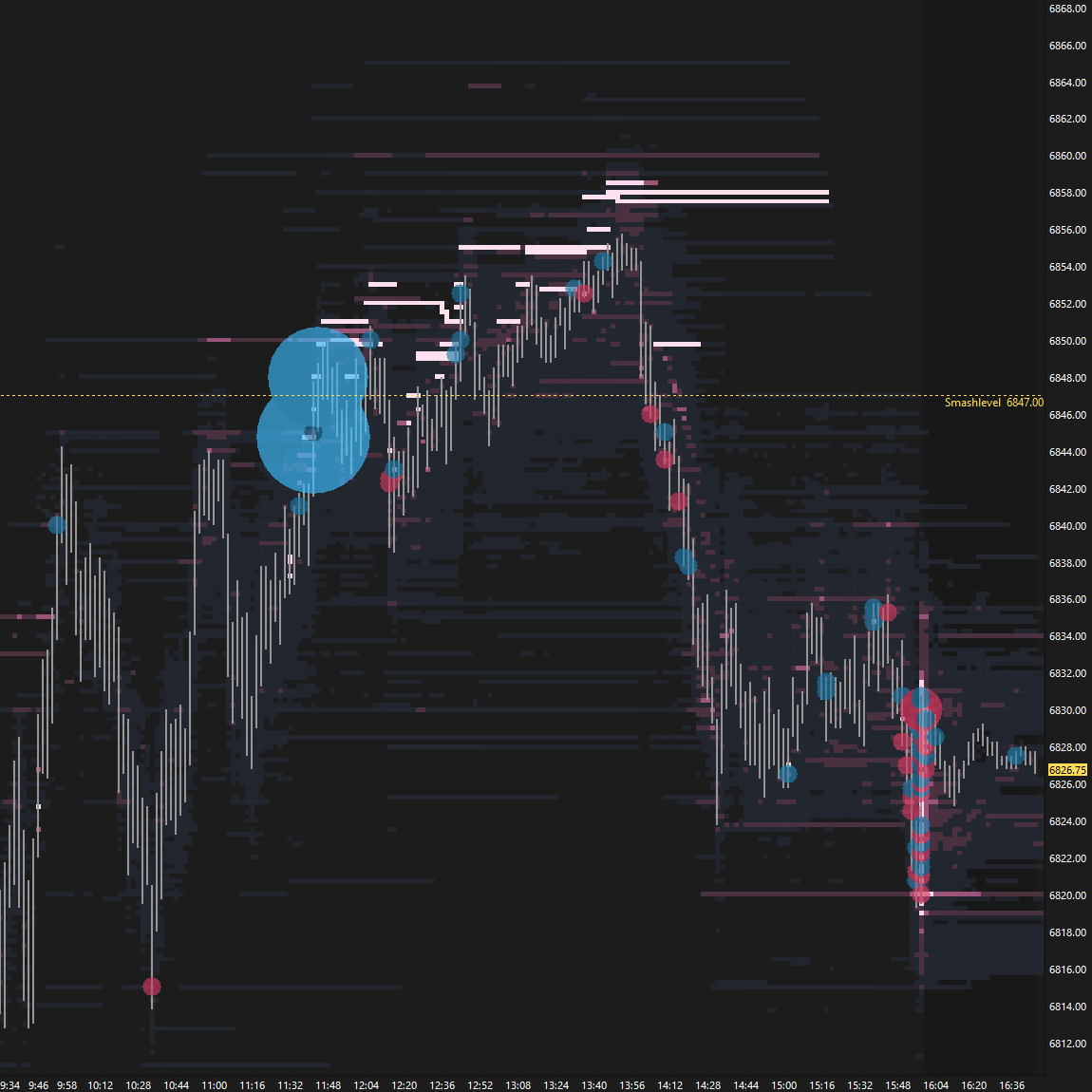

The RTH session opened within Wednesday’s initial balance and entirely outside Friday’s range—a true gap down. The gap was filled in the A-period, with sellers stepping in around Wednesday’s high, a few handles below the Smashlevel at 6847. After some two-sided activity during the initial couple of periods, buyers began attempting to reclaim 6847 for a potential directional move, but the pace was slow. For traders monitoring order flow, there was notable resting liquidity above that level (see Figure 1). Aggressive buyers were absorbed by passive sellers, which ultimately resulted in a liquidation break in the J-period. The market is now forming a 3-day balance, with both short-term value (5D VPOC) and medium-term value (20D VPOC) situated within today’s range. This is considered a bullish consolidation until proven otherwise, as the market is moving sideways following last week’s directional move.

Last week’s directional move has transitioned into a short-term balance after today’s session ended the pattern of higher lows on the daily. The market has now formed a 3-day balance, and in the short term, the key will be to monitor for initiating activity from the 3-day composite value. A strong response would involve reclaiming 6844, setting the stage to clean up Friday’s poor high, while a weak response would see traction below 6824, opening the door to fill Wednesday’s gap at 6792.50—a key level buyers need to defend to demonstrate strength.

In terms of levels, the Smashlevel is 6844—Today’s IB High. Holding below 6844 would target Wednesday’s IB High at 6824 (DT1). Acceptance below 6824 would signal weakness, targeting the unfilled gap at 6792 (DT2), with a final downside target at 6760 (FDT) under sustained selling pressure.

On the flip side, reclaiming and holding above 6844 would shift focus to Friday’s poor high 6864 (UT1), with a final upside target at 6892 (FUT) under sustained buying pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6844.

Break and hold above 6844 would target 6864 / 6892

Holding below 6844 would target 6824 / 6792 / 6760

Additionally, pay attention to the following VIX levels: 18.18 and 16.32. These levels can provide confirmation of strength or weakness.

Break and hold above 6892 with VIX below 16.32 would confirm strength.

Break and hold below 6760 with VIX above 18.18 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Great job

Thanks Smash!