ES Daily Plan | August 20, 2024

My preparations and expectations for the upcoming session.

For new followers: The yellow levels highlighted at the bottom left of the chart are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final yellow upside target and shorts below the final yellow downside target. It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Visual Representation

I’m excited to share that this newsletter has just exceeded 7,000 subscribers, marking an incredible milestone. A lot of work and dedication goes into this project, making your support all the more essential—thank you!

Contextual Analysis

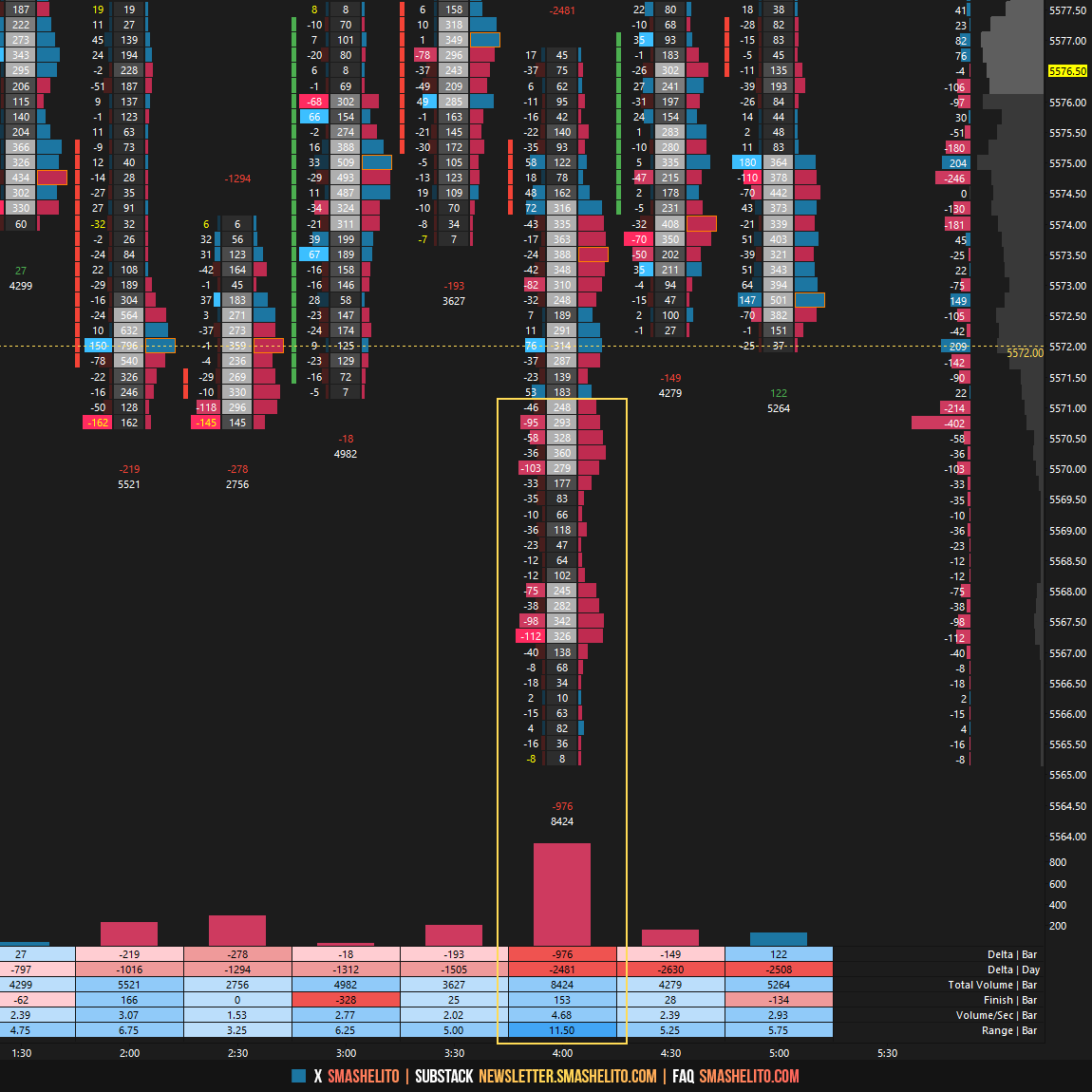

The overnight session initially explored prices above the previous week’s high but later pulled back to test the Smashlevel at 5572. During the European session, aggressive sellers attempted to push below 5572 but ended up getting trapped, resulting in a textbook "look below and fail" scenario. The overnight low of 5565 marked the low of the today’s full session.

The RTH session opened within Friday’s range, and the initial balance (first hour of RTH) held above the 5572 low volume node, signaling strength and favoring an upside continuation (LOD: 5573.50). This also reduced the likelihood of two-sided activity, suggesting that trades aligned with the prevailing trend would be easier and more favorable. The market quickly reached the resistance area between 5601 and 5611, where selling activity was anticipated in the event of an immediate upside continuation. Although both levels triggered pullbacks, they did not result in a continuation lower. Instead, these pullbacks provided an opportunity for dip buyers to re-enter. Sustained buying pressure above 5611 ultimately led to the final upside target of 5625 being tagged in the closing session. The weekly is now one-time framing up after breaking the 3-week balance high at 5600.75.

Maintaining above Thursday's range signaled strength and favored the upside continuation observed today. The closing session formed an upward spike, effectively tagging the final upside target at 5625 in the process. The highlighted spike area is of interest in the short-term. The strongest response would be to accept this closing strength and target an upside continuation, while sellers aim to reject it, which could lead to two-sided activity and potentially slow the daily upside imbalance.

In terms of levels, the Smashlevel is at 5620, marking the M-period spike base. Holding above this level signals acceptance, targeting the composite HVN at 5643, with a final target at the resistance area from 5666 to 5676 under sustained buying pressure. Failure to hold above 5620 signals rejection, targeting a return to today’s VPOC at 5602, with a final target at 5586 under sustained selling pressure.

Levels of Interest

Going into tomorrow's session, I will closely observe the behavior around 5620.

Holding above 5620 would target 5643 / 5666 / 5676

Break and hold below 5620 would target 5602 / 5586

Additionally, pay attention to the following VIX levels: 15.46 and 13.84. These levels can provide confirmation of strength or weakness.

Break and hold above 5676 with VIX below 13.84 would confirm strength.

Break and hold below 5586 with VIX above 15.46 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Weekly Plan

Make sure to review the Weekly Plan, which provides a broader perspective and highlights key levels of interest to observe in the upcoming week.

I've added a snapshot of my Footprint, highlighting the look below 5572 and fail from the overnight session that I forgot to include.

Congratulations, Smash! This is well-deserved. I’m still waiting for the launch of your private Substack so I can support your work directly!