ES Daily Plan | August 18, 2025

Market Context & Key Levels for the Day Ahead

— For new subscribers

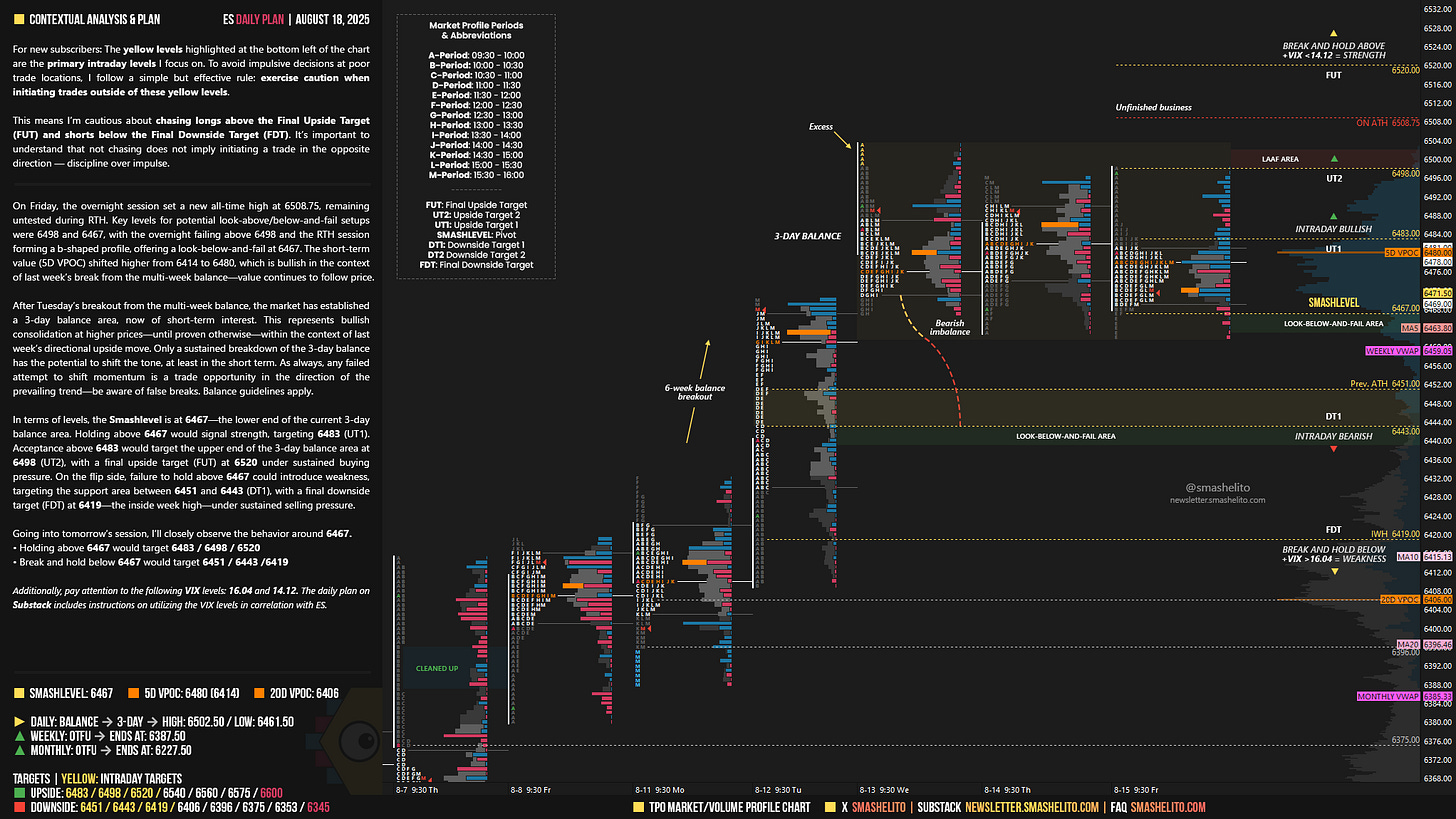

The yellow levels highlighted at the bottom left of the chart are the primary intraday levels I focus on. To avoid impulsive decisions at poor trade locations, I follow a simple but effective rule: exercise caution when initiating trades outside of these yellow levels.

This means I’m cautious about chasing longs above the Final Upside Target (FUT) and shorts below the Final Downside Target (FDT). It’s important to understand that not chasing does not imply initiating a trade in the opposite direction — discipline over impulse.

Be sure to review the ES Weekly Plan | August 18-22, 2025 for a broader perspective, key levels, and market expectations for the week ahead.

Contextual Analysis & Plan

On Friday, the overnight session set a new all-time high at 6508.75, remaining untested during RTH. Key levels for potential look-above/below-and-fail setups were 6498 and 6467, with the overnight failing above 6498 and the RTH session forming a b-shaped profile, offering a look-below-and-fail at 6467. The short-term value (5D VPOC) shifted higher from 6414 to 6480, which is bullish in the context of last week’s break from the multi-week balance—value continues to follow price.

After Tuesday’s breakout from the multi-week balance, the market has established a 3-day balance area, now of short-term interest. This represents bullish consolidation at higher prices—until proven otherwise—within the context of last week’s directional upside move. Only a sustained breakdown of the 3-day balance has the potential to shift the tone, at least in the short term. As always, any failed attempt to shift momentum is a trade opportunity in the direction of the prevailing trend—be aware of false breaks. Balance guidelines apply.

When the market is in balance, we apply balance guidelines to frame trade hypotheses based on how price behaves around that area. A balanced market reflects agreement on value, typically rotating between well-defined highs and lows. In this environment, the first guideline is to fade moves toward the extremes, as they’re often rejected unless supported by strong participation.

If price breaks out of balance and shows signs of acceptance—holding above or below the prior extremes—we follow the break, anticipating discovery of a new value area. But if the breakout fails and price returns inside the range, it signals a lack of conviction, shifting the expectation toward the opposite end of balance. Breakouts against the broader market tone—like upside breaks in bearish environments or downside breaks in bullish ones—carry a higher failure risk, lacking alignment with the prevailing bias.

These guidelines aren’t rigid but serve as context-driven cues to assess whether the market is accepting or rejecting prices relative to prior value. They provide structure for risk management by defining clear invalidation points and supporting decision-making across both rotational and directional conditions.

In terms of levels, the Smashlevel is at 6467—the lower end of the current 3-day balance area. Holding above 6467 would signal strength, targeting 6483 (UT1). Acceptance above 6483 would target the upper end of the 3-day balance area at 6498 (UT2), with a final upside target (FUT) at 6520 under sustained buying pressure.

On the flip side, failure to hold above 6467 could introduce weakness, targeting the support area between 6451 and 6443 (DT1), with a final downside target (FDT) at 6419—the inside week high—under sustained selling pressure.

Levels of Interest

Going into tomorrow’s session, I’ll closely observe the behavior around 6467.

Holding above 6467 would target 6483 / 6498 / 6520

Break and hold below 6467 would target 6451 / 6443 / 6419

Additionally, pay attention to the following VIX levels: 16.04 and 14.12. These levels can provide confirmation of strength or weakness.

Break and hold above 6520 with VIX below 14.12 would confirm strength.

Break and hold below 6419 with VIX above 16.04 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Thank you very much!

Thanks Smash!