ES Daily Plan | August 1, 2024

My preparations and expectations for the upcoming session.

For new followers: the yellow levels highlighted at the bottom are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final yellow upside target and shorts below the final yellow downside target. It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Visual Representation

Contextual Analysis

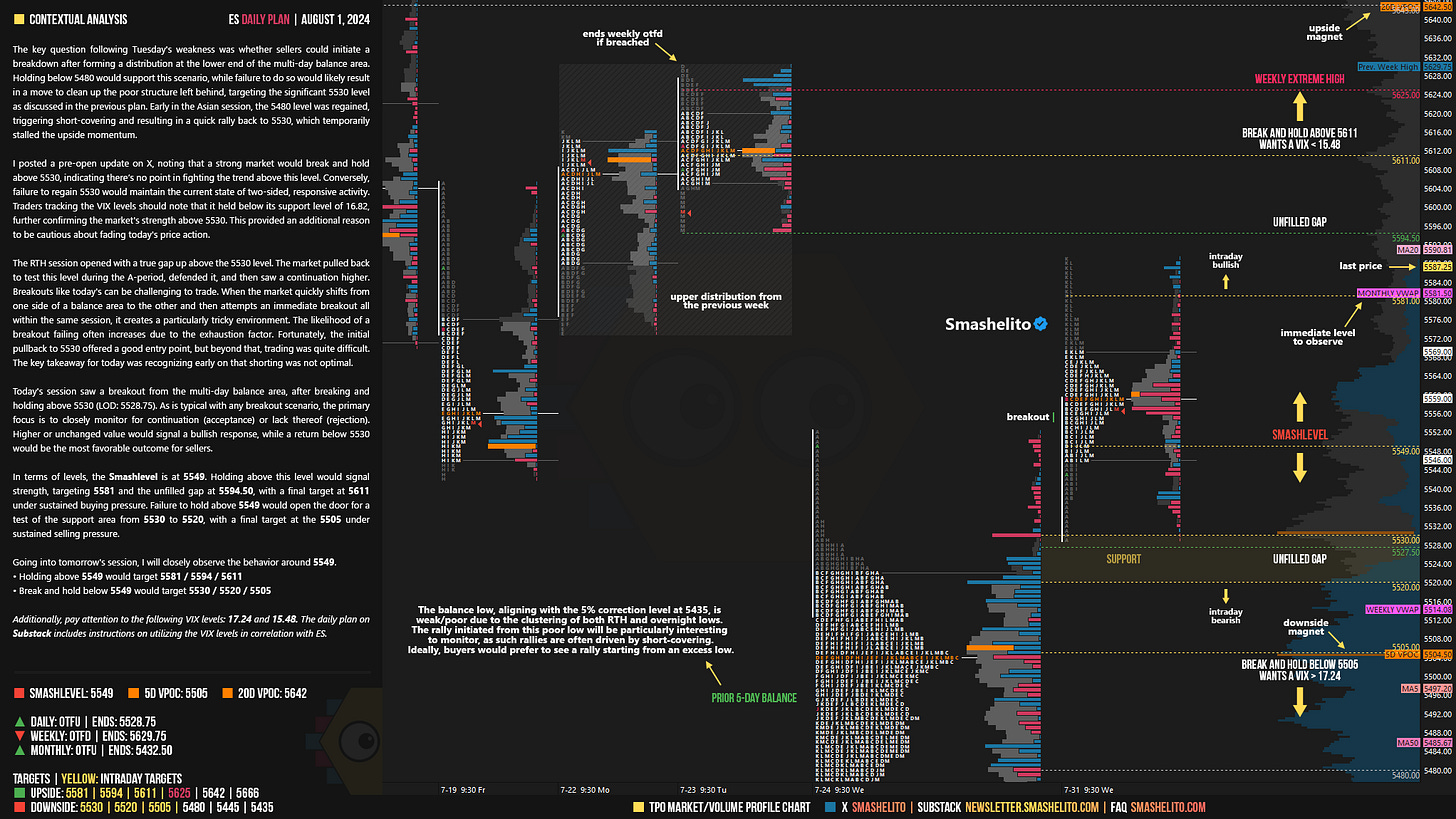

The key question following Tuesday's weakness was whether sellers could initiate a breakdown after forming a distribution at the lower end of the multi-day balance area. Holding below 5480 would support this scenario, while failure to do so would likely result in a move to clean up the poor structure left behind, targeting the significant 5530 level as discussed in the previous plan. Early in the Asian session, the 5480 level was regained, triggering short-covering and resulting in a quick rally back to 5530, which temporarily stalled the upside momentum.

I posted a pre-open update on X (Link), noting that a strong market would break and hold above 5530, indicating there’s no point in fighting the trend above this level. Conversely, failure to regain 5530 would maintain the current state of two-sided, responsive activity. Traders tracking the VIX levels should note that it held below its support level of 16.82, further confirming the market's strength above 5530. This provided an additional reason to be cautious about fading today's price action.

The RTH session opened with a true gap up above the 5530 level. The market pulled back to test this level during the A-period, defended it, and then saw a continuation higher. Breakouts like today's can be challenging to trade. When the market quickly shifts from one side of a balance area to the other and then attempts an immediate breakout all within the same session, it creates a particularly tricky environment. The likelihood of a breakout failing often increases due to the exhaustion factor. Fortunately, the initial pullback to 5530 offered a good entry point, but beyond that, trading was quite difficult. The key takeaway for today was recognizing early on that shorting was not optimal.

Today's session saw a breakout from the multi-day balance area, after breaking and holding above 5530 (LOD: 5528.75). As is typical with any breakout scenario, the primary focus is to closely monitor for continuation (acceptance) or lack thereof (rejection). Higher or unchanged value would signal a bullish response, while a return below 5530 would be the most favorable outcome for sellers.

In terms of levels, the Smashlevel is at 5549. Holding above this level would signal strength, targeting 5581 and the unfilled gap at 5594.50, with a final target at 5611 under sustained buying pressure. Failure to hold above 5549 would open the door for a test of the support area from 5530 to 5520, with a final target at the 5505 under sustained selling pressure.

Levels of Interest

Going into tomorrow's session, I will closely observe the behavior around 5549.

Holding above 5549 would target 5581 / 5594 / 5611

Break and hold below 5549 would target 5530 / 5520 / 5505

Additionally, pay attention to the following VIX levels: 17.24 and 15.48. These levels can provide confirmation of strength or weakness.

Break and hold above 5611 with VIX below 15.48 would confirm strength.

Break and hold below 5505 with VIX above 17.24 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Weekly Plan

Make sure to review the Weekly Plan, which provides a broader perspective and highlights key levels of interest to observe in the upcoming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

5530 has been magic!

Selling at 5594.50 was the optimal strategy, aggressive activity occurred there, price crashed below the gap, sellers are recouping all levels of VWAP, and we are crossing the composite value continent. Don't be a buyer until this is done.