ES Daily Plan | August 20, 2025

Market Context & Key Levels for the Day Ahead

— For new subscribers

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the ES Weekly Plan | August 18-22, 2025 for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

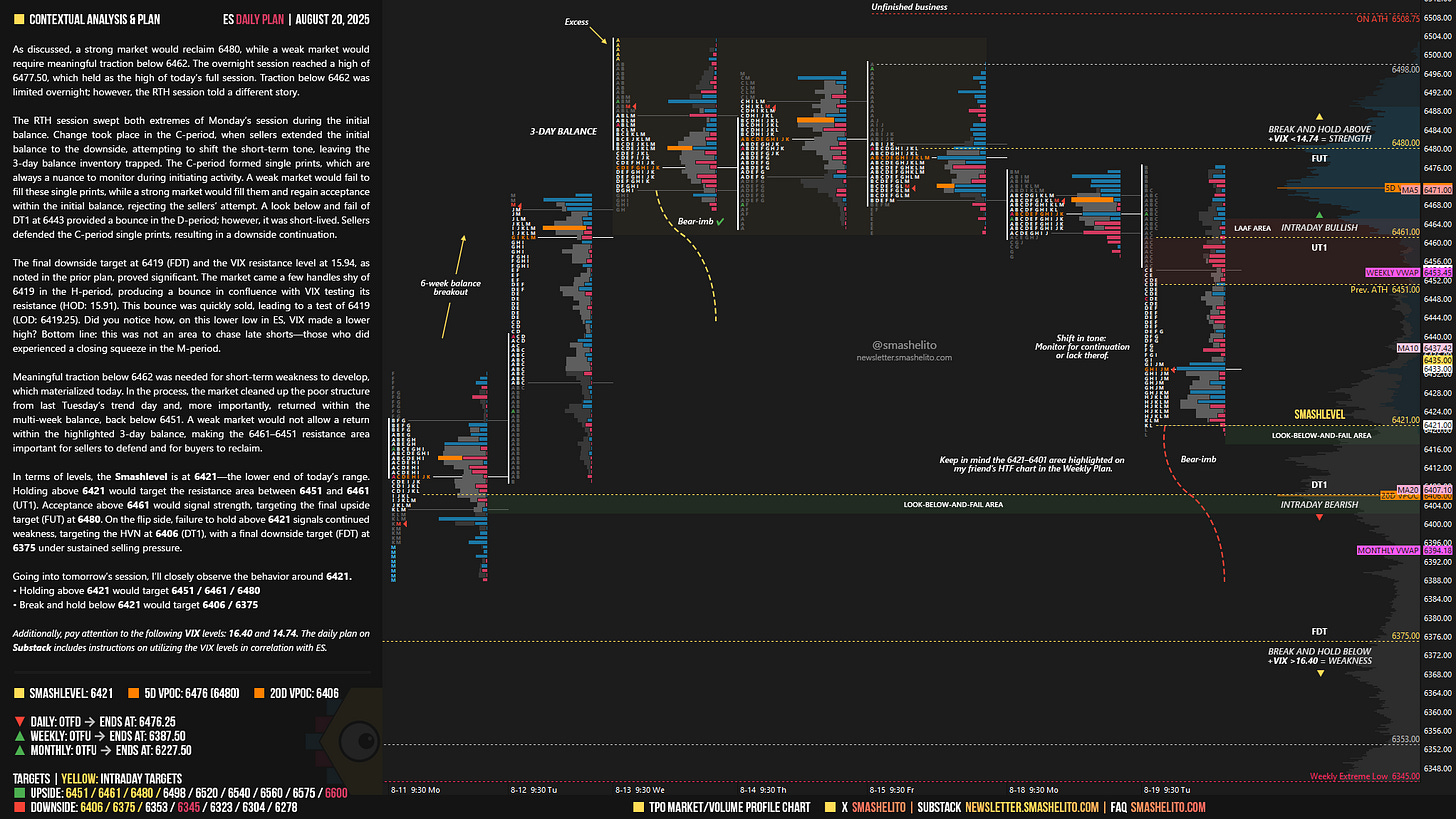

As discussed, a strong market would reclaim 6480, while a weak market would require meaningful traction below 6462. The overnight session reached a high of 6477.50, which held as the high of today’s full session. Traction below 6462 was limited overnight; however, the RTH session told a different story.

The RTH session swept both extremes of Monday’s session during the initial balance. Change took place in the C-period, when sellers extended the initial balance to the downside, attempting to shift the short-term tone, leaving the 3-day balance inventory trapped. The C-period formed single prints, which are always a nuance to monitor during initiating activity. A weak market would fail to fill these single prints, while a strong market would fill them and regain acceptance within the initial balance, rejecting the sellers’ attempt. A look below and fail of DT1 at 6443 provided a bounce in the D-period; however, it was short-lived. Sellers defended the C-period single prints, resulting in a downside continuation.

The final downside target at 6419 (FDT) and the VIX resistance level at 15.94, as noted in the prior plan, proved significant. The market came a few handles shy of 6419 in the H-period, producing a bounce in confluence with VIX testing its resistance (HOD: 15.91). This bounce was quickly sold, leading to a test of 6419 (LOD: 6419.25). Did you notice how, on this lower low in ES, VIX made a lower high? Bottom line: this was not an area to chase late shorts—those who did experienced a closing squeeze in the M-period.

Meaningful traction below 6462 was needed for short-term weakness to develop, which materialized today. In the process, the market cleaned up the poor structure from last Tuesday’s trend day and, more importantly, returned within the multi-week balance, back below 6451. A weak market would not allow a return within the highlighted 3-day balance, making the 6461–6451 resistance area important for sellers to defend and for buyers to reclaim.

In terms of levels, the Smashlevel is at 6421—the lower end of today’s range. Holding above 6421 would target the resistance area between 6451 and 6461 (UT1). Acceptance above 6461 would signal strength, targeting the final upside target (FUT) at 6480.

On the flip side, failure to hold above 6421 signals continued weakness, targeting the HVN at 6406 (DT1), with a final downside target (FDT) at 6375 under sustained selling pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6421.

Holding above 6421 would target 6451 / 6461 / 6480

Break and hold below 6421 would target 6406 / 6375

Additionally, pay attention to the following VIX levels: 16.40 and 14.74. These levels can provide confirmation of strength or weakness.

Break and hold above 6480 with VIX below 14.74 would confirm strength.

Break and hold below 6375 with VIX above 16.40 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

I appreciate you pointing out the VIX making a lower high when price made a lower low, I take that as signaling divergence between price and volatility and increased risk for a continuation trade. I continue learning a lot from your work Smash, many thanks.

Did you notice how, on this lower low in ES, VIX made a lower high? Bottom line: this was not an area to chase late shorts—those who did experienced a closing squeeze in the M-period.

Watched it and killed it…. Lotto call made insane profits 🥳