ES Daily Plan | December 18, 2024

My preparations and expectations for the upcoming session.

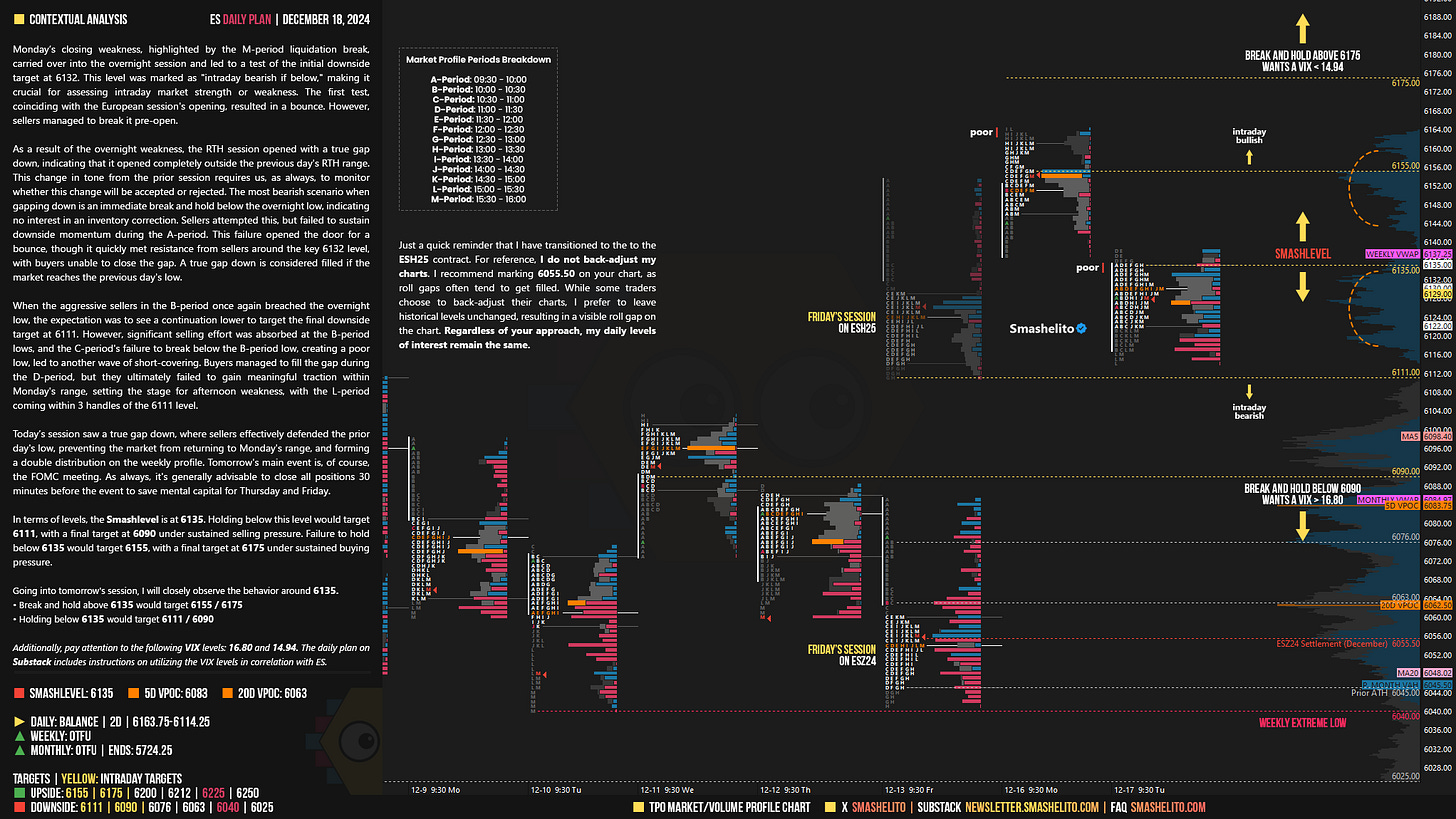

For new followers: The yellow levels highlighted at the bottom left of the chart are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final yellow upside target and shorts below the final yellow downside target. It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Visual Representation

Contextual Analysis

Just a quick reminder that I have transitioned to the to the ESH25 contract. For reference, I do not back-adjust my charts. I recommend marking 6055.50 on your chart, as roll gaps often tend to get filled. While some traders choose to back-adjust their charts, I prefer to leave historical levels unchanged, resulting in a visible roll gap on the chart. Regardless of your approach, my daily levels of interest remain the same.

Monday’s closing weakness, highlighted by the M-period liquidation break, carried over into the overnight session and led to a test of the initial downside target at 6132. This level was marked as "intraday bearish if below," making it crucial for assessing intraday market strength or weakness. The first test, coinciding with the European session's opening, resulted in a bounce. However, sellers managed to break it pre-open.

As a result of the overnight weakness, the RTH session opened with a true gap down, indicating that it opened completely outside the previous day's RTH range. This change in tone from the prior session requires us, as always, to monitor whether this change will be accepted or rejected. The most bearish scenario when gapping down is an immediate break and hold below the overnight low, indicating no interest in an inventory correction. Sellers attempted this, but failed to sustain downside momentum during the A-period. This failure opened the door for a bounce, though it quickly met resistance from sellers around the key 6132 level, with buyers unable to close the gap. A true gap down is considered filled if the market reaches the previous day's low.

When the aggressive sellers in the B-period once again breached the overnight low, the expectation was to see a continuation lower to target the final downside target at 6111. However, significant selling effort was absorbed at the B-period lows, and the C-period's failure to break below the B-period low, creating a poor low, led to another wave of short-covering. Buyers managed to fill the gap during the D-period, but they ultimately failed to gain meaningful traction within Monday's range, setting the stage for afternoon weakness, with the L-period coming within 3 handles of the 6111 level.

Today’s session saw a true gap down, where sellers effectively defended the prior day's low, preventing the market from returning to Monday's range, and forming a double distribution on the weekly profile. Tomorrow's main event is, of course, the FOMC meeting. As always, it's generally advisable to close all positions 30 minutes before the event to save mental capital for Thursday and Friday.

In terms of levels, the Smashlevel is at 6135. Holding below this level would target 6111, with a final target at 6090 under sustained selling pressure. Failure to hold below 6135 would target 6155, with a final target at 6175 under sustained buying pressure.

Levels of Interest

Going into tomorrow's session, I will closely observe the behavior around 6135.

Break and hold above 6135 would target 6155 / 6175

Holding below 6135 would target 6111 / 6090

Additionally, pay attention to the following VIX levels: 16.80 and 14.94. These levels can provide confirmation of strength or weakness.

Break and hold above 6175 with VIX below 14.94 would confirm strength.

Break and hold below 6090 with VIX above 16.80 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Weekly Plan

Make sure to review the Weekly Plan, which provides a broader perspective and highlights key levels of interest to observe in the upcoming week.

Thank you buddy! Another great day!

Thank you as always!