ES Daily Plan | August 21, 2025

Market Context & Key Levels for the Day Ahead

— For new subscribers

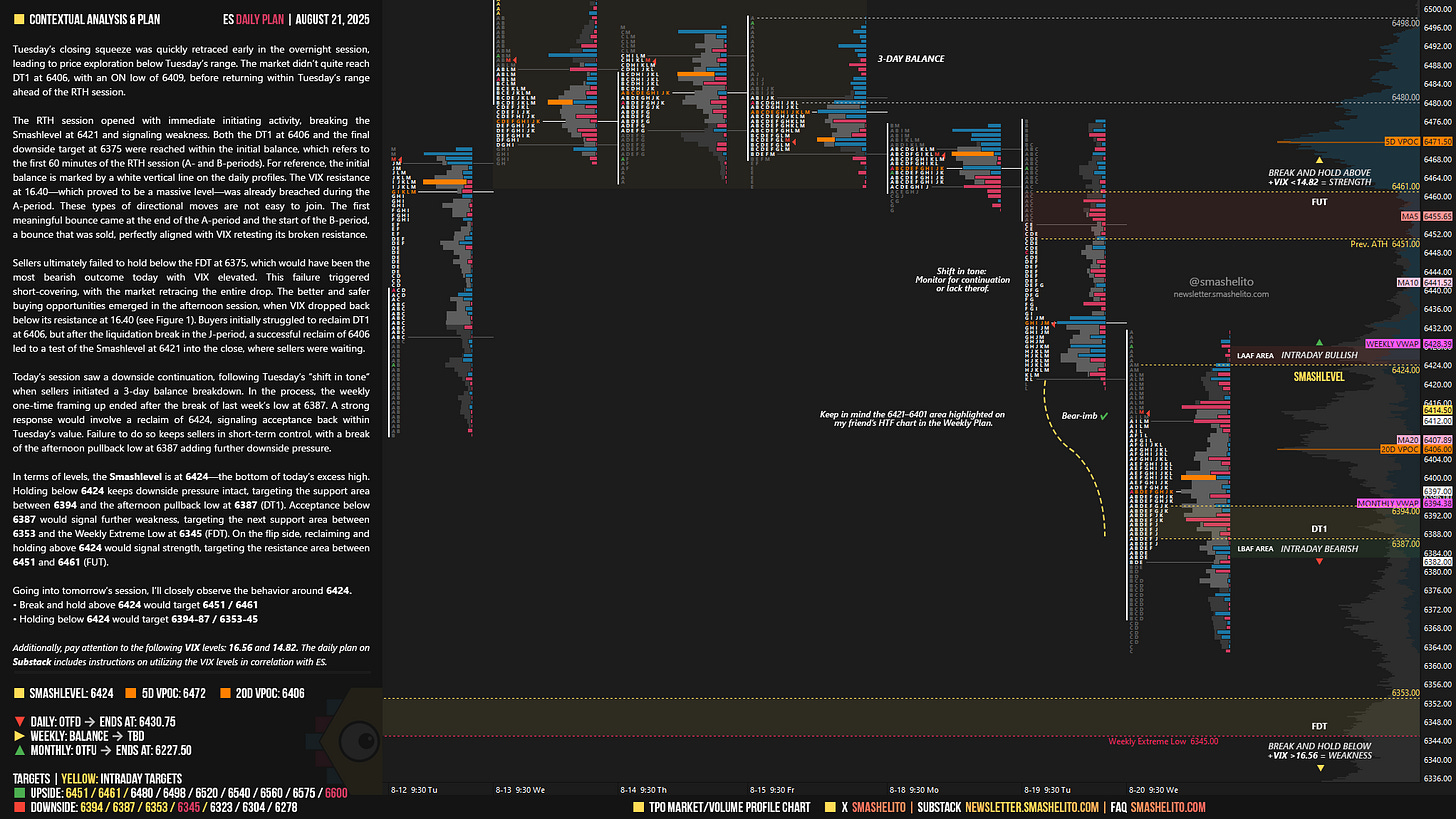

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the ES Weekly Plan | August 18-22, 2025 for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

Tuesday’s closing squeeze was quickly retraced early in the overnight session, leading to price exploration below Tuesday’s range. The market didn’t quite reach DT1 at 6406, with an ON low of 6409, before returning within Tuesday’s range ahead of the RTH session.

The RTH session opened with immediate initiating activity, breaking the Smashlevel at 6421 and signaling weakness. Both the DT1 at 6406 and the final downside target at 6375 were reached within the initial balance, which refers to the first 60 minutes of the RTH session (A- and B-periods). For reference, the initial balance is marked by a white vertical line on the daily profiles. The VIX resistance at 16.40—which proved to be a massive level—was already breached during the A-period. These types of directional moves are not easy to join. The first meaningful bounce came at the end of the A-period and the start of the B-period, a bounce that was sold, perfectly aligned with VIX retesting its broken resistance.

Sellers ultimately failed to hold below the FDT at 6375, which would have been the most bearish outcome today with VIX elevated. This failure triggered short-covering, with the market retracing the entire drop. The better and safer buying opportunities emerged in the afternoon session, when VIX dropped back below its resistance at 16.40 (see Figure 1). Buyers initially struggled to reclaim DT1 at 6406, but after the liquidation break in the J-period, a successful reclaim of 6406 led to a test of the Smashlevel at 6421 into the close, where sellers were waiting.

Today’s session saw a downside continuation, following Tuesday’s “shift in tone” when sellers initiated a 3-day balance breakdown. In the process, the weekly one-time framing up ended after the break of last week’s low at 6387. A strong response would involve a reclaim of 6424, signaling acceptance back within Tuesday’s value. Failure to do so keeps sellers in short-term control, with a break of the afternoon pullback low at 6387 adding further downside pressure.

In terms of levels, the Smashlevel is at 6424—the bottom of today’s excess high. Holding below 6424 keeps downside pressure intact, targeting the support area between 6394 and the afternoon pullback low at 6387 (DT1). Acceptance below 6387 would signal further weakness, targeting the next support area between 6353 and the Weekly Extreme Low at 6345 (FDT).

On the flip side, reclaiming and holding above 6424 would signal strength, targeting the resistance area between 6451 and 6461 (FUT).

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6424.

Break and hold above 6424 would target 6451 / 6461

Holding below 6424 would target 6394-87 / 6353-45

Additionally, pay attention to the following VIX levels: 16.56 and 14.82. These levels can provide confirmation of strength or weakness.

Break and hold above 6461 with VIX below 14.82 would confirm strength.

Break and hold below 6345 with VIX above 16.56 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Thanks Smash! VIX levels goated.

Thank you. Will it go down today? Or tomorrow