ES Daily Plan | December 17, 2025

Market Context & Key Levels for the Day Ahead

— For new subscribers

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the Weekly Plan for a broader perspective, key levels, and market expectations for the week ahead.

Contract Rollover

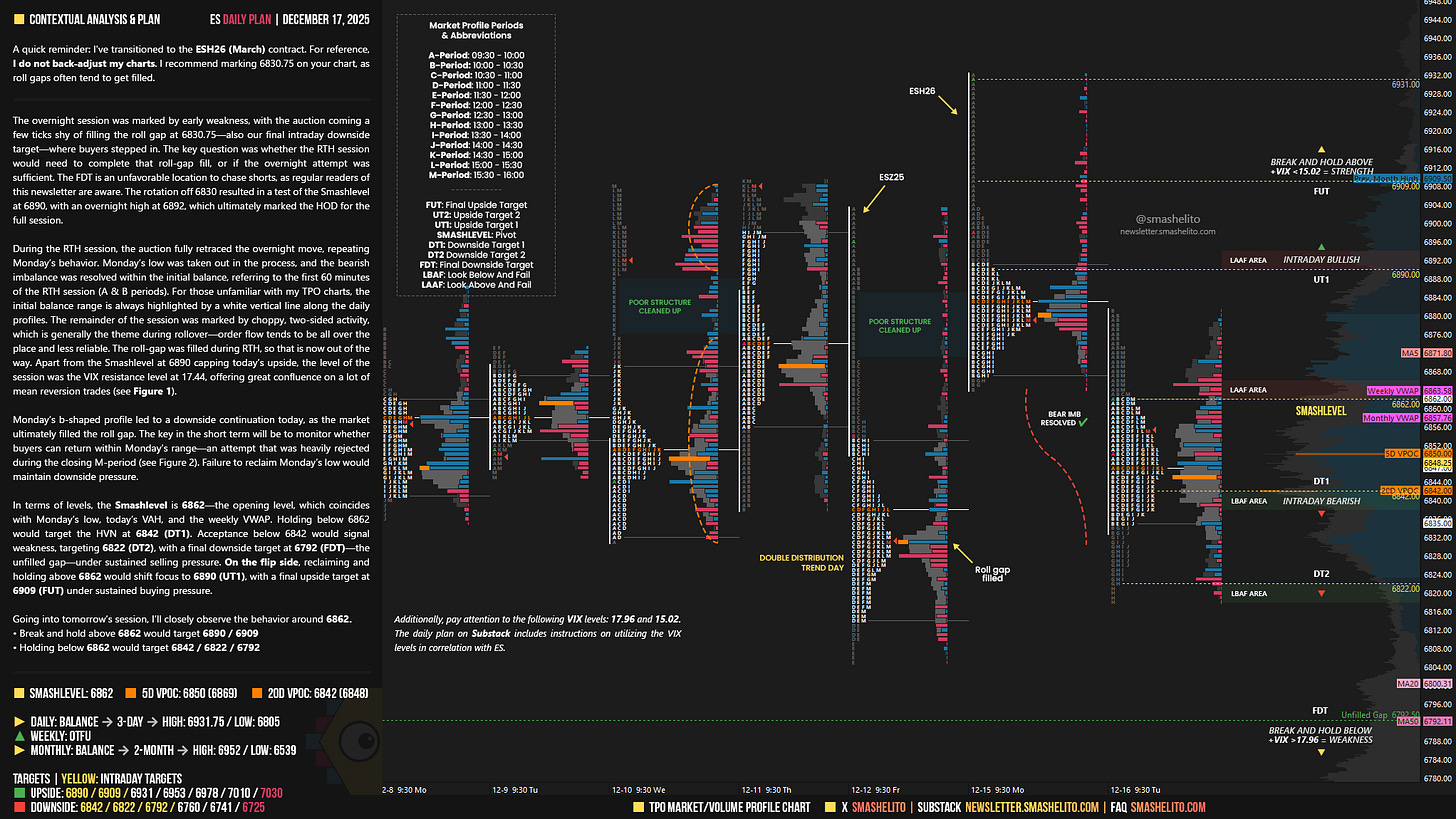

A quick reminder: I’ve transitioned to the ESH26 (March) contract. For reference, I do not back-adjust my charts. I recommend marking 6830.75 on your chart, as roll gaps often tend to get filled.

Contextual Analysis & Plan

The overnight session was marked by early weakness, with the auction coming a few ticks shy of filling the roll gap at 6830.75—also our final intraday downside target—where buyers stepped in. The key question was whether the RTH session would need to complete that roll-gap fill, or if the overnight attempt was sufficient. The FDT is an unfavorable location to chase shorts, as regular readers of this newsletter are aware. The rotation off 6830 resulted in a test of the Smashlevel at 6890, with an overnight high at 6892, which ultimately marked the HOD for the full session.

During the RTH session, the auction fully retraced the overnight move, repeating Monday’s behavior. Monday’s low was taken out in the process, and the bearish imbalance was resolved within the initial balance, referring to the first 60 minutes of the RTH session (A & B periods). For those unfamiliar with my TPO charts, the initial balance range is always highlighted by a white vertical line along the daily profiles. The remainder of the session was marked by choppy, two-sided activity, which is generally the theme during rollover—order flow tends to be all over the place and less reliable. The roll-gap was filled during RTH, so that is now out of the way. Apart from the Smashlevel at 6890 capping today’s upside, the level of the session was the VIX resistance level at 17.44, offering great confluence on a lot of mean reversion trades (see Figure 1).

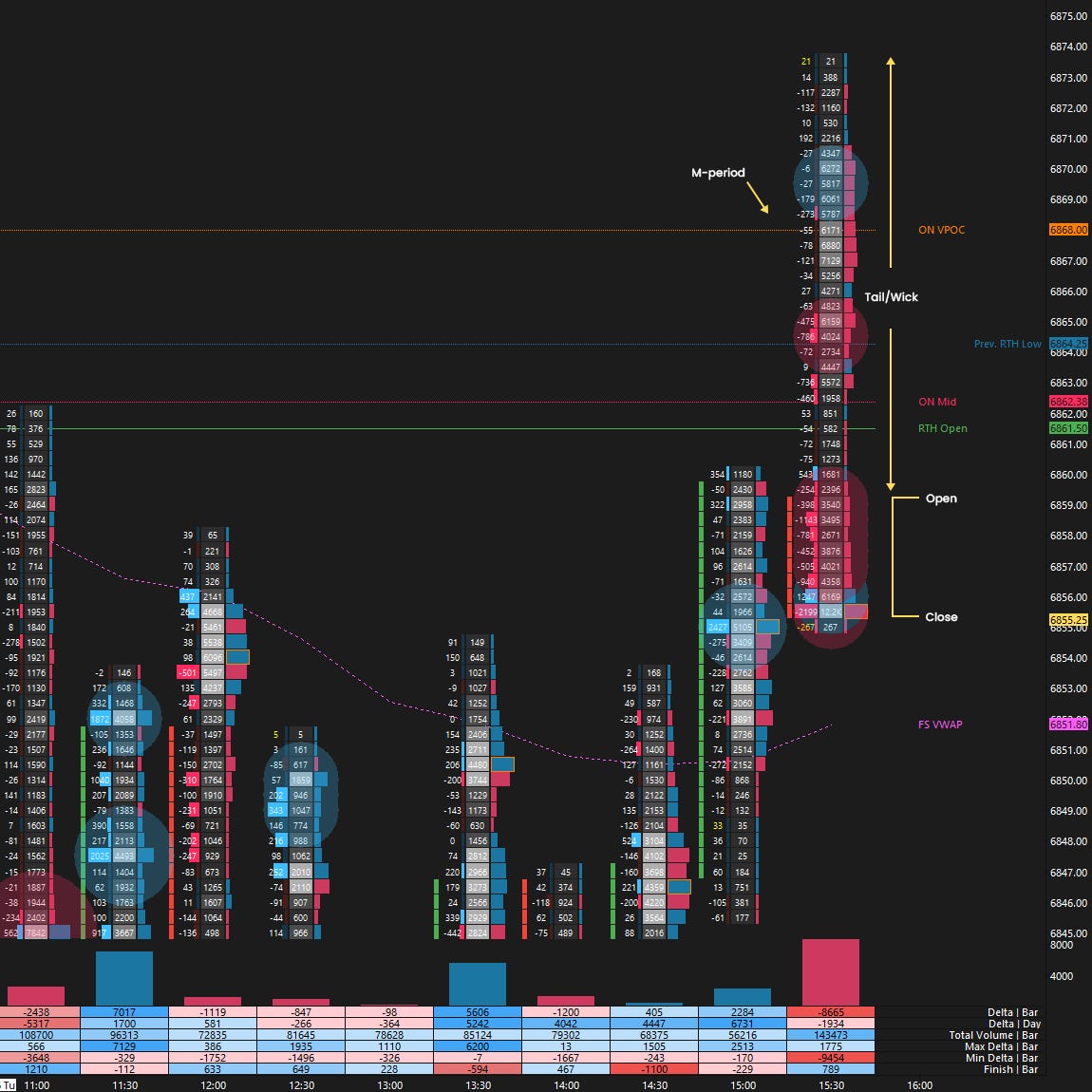

Monday’s b-shaped profile led to a downside continuation today, as the market ultimately filled the roll gap. The key in the short term will be to monitor whether buyers can return within Monday’s range—an attempt that was heavily rejected during the closing M-period (see Figure 2). Failure to reclaim Monday’s low would maintain downside pressure.

In terms of levels, the Smashlevel is 6862—the opening level, which coincides with Monday’s low, today’s VAH, and the weekly VWAP. Holding below 6862 would target the HVN at 6842 (DT1). Acceptance below 6842 would signal weakness, targeting 6822 (DT2), with a final downside target at 6792 (FDT)—the unfilled gap—under sustained selling pressure.

On the flip side, reclaiming and holding above 6862 would shift focus to 6890 (UT1), with a final upside target at 6909 (FUT) under sustained buying pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6862.

Break and hold above 6862 would target 6890 / 6909

Holding below 6862 would target 6842 / 6822 / 6792

Additionally, pay attention to the following VIX levels: 17.96 and 15.02. These levels can provide confirmation of strength or weakness.

Break and hold above 6909 with VIX below 15.02 would confirm strength.

Break and hold below 6792 with VIX above 17.96 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Quite a few confluences at the Smash level, wow, we'll see how the market takes it. Thanks for everything, have a great session!

Thank you