ES Daily Plan | December 15, 2023

The context remains unchanged as the market continues its phase of imbalance to the upside across all time frames.

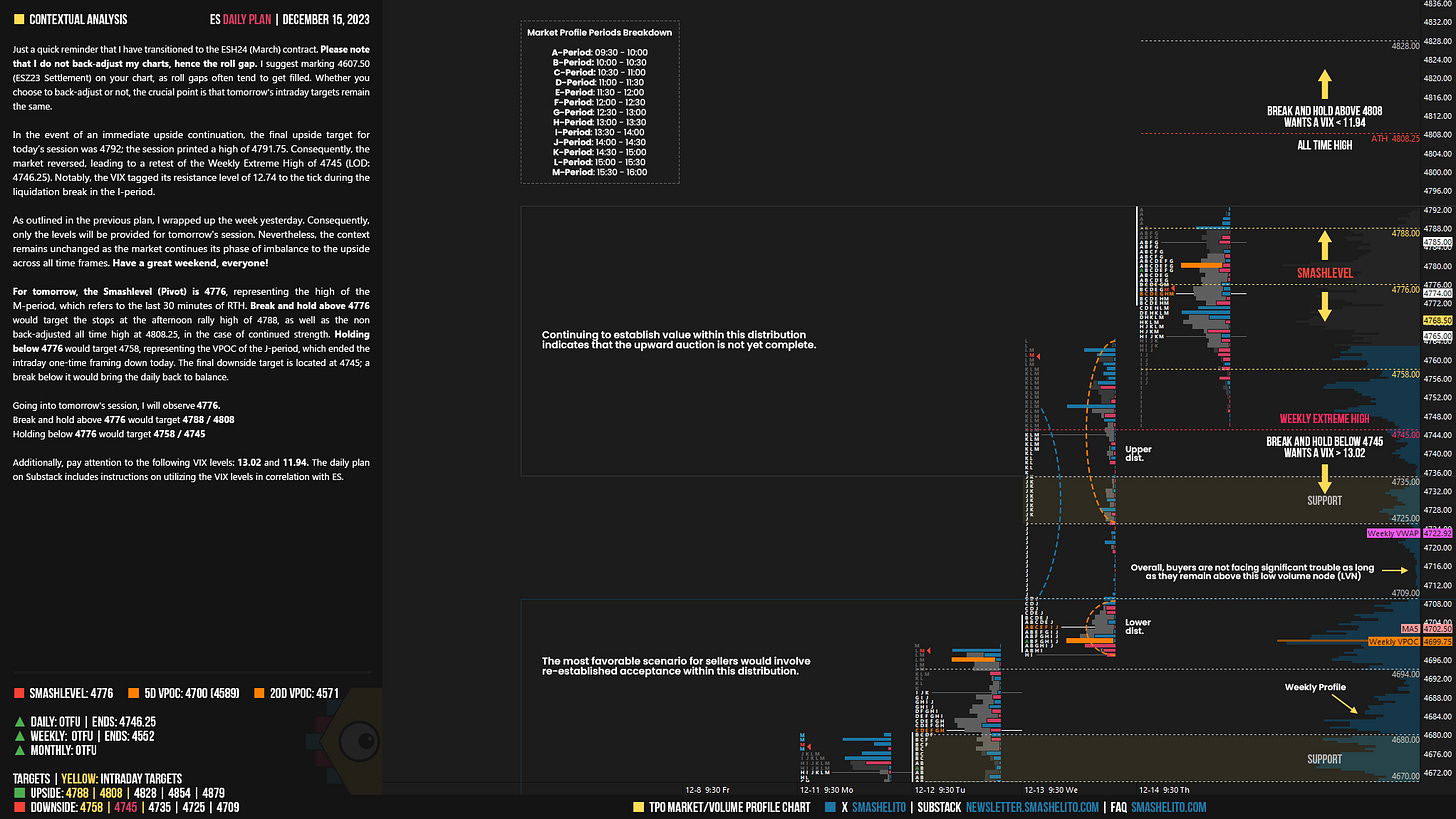

Visual Representation

For new followers, the yellow levels highlighted at the bottom are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final yellow upside target and shorts below the final yellow downside target. It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Contextual Analysis

Just a quick reminder that I have transitioned to the ESH24 (March) contract. Please note that I do not back-adjust my charts, hence the roll gap. I suggest marking 4607.50 (ESZ23 Settlement) on your chart, as roll gaps often tend to get filled. Whether you choose to back-adjust or not, the crucial point is that tomorrow's intraday targets remain the same.

In the event of an immediate upside continuation, the final upside target for today’s session was 4792; the session printed a high of 4791.75. Consequently, the market reversed, leading to a retest of the Weekly Extreme High of 4745 (LOD: 4746.25). Notably, the VIX tagged its resistance level of 12.74 to the tick during the liquidation break in the I-period.

As outlined in the previous plan, I wrapped up the week yesterday. Consequently, only the levels will be provided for tomorrow's session. Nevertheless, the context remains unchanged as the market continues its phase of imbalance to the upside across all time frames. Have a great weekend, everyone!

For tomorrow, the Smashlevel (Pivot) is 4776, representing the high of the M-period, which refers to the last 30 minutes of RTH. Break and hold above 4776 would target the stops at the afternoon rally high of 4788, as well as the non back-adjusted all time high at 4808.25, in the case of continued strength. Holding below 4776 would target 4758, representing the VPOC of the J-period, which ended the intraday one-time framing down today. The final downside target is located at 4745; a break below it would bring the daily back to balance.

Levels of Interest

Going into tomorrow's session, I will observe 4776.

Break and hold above 4776 would target 4788 / 4808

Holding below 4776 would target 4758 / 4745

Additionally, pay attention to the following VIX levels: 13.02 and 11.94. These levels can provide confirmation of strength or weakness.

Break and hold above 4808 with VIX below 11.94 would confirm strength.

Break and hold below 4745 with VIX above 13.02 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Weekly Plan

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Thanks for the write up Smash. I think next week will be it for me for the year. Have a great holiday if you celebrate and a Happy and Healthy New Year. Thanks for the content. Maybe you can get a discord going if its not too much. All the Best.

Thank you, buddy! Another amazing day. Levels kept me on the right side.