ES Daily Plan | August 5, 2024

My preparations and expectations for the upcoming session.

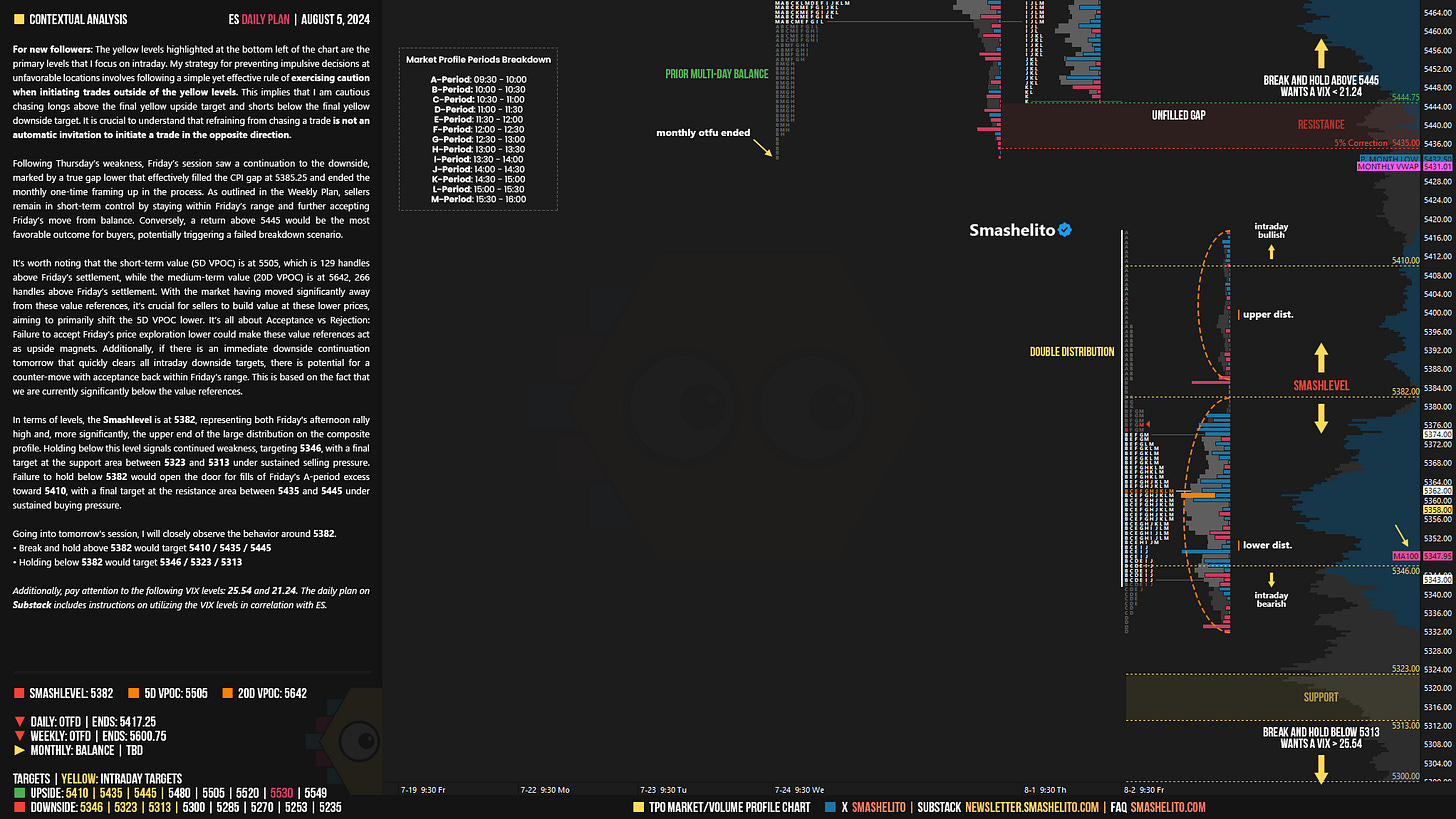

For new followers: The yellow levels highlighted at the bottom left of the chart are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final yellow upside target and shorts below the final yellow downside target. It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Visual Representation

Contextual Analysis

Following Thursday’s weakness, Friday’s session saw a continuation to the downside, marked by a true gap lower that effectively filled the CPI gap at 5385.25 and ended the monthly one-time framing up in the process. As outlined in the Weekly Plan, sellers remain in short-term control by staying within Friday’s range and further accepting Friday’s move from balance. Conversely, a return above 5445 would be the most favorable outcome for buyers, potentially triggering a failed breakdown scenario.

It’s worth noting that the short-term value (5D VPOC) is at 5505, which is 129 handles above Friday’s settlement, while the medium-term value (20D VPOC) is at 5642, 266 handles above Friday’s settlement. With the market having moved significantly away from these value references, it’s crucial for sellers to build value at these lower prices, aiming to primarily shift the 5D VPOC lower. It’s all about Acceptance vs Rejection: Failure to accept Friday’s price exploration lower could make these value references act as upside magnets. Additionally, if there is an immediate downside continuation tomorrow that quickly clears all intraday downside targets, there is potential for a counter-move with acceptance back within Friday’s range. This is based on the fact that we are currently significantly below the value references.

In terms of levels, the Smashlevel is at 5382, representing both Friday's afternoon rally high and, more significantly, the upper end of the large distribution on the composite profile. Holding below this level signals continued weakness, targeting 5346, with a final target at the support area between 5323 and 5313 under sustained selling pressure. Failure to hold below 5382 would open the door for fills of Friday’s A-period excess toward 5410, with a final target at the resistance area between 5435 and 5445 under sustained buying pressure.

Levels of Interest

Going into tomorrow's session, I will closely observe the behavior around 5382.

Break and hold above 5382 would target 5410 / 5435 / 5445

Holding below 5382 would target 5346 / 5323 / 5313

Additionally, pay attention to the following VIX levels: 25.54 and 21.24. These levels can provide confirmation of strength or weakness.

Break and hold above 5445 with VIX below 21.24 would confirm strength.

Break and hold below 5313 with VIX above 25.54 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Weekly Plan

Make sure to review the Weekly Plan, which provides a broader perspective and highlights key levels of interest to observe in the upcoming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Thank you! Testing support instantly!

VIX hits 40!!!