ES Daily Plan | August 5, 2025

Market Context & Key Levels for the Day Ahead

— For new subscribers

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the ES Weekly Plan | August 4-8, 2025 for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

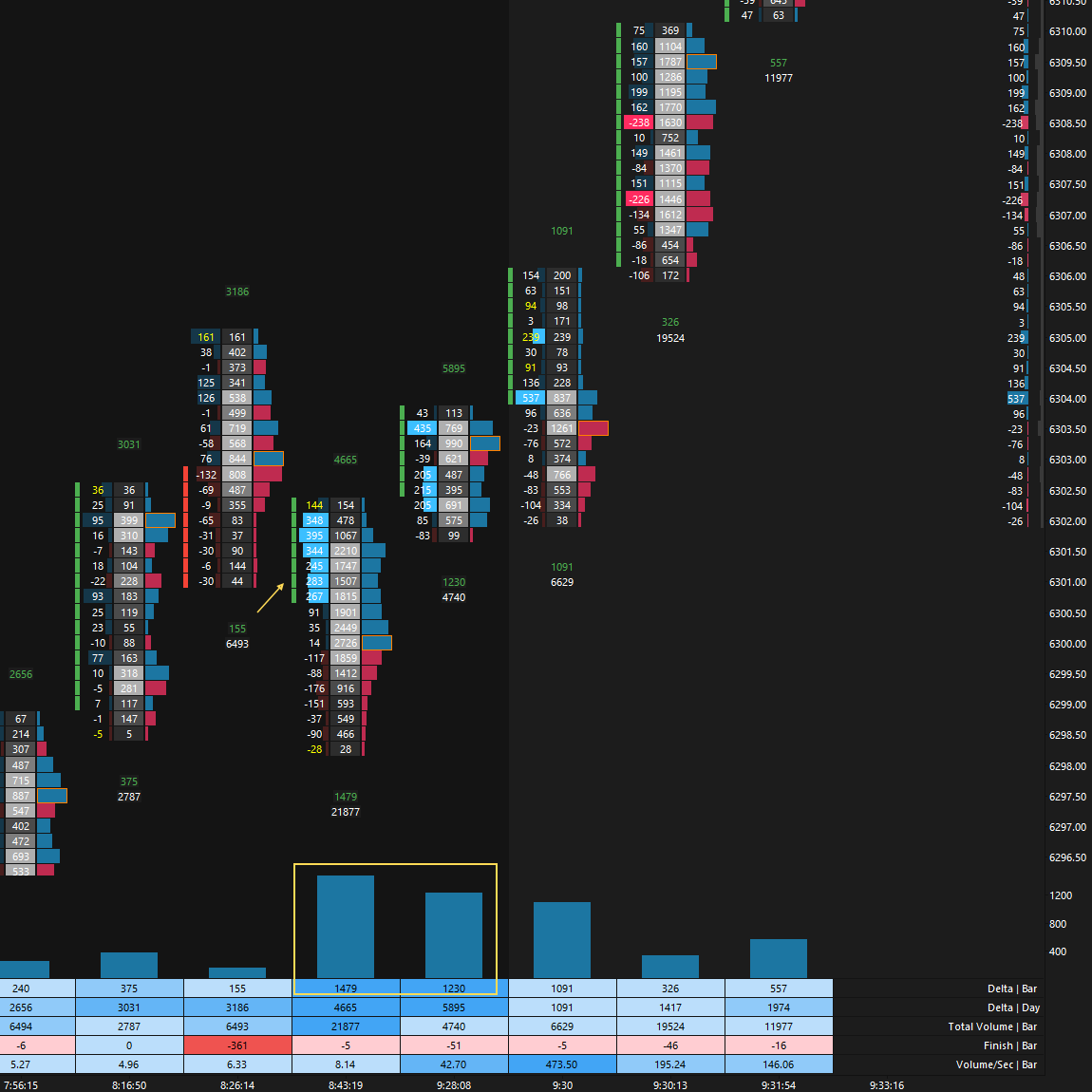

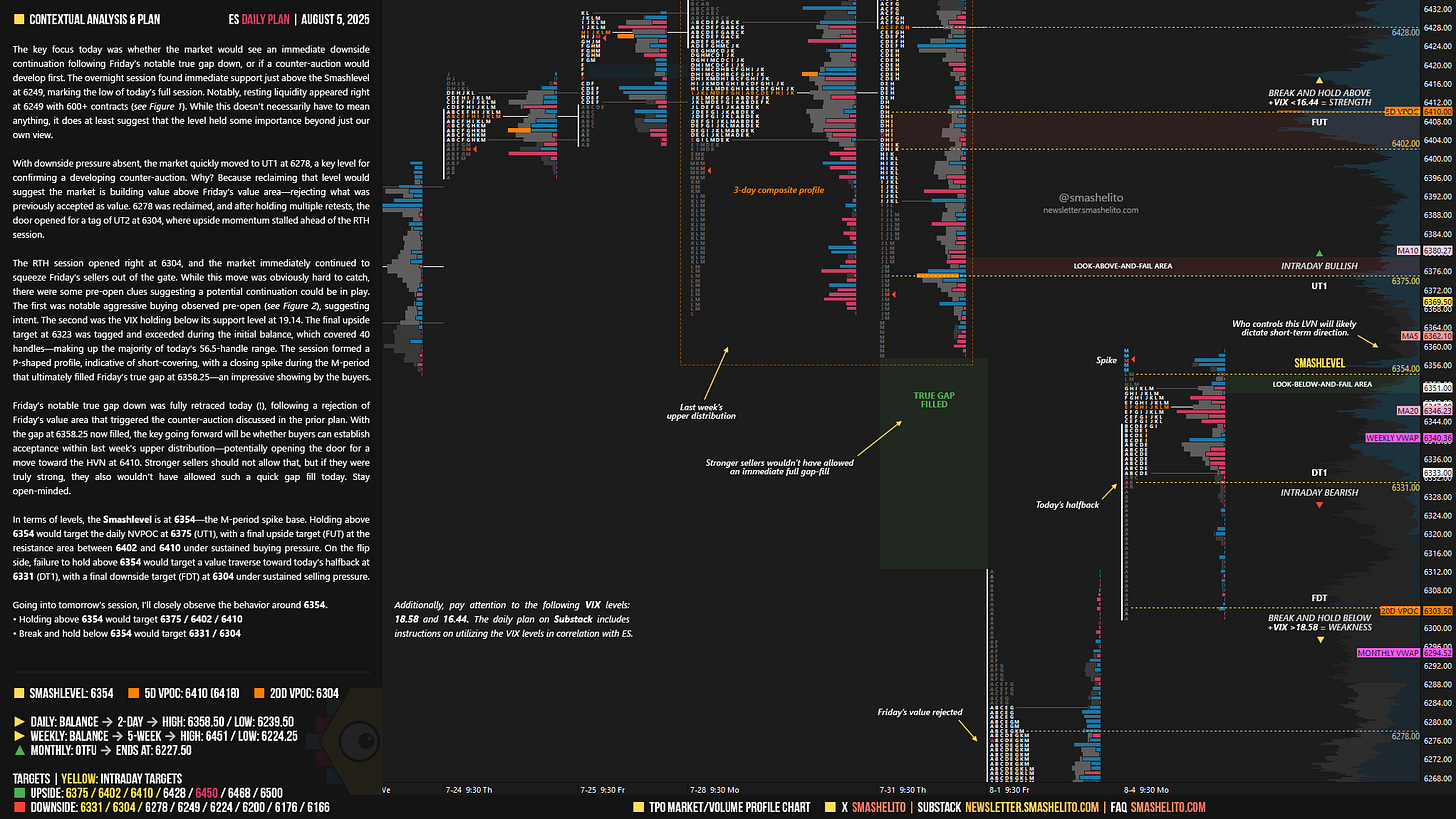

The key focus today was whether the market would see an immediate downside continuation following Friday’s notable true gap down, or if a counter-auction would develop first. The overnight session found immediate support just above the Smashlevel at 6249, marking the low of today’s full session. Notably, resting liquidity appeared right at 6249 with 600+ contracts (see Figure 1). While this doesn’t necessarily have to mean anything, it does at least suggest that the level held some importance beyond just our own view.

With downside pressure absent, the market quickly moved to UT1 at 6278, a key level for confirming a developing counter-auction. Why? Because reclaiming that level would suggest the market is building value above Friday’s value area—rejecting what was previously accepted as value. 6278 was reclaimed, and after holding multiple retests, the door opened for a tag of UT2 at 6304, where upside momentum stalled ahead of the RTH session.

The RTH session opened right at 6304, and the market immediately continued to squeeze Friday’s sellers out of the gate. While this move was obviously hard to catch, there were some pre-open clues suggesting a potential continuation could be in play. The first was notable aggressive buying observed pre-open (see Figure 2), suggesting intent. The second was the VIX holding below its support level at 19.14. The final upside target at 6323 was tagged and exceeded during the initial balance, which covered 40 handles—making up the majority of today’s 56.5-handle range. The session formed a P-shaped profile, indicative of short-covering, with a closing spike during the M-period that ultimately filled Friday’s true gap at 6358.25—an impressive showing by the buyers.

Friday’s notable true gap down was fully retraced today (!), following a rejection of Friday’s value area that triggered the counter-auction discussed in the prior plan. With the gap at 6358.25 now filled, the key going forward will be whether buyers can establish acceptance within last week’s upper distribution—potentially opening the door for a move toward the HVN at 6410. Stronger sellers should not allow that, but if they were truly strong, they also wouldn’t have allowed such a quick gap fill today. Stay open-minded.

In terms of levels, the Smashlevel is at 6354—the M-period spike base. Holding above 6354 would target the daily NVPOC at 6375 (UT1), with a final upside target (FUT) at the resistance area between 6402 and 6410 under sustained buying pressure.

On the flip side, failure to hold above 6354 would target a value traverse toward today’s halfback at 6331 (DT1), with a final downside target (FDT) at 6304 under sustained selling pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6354.

Holding above 6354 would target 6375 / 6402 / 6410

Break and hold below 6354 would target 6331 / 6304

Additionally, pay attention to the following VIX levels: 18.58 and 16.44. These levels can provide confirmation of strength or weakness.

Break and hold above 6410 with VIX below 16.44 would confirm strength.

Break and hold below 6304 with VIX above 18.58 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Thank you Smash!!

Excellent thamk you once more