ES Daily Plan | August 4, 2025

Market Context & Key Levels for the Day Ahead

— For new subscribers

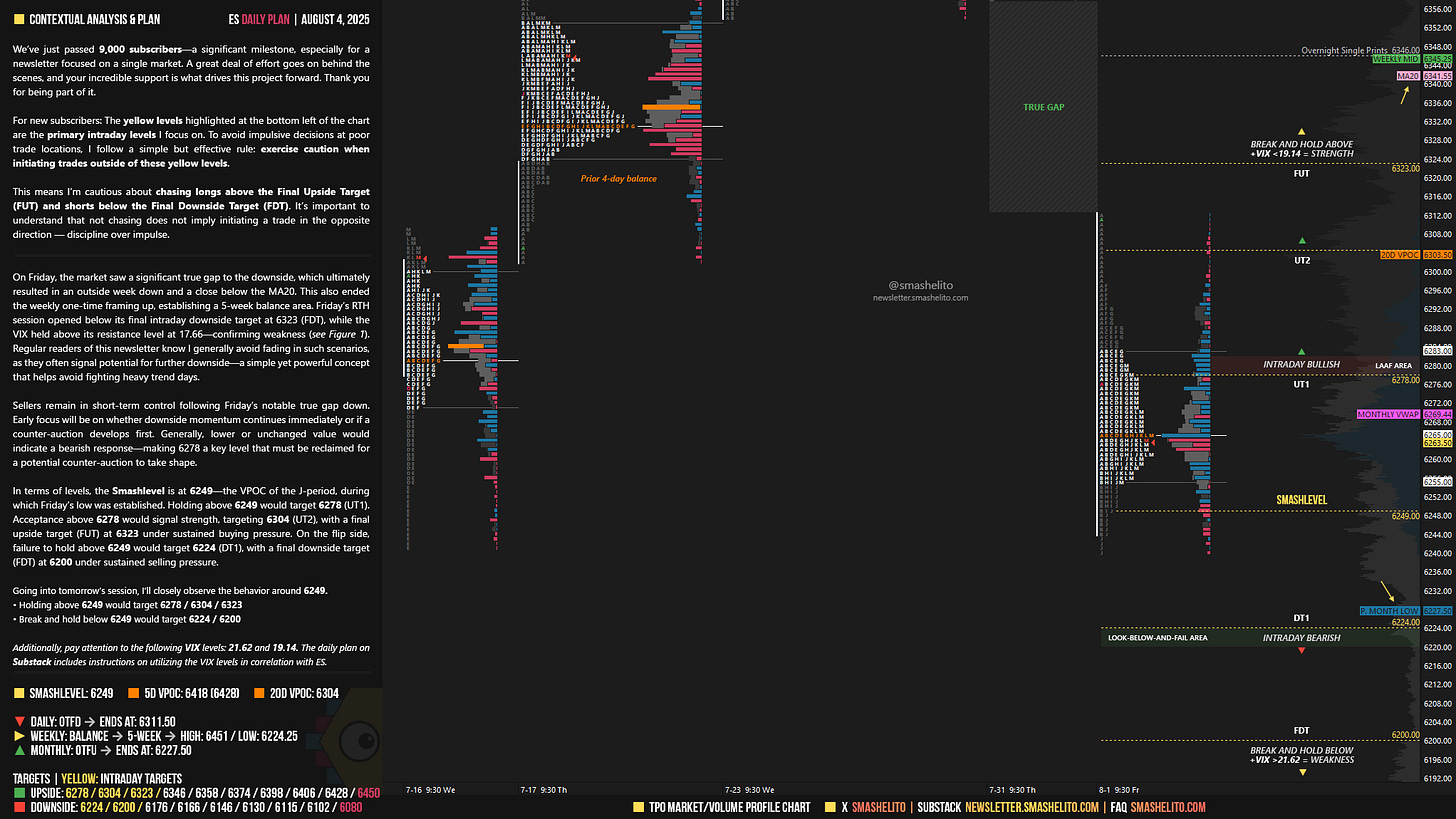

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the ES Weekly Plan | August 4-8, 2025 for a broader perspective, key levels, and market expectations for the week ahead.

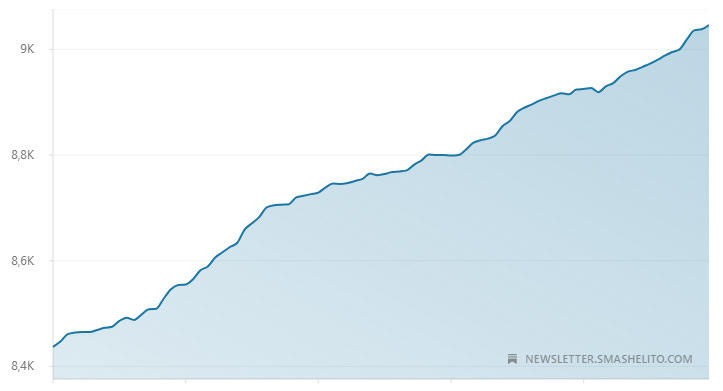

9,000+ Subscribers

We’ve just passed 9,000 subscribers—a significant milestone, especially for a newsletter focused on a single market. A great deal of effort goes on behind the scenes, and your incredible support is what drives this project forward. Thank you for being part of it.

Contextual Analysis & Plan

On Friday, the market saw a significant true gap to the downside, which ultimately resulted in an outside week down and a close below the MA20. This also ended the weekly one-time framing up, establishing a 5-week balance area. Friday’s RTH session opened below its final intraday downside target at 6323 (FDT), while the VIX held above its resistance level at 17.66—confirming weakness (see Figure 1). Regular readers of this newsletter know I generally avoid fading in such scenarios, as they often signal potential for further downside—a simple yet powerful concept that helps avoid fighting heavy trend days.

Sellers remain in short-term control following Friday’s notable true gap down. Early focus will be on whether downside momentum continues immediately or if a counter-auction develops first. Generally, lower or unchanged value would indicate a bearish response—making 6278 a key level that must be reclaimed for a potential counter-auction to take shape.

In terms of levels, the Smashlevel is at 6249—the VPOC of the J-period, during which Friday’s low was established. Holding above 6249 would target 6278 (UT1). Acceptance above 6278 would signal strength, targeting 6304 (UT2), with a final upside target (FUT) at 6323 under sustained buying pressure.

On the flip side, failure to hold above 6249 would target 6224 (DT1), with a final downside target (FDT) at 6200 under sustained selling pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6249.

Holding above 6249 would target 6278 / 6304 / 6323

Break and hold below 6249 would target 6224 / 6200

Additionally, pay attention to the following VIX levels: 21.62 and 19.14. These levels can provide confirmation of strength or weakness.

Break and hold above 6323 with VIX below 19.14 would confirm strength.

Break and hold below 6200 with VIX above 21.62 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Thanks Smash! Congrats on 9K! Only 91,000 more to go until you’re where you deserve to be.

Congrats on the 9k+ subscribers, well deserved and will only keep increasing IMO - thanks as always Smash 👍🏻