ES Daily Plan | December 18, 2025

Market Context & Key Levels for the Day Ahead

— For new subscribers

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the Weekly Plan for a broader perspective, key levels, and market expectations for the week ahead.

Contract Rollover

A quick reminder: I’ve transitioned to the ESH26 (March) contract. For reference, I do not back-adjust my charts.

Contextual Analysis & Plan

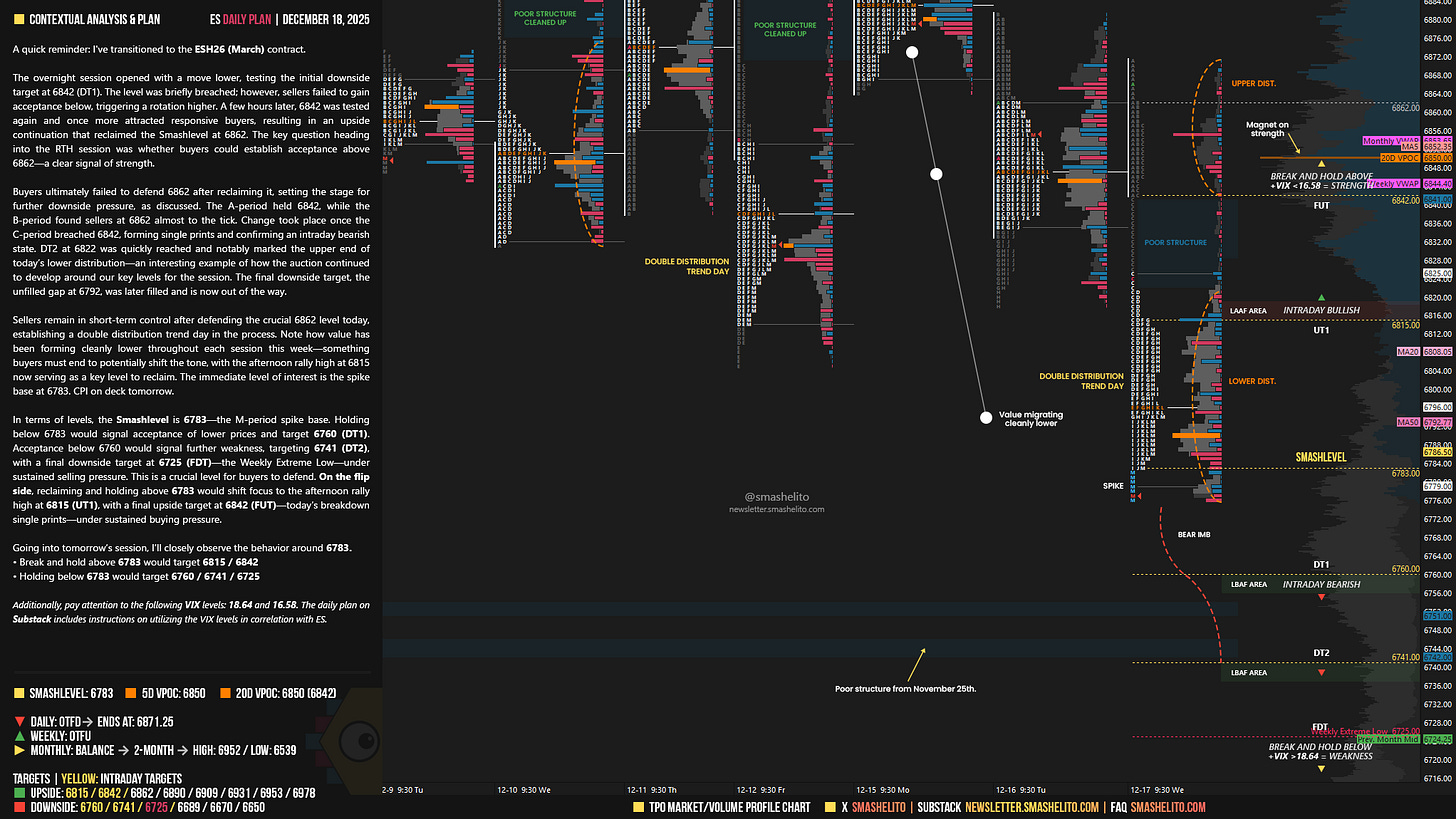

The overnight session opened with a move lower, testing the initial downside target at 6842 (DT1). The level was briefly breached; however, sellers failed to gain acceptance below, triggering a rotation higher. A few hours later, 6842 was tested again and once more attracted responsive buyers, resulting in an upside continuation that reclaimed the Smashlevel at 6862. The key question heading into the RTH session was whether buyers could establish acceptance above 6862—a clear signal of strength.

Buyers ultimately failed to defend 6862 after reclaiming it, setting the stage for further downside pressure, as discussed. The A-period held 6842, while the B-period found sellers at 6862 almost to the tick. Change took place once the C-period breached 6842, forming single prints and confirming an intraday bearish state. DT2 at 6822 was quickly reached and notably marked the upper end of today’s lower distribution—an interesting example of how the auction continued to develop around our key levels for the session. The final downside target, the unfilled gap at 6792, was later filled and is now out of the way.

Sellers remain in short-term control after defending the crucial 6862 level today, establishing a double distribution trend day in the process. Note how value has been forming cleanly lower throughout each session this week—something buyers must end to potentially shift the tone, with the afternoon rally high at 6815 now serving as a key level to reclaim. The immediate level of interest is the spike base at 6783. CPI on deck tomorrow.

In terms of levels, the Smashlevel is 6783—the M-period spike base. Holding below 6783 would signal acceptance of lower prices and target 6760 (DT1). Acceptance below 6760 would signal further weakness, targeting 6741 (DT2), with a final downside target at 6725 (FDT)—the Weekly Extreme Low—under sustained selling pressure. This is a crucial level for buyers to defend.

On the flip side, reclaiming and holding above 6783 would shift focus to the afternoon rally high at 6815 (UT1), with a final upside target at 6842 (FUT)—today’s breakdown single prints—under sustained buying pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6783.

Break and hold above 6783 would target 6815 / 6842

Holding below 6783 would target 6760 / 6741 / 6725

Additionally, pay attention to the following VIX levels: 18.64 and 16.58. These levels can provide confirmation of strength or weakness.

Break and hold above 6842 with VIX below 16.58 would confirm strength.

Break and hold below 6725 with VIX above 18.64 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Goat!

Thank you Smash!