ES Daily Plan | December 11, 2025

Market Context & Key Levels for the Day Ahead

— For new subscribers

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the Weekly Plan for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

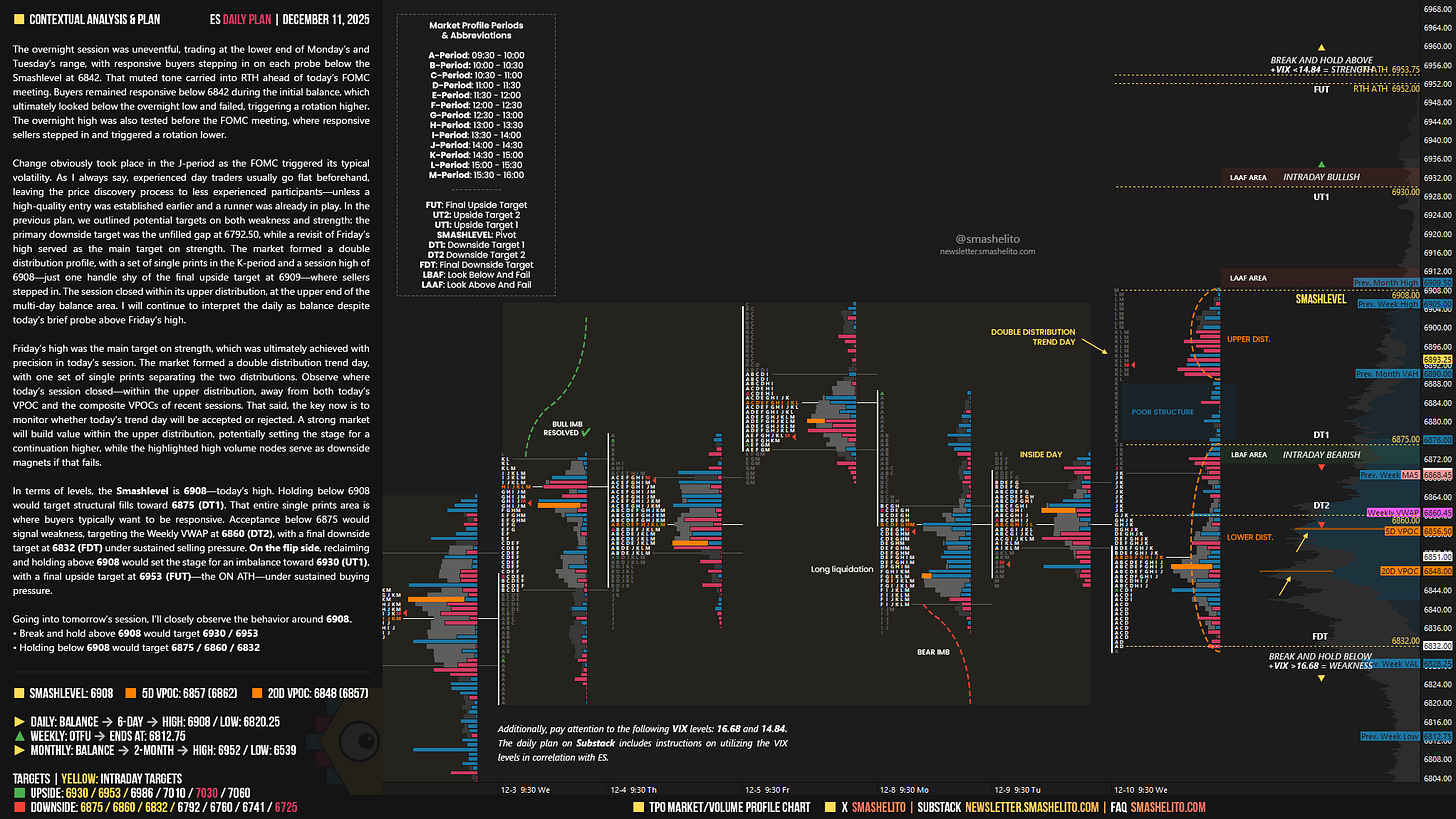

The overnight session was uneventful, trading at the lower end of Monday’s and Tuesday’s range, with responsive buyers stepping in on each probe below the Smashlevel at 6842. That muted tone carried into RTH ahead of today’s FOMC meeting. Buyers remained responsive below 6842 during the initial balance, which ultimately looked below the overnight low and failed, triggering a rotation higher. The overnight high was also tested before the FOMC meeting, where responsive sellers stepped in and triggered a rotation lower.

Change obviously took place in the J-period as the FOMC triggered its typical volatility. As I always say, experienced day traders usually go flat beforehand, leaving the price discovery process to less experienced participants—unless a high-quality entry was established earlier and a runner was already in play. In the previous plan, we outlined potential targets on both weakness and strength: the primary downside target was the unfilled gap at 6792.50, while a revisit of Friday’s high served as the main target on strength. The market formed a double distribution profile, with a set of single prints in the K-period and a session high of 6908—just one handle shy of the final upside target at 6909—where sellers stepped in. The session closed within its upper distribution, at the upper end of the multi-day balance area. I will continue to interpret the daily as balance despite today’s brief probe above Friday’s high.

Friday’s high was the main target on strength, which was ultimately achieved with precision in today’s session. The market formed a double distribution trend day, with one set of single prints separating the two distributions.

Observe where today’s session closed—within the upper distribution, away from both today’s VPOC and the composite VPOCs of recent sessions. That said, the key now is to monitor whether today’s trend day will be accepted or rejected.

A strong market will build value within the upper distribution, potentially setting the stage for a continuation higher, while the highlighted high volume nodes serve as downside magnets if that fails.

In terms of levels, the Smashlevel is 6908—today’s high. Holding below 6908 would target structural fills toward 6875 (DT1). That entire single prints area is where buyers typically want to be responsive. Acceptance below 6875 would signal weakness, targeting the Weekly VWAP at 6860 (DT2), with a final downside target at 6832 (FDT) under sustained selling pressure.

On the flip side, reclaiming and holding above 6908 would set the stage for an imbalance toward 6930 (UT1), with a final upside target at 6953 (FUT)—the ON ATH—under sustained buying pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6908.

Break and hold above 6908 would target 6930 / 6953

Holding below 6908 would target 6875 / 6860 / 6832

Additionally, pay attention to the following VIX levels: 16.68 and 14.84. These levels can provide confirmation of strength or weakness.

Break and hold above 6953 with VIX below 14.84 would confirm strength.

Break and hold below 6832 with VIX above 16.68 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Thank you Smash!

You nailed that target! Thanks for the guidance.