ES Daily Plan | December 1, 2025

Market Context & Key Levels for the Day Ahead

— For new subscribers

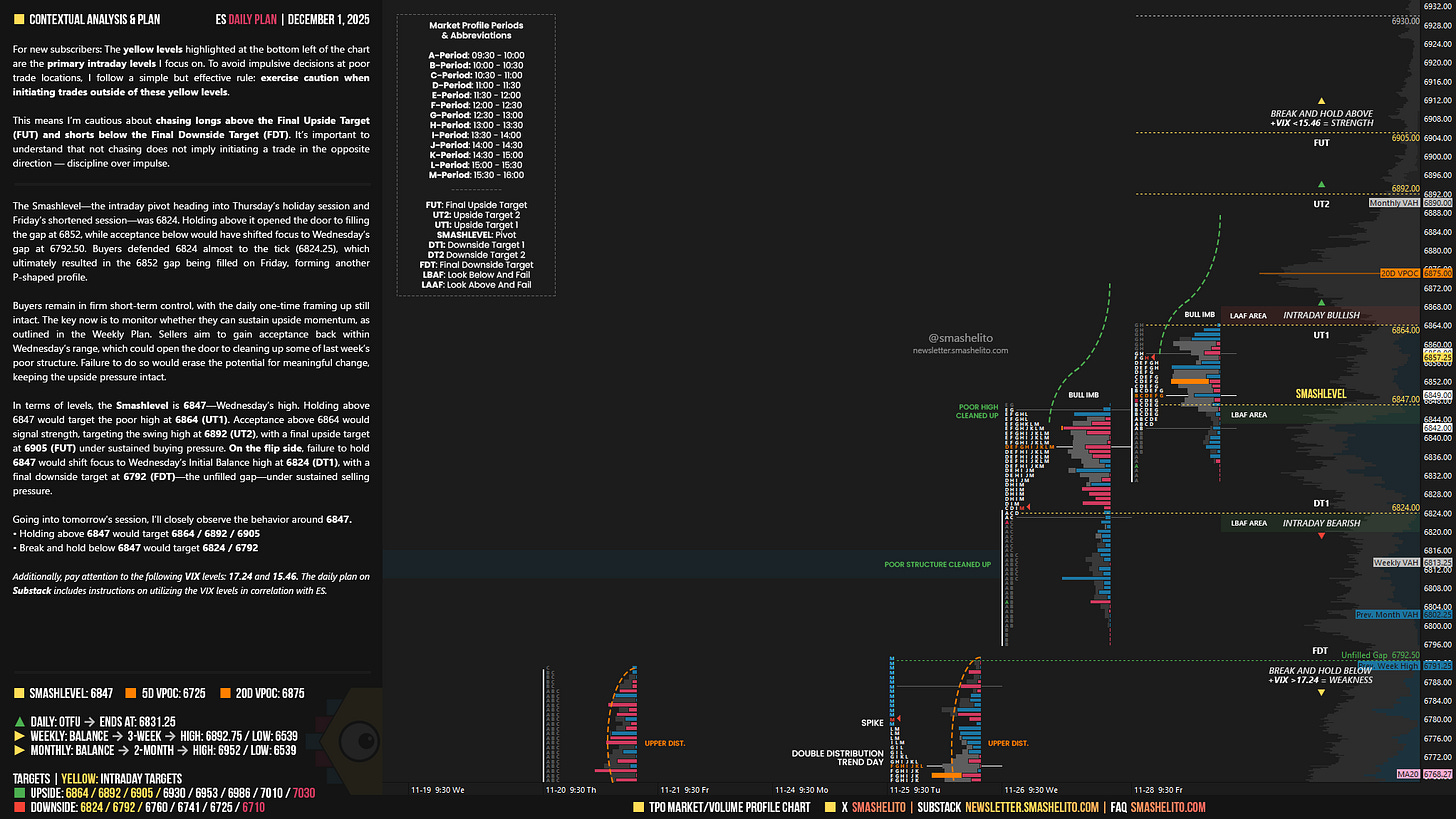

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the Weekly Plan for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

The Smashlevel—the intraday pivot heading into Thursday’s holiday session and Friday’s shortened session—was 6824. Holding above it opened the door to filling the gap at 6852, while acceptance below would have shifted focus to Wednesday’s gap at 6792.50. Buyers defended 6824 almost to the tick (6824.25), which ultimately resulted in the 6852 gap being filled on Friday, forming another P-shaped profile.

Buyers remain in firm short-term control, with the daily one-time framing up still intact. The key now is to monitor whether they can sustain upside momentum, as outlined in the Weekly Plan. Sellers aim to gain acceptance back within Wednesday’s range, which could open the door to cleaning up some of last week’s poor structure. Failure to do so would erase the potential for meaningful change, keeping the upside pressure intact.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6847.

Holding above 6847 would target 6864 / 6892 / 6905

Break and hold below 6847 would target 6824 / 6792

Additionally, pay attention to the following VIX levels: 17.24 and 15.46. These levels can provide confirmation of strength or weakness.

Break and hold above 6905 with VIX below 15.46 would confirm strength.

Break and hold below 6792 with VIX above 17.24 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Buenas tardes, Smashelito y buena semana. Mil gracias por il boletin.

Thanks! Let's go!