ES Daily Plan | December 15, 2025

Market Context & Key Levels for the Day Ahead

— For new subscribers

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the Weekly Plan for a broader perspective, key levels, and market expectations for the week ahead.

Contract Rollover

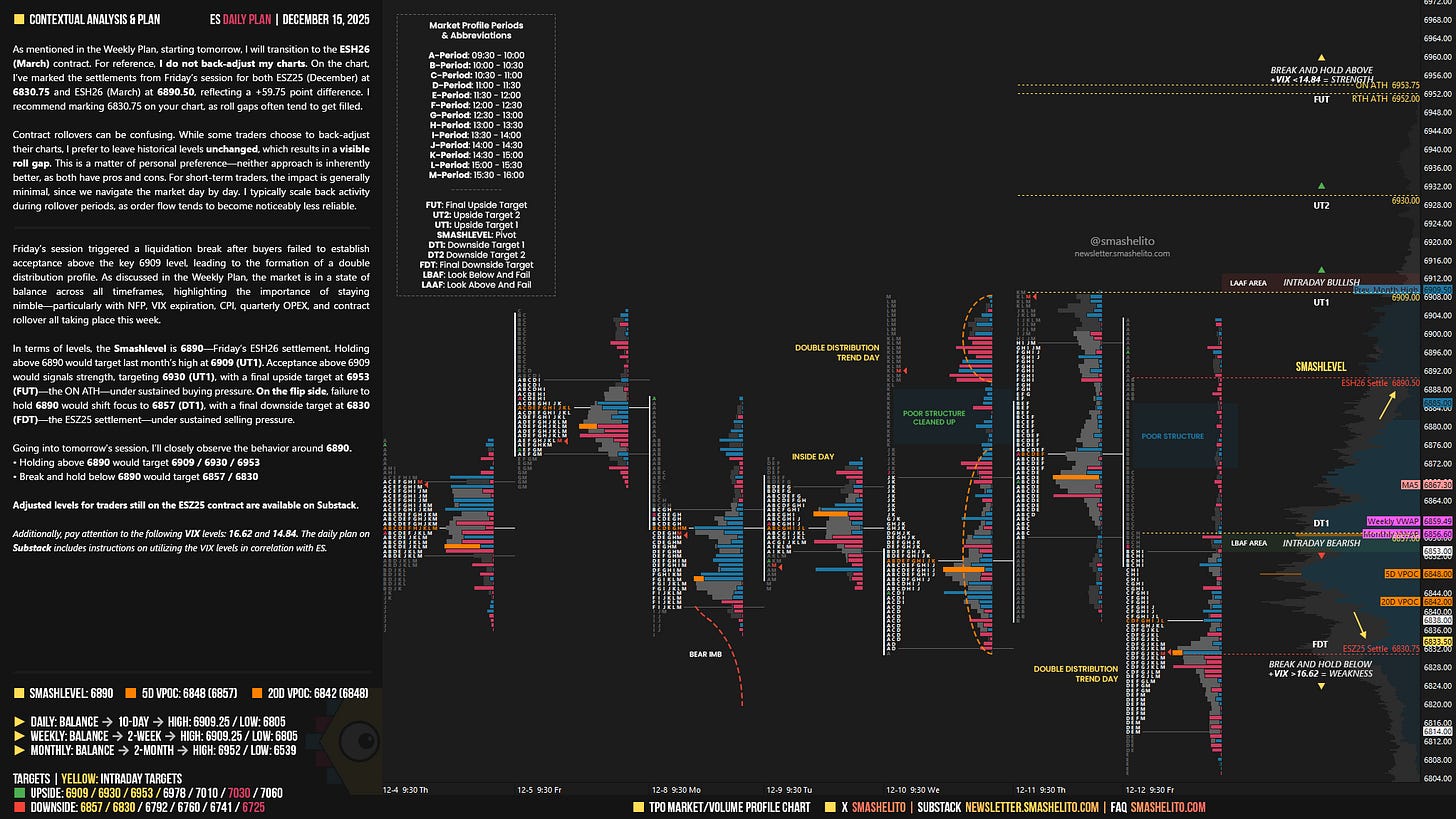

As mentioned in the Weekly Plan, starting tomorrow, I will transition to the ESH26 (March) contract. For reference, I do not back-adjust my charts. On the chart, I’ve marked the settlements from Friday’s session for both ESZ25 (December) at 6830.75 and ESH26 (March) at 6890.50, reflecting a +59.75 point difference. I recommend marking 6830.75 on your chart, as roll gaps often tend to get filled.

Contract rollovers can be confusing. While some traders choose to back-adjust their charts, I prefer to leave historical levels unchanged, which results in a visible roll gap. This is a matter of personal preference—neither approach is inherently better, as both have pros and cons. For short-term traders, the impact is generally minimal, since we navigate the market day by day. I typically scale back activity during rollover periods, as order flow tends to become noticeably less reliable.

Contextual Analysis & Plan

Friday’s session triggered a liquidation break after buyers failed to establish acceptance above the key 6909 level, leading to the formation of a double distribution profile. As discussed in the Weekly Plan, the market is in a state of balance across all timeframes, highlighting the importance of staying nimble—particularly with NFP, VIX expiration, CPI, quarterly OPEX, and contract rollover all taking place this week.

In terms of levels, the Smashlevel is 6890—Friday’s ESH26 settlement. Holding above 6890 would target last month’s high at 6909 (UT1). Acceptance above 6909 would signals strength, targeting 6930 (UT1), with a final upside target at 6953 (FUT)—the ON ATH—under sustained buying pressure.

On the flip side, failure to hold 6890 would shift focus to 6857 (DT1), with a final downside target at 6830 (FDT)—the ESZ25 settlement—under sustained selling pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6890.

Holding above 6890 would target 6909 / 6930 / 6953

Break and hold below 6890 would target 6857 / 6830

Additionally, pay attention to the following VIX levels: 16.62 and 14.84. These levels can provide confirmation of strength or weakness.

Break and hold above 6953 with VIX below 14.84 would confirm strength.

Break and hold below 6830 with VIX above 16.62 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Adjusted levels for traders still on the ESU25 contract:

Going into tomorrow’s session, I’ll closely observe the behavior around 6830.

Holding above 6830 would target 6849 / 6870 / 6893

Break and hold below 6830 would target 6797 / 6770

Another contract change and we're still learning. Thank you for being a great mentor. Have a great week, and I wish you good health and abundance.