ES Daily Plan | December 12, 2025

Market Context & Key Levels for the Day Ahead

— For new subscribers

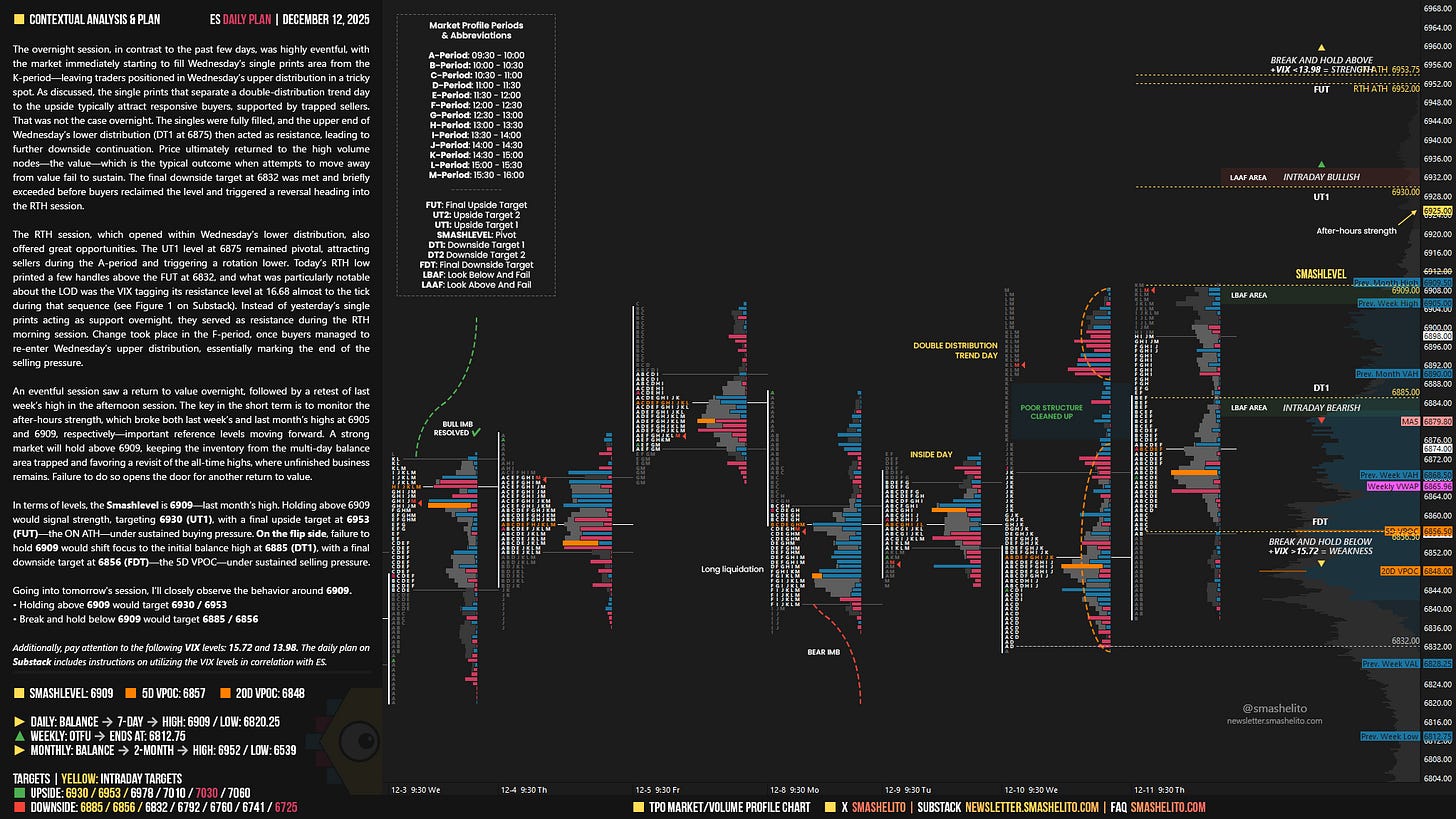

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the Weekly Plan for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

The overnight session, in contrast to the past few days, was highly eventful, with the market immediately starting to fill Wednesday’s single prints area from the K-period—leaving traders positioned in Wednesday’s upper distribution in a tricky spot. As discussed, the single prints that separate a double-distribution trend day to the upside typically attract responsive buyers, supported by trapped sellers. That was not the case overnight. The singles were fully filled, and the upper end of Wednesday’s lower distribution (DT1 at 6875) then acted as resistance, leading to further downside continuation. Price ultimately returned to the high volume nodes—the value—which is the typical outcome when attempts to move away from value fail to sustain. The final downside target at 6832 was met and briefly exceeded before buyers reclaimed the level and triggered a reversal heading into the RTH session.

The RTH session, which opened within Wednesday’s lower distribution, also offered great opportunities. The UT1 level at 6875 remained pivotal, attracting sellers during the A-period and triggering a rotation lower. Today’s RTH low printed a few handles above the FUT at 6832, and what was particularly notable about the LOD was the VIX tagging its resistance level at 16.68 almost to the tick during that sequence (see Figure 1). Instead of yesterday’s single prints acting as support overnight, they served as resistance during the RTH morning session. Change took place in the F-period, once buyers managed to re-enter Wednesday’s upper distribution, essentially marking the end of the selling pressure.

An eventful session saw a return to value overnight, followed by a retest of last week’s high in the afternoon session. The key in the short term is to monitor the after-hours strength, which broke both last week’s and last month’s highs at 6905 and 6909, respectively—important reference levels moving forward. A strong market will hold above 6909, keeping the inventory from the multi-day balance area trapped and favoring a revisit of the all-time highs, where unfinished business remains. Failure to do so opens the door for another return to value.

In terms of levels, the Smashlevel is 6909—last month’s high. Holding above 6909 would signal strength, targeting 6930 (UT1), with a final upside target at 6953 (FUT)—the ON ATH—under sustained buying pressure.

On the flip side, failure to hold 6909 would shift focus to the initial balance high at 6885 (DT1), with a final downside target at 6856 (FDT)—the 5D VPOC—under sustained selling pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6909.

Holding above 6909 would target 6930 / 6953

Break and hold below 6909 would target 6885 / 6856

Additionally, pay attention to the following VIX levels: 15.72 and 13.98. These levels can provide confirmation of strength or weakness.

Break and hold above 6953 with VIX below 13.98 would confirm strength.

Break and hold below 6856 with VIX above 15.72 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

It's a pleasure to read your posts every day and understand your approach to the markets. Thank you for your consistency, discipline, and the time you dedicate to this. Last trading day. Thank you so much. May life continue to bring you abundance and good health. Have a great weekend!

Thank you