ES Daily Plan | August 22, 2025

Market Context & Key Levels for the Day Ahead

— For new subscribers

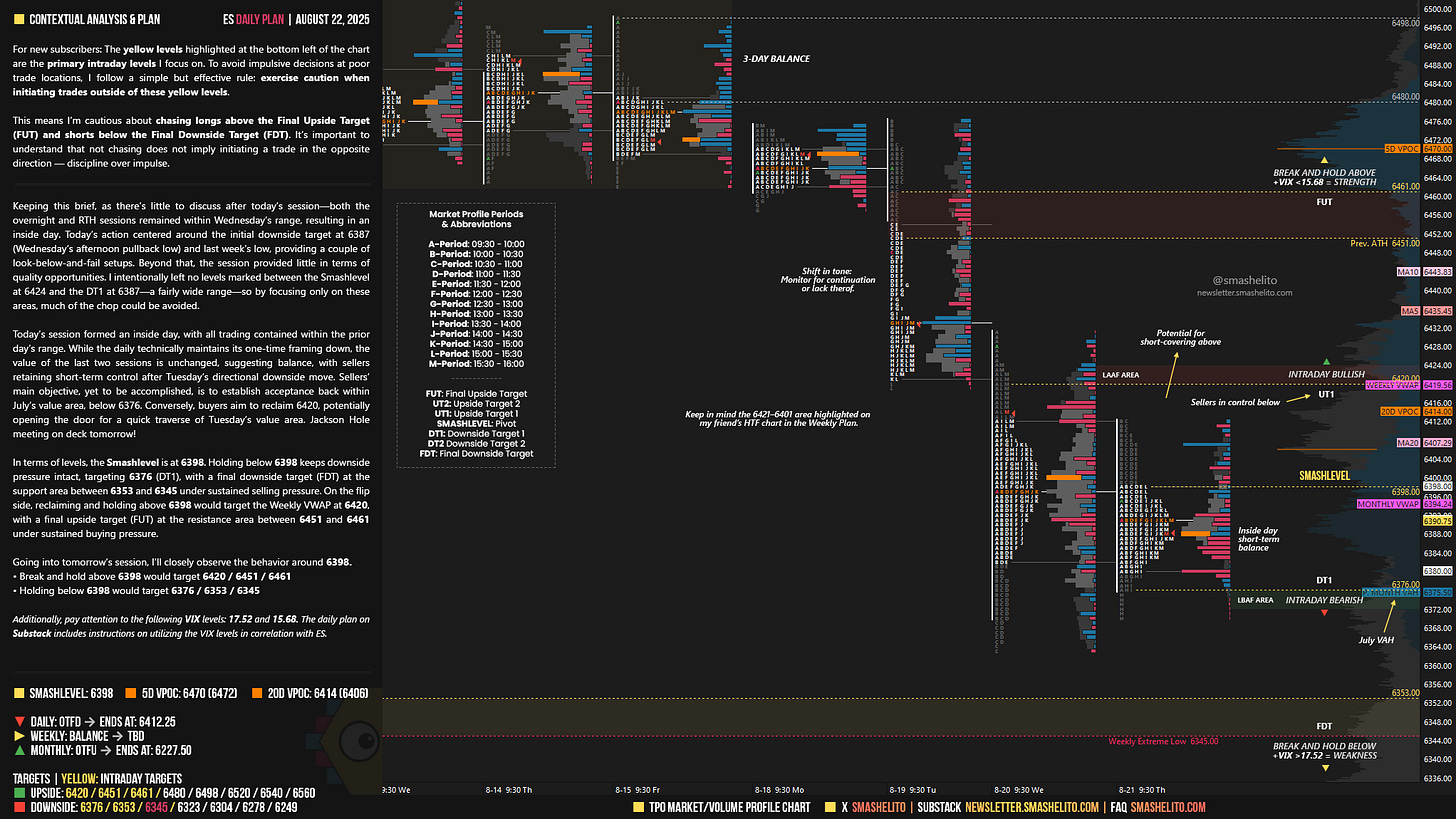

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the ES Weekly Plan | August 18-22, 2025 for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

Keeping this brief, as there’s little to discuss after today’s session—both the overnight and RTH sessions remained within Wednesday’s range, resulting in an inside day. Today’s action centered around the initial downside target at 6387 (Wednesday’s afternoon pullback low) and last week’s low, providing a couple of look-below-and-fail setups. Beyond that, the session provided little in terms of quality opportunities. I intentionally left no levels marked between the Smashlevel at 6424 and the DT1 at 6387—a fairly wide range—so by focusing only on these areas, much of the chop could be avoided.

Today’s session formed an inside day, with all trading contained within the prior day’s range. While the daily technically maintains its one-time framing down, the value of the last two sessions is unchanged, suggesting balance, with sellers retaining short-term control after Tuesday’s directional downside move. Sellers’ main objective, yet to be accomplished, is to establish acceptance back within July’s value area, below 6376. Conversely, buyers aim to reclaim 6420, potentially opening the door for a quick traverse of Tuesday’s value area. Jackson Hole meeting on deck tomorrow!

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6398.

Break and hold above 6398 would target 6420 / 6451 / 6461

Holding below 6398 would target 6376 / 6353 / 6345

Additionally, pay attention to the following VIX levels: 17.52 and 15.68. These levels can provide confirmation of strength or weakness.

Break and hold above 6461 with VIX below 15.68 would confirm strength.

Break and hold below 6345 with VIX above 17.52 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Unbelievable call for the potential traverse of Tuesday's entire value area. Objective gold! You're the best Smash!

Agree chop here is this zone. Need some form of emerging trend bull or bear.