ES Daily Plan | August 23, 2024

My preparations and expectations for the upcoming session.

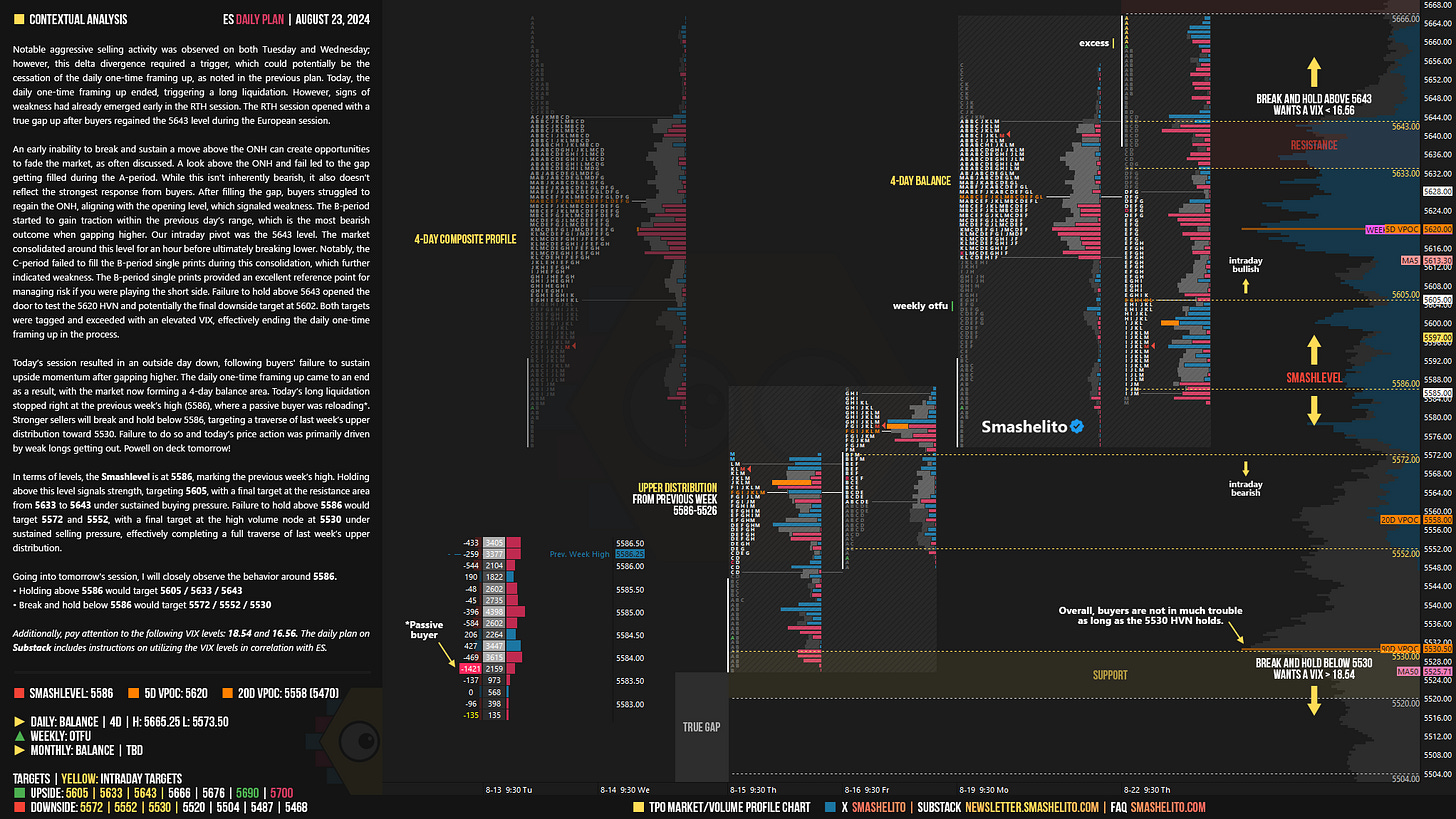

For new followers: The yellow levels highlighted at the bottom left of the chart are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final yellow upside target and shorts below the final yellow downside target. It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Visual Representation

Contextual Analysis

Notable aggressive selling activity was observed on both Tuesday and Wednesday; however, this delta divergence required a trigger, which could potentially be the cessation of the daily one-time framing up, as noted in the previous plan. Today, the daily one-time framing up ended, triggering a long liquidation. However, signs of weakness had already emerged early in the RTH session. The RTH session opened with a true gap up after buyers regained the 5643 level during the European session.

An early inability to break and sustain a move above the ONH can create opportunities to fade the market, as often discussed. A look above the ONH and fail led to the gap getting filled during the A-period. While this isn’t inherently bearish, it also doesn’t reflect the strongest response from buyers. After filling the gap, buyers struggled to regain the ONH, aligning with the opening level, which signaled weakness. The B-period started to gain traction within the previous day’s range, which is the most bearish outcome when gapping higher. Our intraday pivot was the 5643 level. The market consolidated around this level for an hour before ultimately breaking lower. Notably, the C-period failed to fill the B-period single prints during this consolidation, which further indicated weakness. The B-period single prints provided an excellent reference point for managing risk if you were playing the short side. Failure to hold above 5643 opened the door to test the 5620 HVN and potentially the final downside target at 5602. Both targets were tagged and exceeded with an elevated VIX, effectively ending the daily one-time framing up in the process.

Today’s session resulted in an outside day down, following buyers' failure to sustain upside momentum after gapping higher. The daily one-time framing up came to an end as a result, with the market now forming a 4-day balance area. Today’s long liquidation stopped right at the previous week’s high (5586), where a passive buyer was reloading. Stronger sellers will break and hold below 5586, targeting a traverse of last week’s upper distribution toward 5530. Failure to do so and today’s price action was primarily driven by weak longs getting out. Powell on deck tomorrow!

In terms of levels, the Smashlevel is at 5586, marking the previous week’s high. Holding above this level signals strength, targeting 5605, with a final target at the resistance area from 5633 to 5643 under sustained buying pressure. Failure to hold above 5586 would target 5572 and 5552, with a final target at the high volume node at 5530 under sustained selling pressure, effectively completing a full traverse of last week’s upper distribution.

Levels of Interest

Going into tomorrow's session, I will closely observe the behavior around 5586.

Holding above 5586 would target 5605 / 5633 / 5643

Break and hold below 5586 would target 5572 / 5552 / 5530

Additionally, pay attention to the following VIX levels: 18.54 and 16.56. These levels can provide confirmation of strength or weakness.

Break and hold above 5643 with VIX below 16.56 would confirm strength.

Break and hold below 5530 with VIX above 18.54 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Weekly Plan

Make sure to review the Weekly Plan, which provides a broader perspective and highlights key levels of interest to observe in the upcoming week.

Brilliant as always! Thank you!