ES Daily Plan | August 7, 2025

Market Context & Key Levels for the Day Ahead

— For new subscribers

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the ES Weekly Plan | August 4-8, 2025 for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

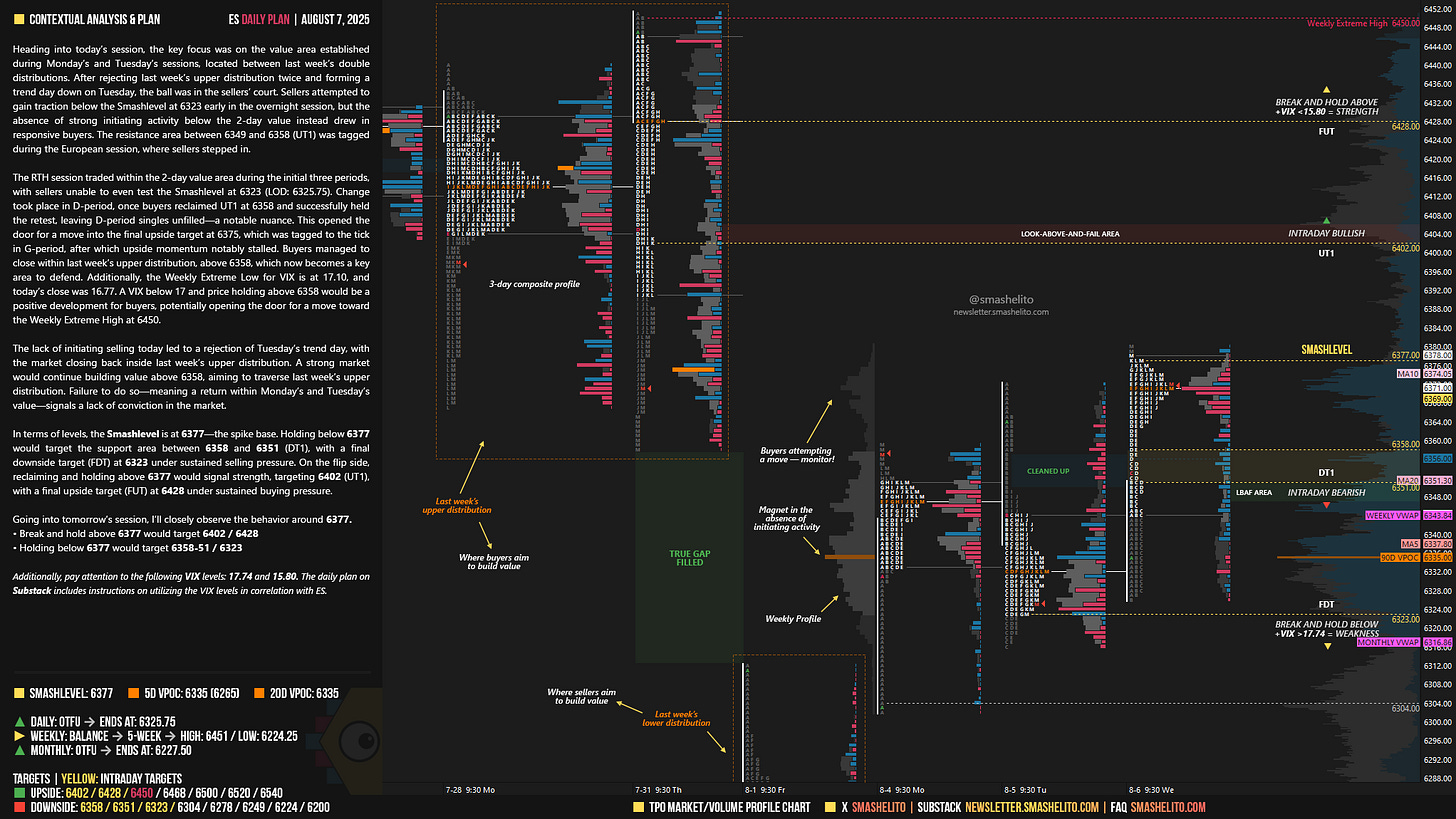

Heading into today’s session, the key focus was on the value area established during Monday’s and Tuesday’s sessions, located between last week’s double distributions. After rejecting last week’s upper distribution twice and forming a trend day down on Tuesday, the ball was in the sellers’ court. Sellers attempted to gain traction below the Smashlevel at 6323 early in the overnight session, but the absence of strong initiating activity below the 2-day value instead drew in responsive buyers. The resistance area between 6349 and 6358 (UT1) was tagged during the European session, where sellers stepped in.

The RTH session traded within the 2-day value area during the initial three periods, with sellers unable to even test the Smashlevel at 6323 (LOD: 6325.75). Change took place in D-period, once buyers reclaimed UT1 at 6358 and successfully held the retest, leaving D-period singles unfilled—a notable nuance. This opened the door for a move into the final upside target at 6375, which was tagged to the tick in G-period, after which upside momentum notably stalled. Buyers managed to close within last week’s upper distribution, above 6358, which now becomes a key area to defend. Additionally, the Weekly Extreme Low for VIX is at 17.10, and today’s close was 16.77. A VIX below 17 and price holding above 6358 would be a positive development for buyers, potentially opening the door for a move toward the Weekly Extreme High at 6450.

The lack of initiating selling today led to a rejection of Tuesday’s trend day, with the market closing back inside last week’s upper distribution. A strong market would continue building value above 6358, aiming to traverse last week’s upper distribution. Failure to do so—meaning a return within Monday’s and Tuesday’s value—signals a lack of conviction in the market.

In terms of levels, the Smashlevel is at 6377—the spike base. Holding below 6377 would target the support area between 6358 and 6351 (DT1), with a final downside target (FDT) at 6323 under sustained selling pressure.

On the flip side, reclaiming and holding above 6377 would signal strength, targeting 6402 (UT1), with a final upside target (FUT) at 6428 under sustained buying pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6377.

Break and hold above 6377 would target 6402 / 6428

Holding below 6377 would target 6358-51 / 6323

Additionally, pay attention to the following VIX levels: 17.74 and 15.80. These levels can provide confirmation of strength or weakness.

Break and hold above 6428 with VIX below 15.80 would confirm strength.

Break and hold below 6323 with VIX above 17.74 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Thank you.Always so valuable

Thank you Smash!