ES Daily Plan | December 10, 2025

Market Context & Key Levels for the Day Ahead

— For new subscribers

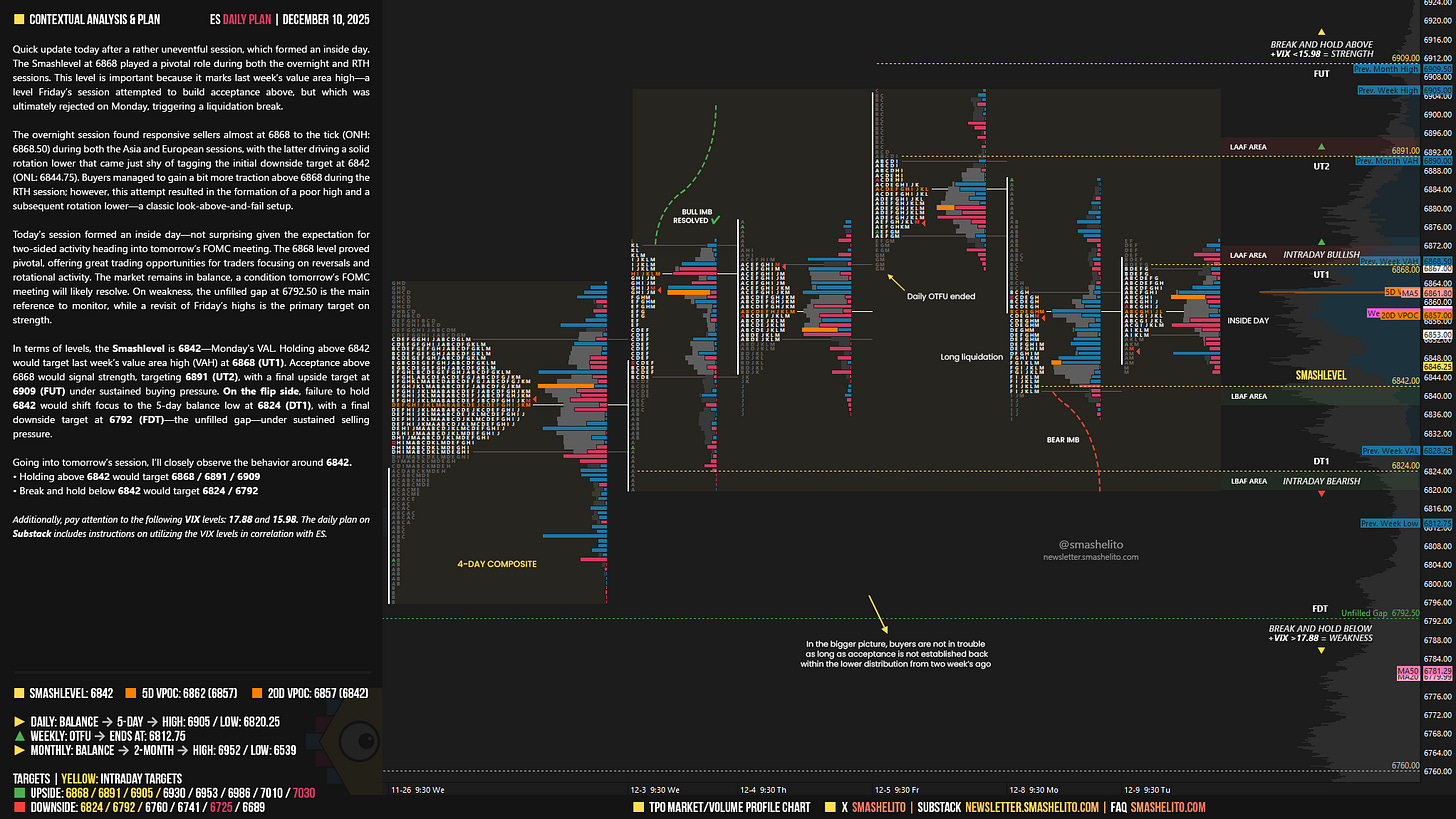

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the Weekly Plan for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

Quick update today after a rather uneventful session, which formed an inside day. The Smashlevel at 6868 played a pivotal role during both the overnight and RTH sessions. This level is important because it marks last week’s value area high—a level Friday’s session attempted to build acceptance above, but which was ultimately rejected on Monday, triggering a liquidation break.

The overnight session found responsive sellers almost at 6868 to the tick (ONH: 6868.50) during both the Asia and European sessions, with the latter driving a solid rotation lower that came just shy of tagging the initial downside target at 6842 (ONL: 6844.75). Buyers managed to gain a bit more traction above 6868 during the RTH session; however, this attempt resulted in the formation of a poor high and a subsequent rotation lower—a classic look-above-and-fail setup.

Today’s session formed an inside day—not surprising given the expectation for two-sided activity heading into tomorrow’s FOMC meeting. The 6868 level proved pivotal, offering great trading opportunities for traders focusing on reversals and rotational activity. The market remains in balance, a condition tomorrow’s FOMC meeting will likely resolve. On weakness, the unfilled gap at 6792.50 is the main reference to monitor, while a revisit of Friday’s highs is the primary target on strength.

In terms of levels, the Smashlevel is 6842—Monday’s VAL. Holding above 6842 would target last week’s value area high (VAH) at 6868 (UT1). Acceptance above 6868 would signal strength, targeting 6891 (UT2), with a final upside target at 6909 (FUT) under sustained buying pressure.

On the flip side, failure to hold 6842 would shift focus to the 5-day balance low at 6824 (DT1), with a final downside target at 6792 (FDT)—the unfilled gap—under sustained selling pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6842.

Holding above 6842 would target 6868 / 6891 / 6909

Break and hold below 6842 would target 6824 / 6792

Additionally, pay attention to the following VIX levels: 17.88 and 15.98. These levels can provide confirmation of strength or weakness.

Break and hold above 6909 with VIX below 15.98 would confirm strength.

Break and hold below 6792 with VIX above 17.88 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Thanks Smash! Your levels are always on point!

Hopefully today's events will allow us to break the balance, and thus be able to seek opportunities with greater asymmetry. Have a great day, helmet and vest on! thanks for all!