ES Daily Plan | April 8, 2025

Key Levels & Market Context for the Upcoming Session.

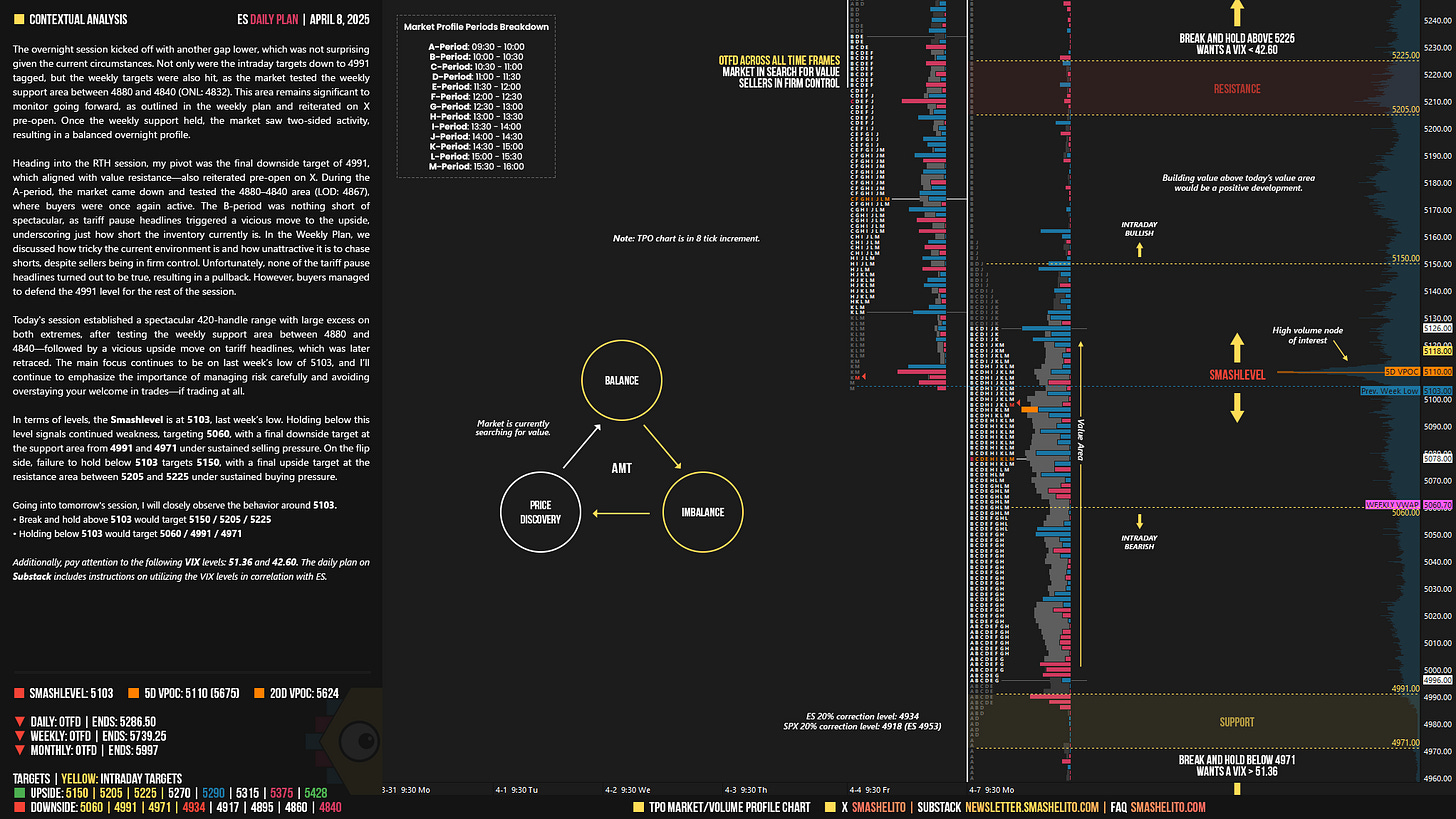

For new followers: The yellow levels highlighted at the bottom left of the chart are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final yellow upside target and shorts below the final yellow downside target. It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Make sure to review the Weekly Plan, which provides a broader perspective and highlights key levels of interest to observe in the upcoming week.

Visual Representation

Contextual Analysis

The overnight session kicked off with another gap lower, which was not surprising given the current circumstances. Not only were the intraday targets down to 4991 tagged, but the weekly targets were also hit, as the market tested the weekly support area between 4880 and 4840 (ONL: 4832). This area remains significant to monitor going forward, as outlined in the weekly plan and reiterated on X pre-open. Once the weekly support held, the market saw two-sided activity, resulting in a balanced overnight profile.

Heading into the RTH session, my pivot was the final downside target of 4991, which aligned with value resistance—also reiterated pre-open on X. During the A-period, the market came down and tested the 4880–4840 area (LOD: 4867), where buyers were once again active. The B-period was nothing short of spectacular, as tariff pause headlines triggered a vicious move to the upside, underscoring just how short the inventory currently is.

In the Weekly Plan, we discussed how tricky the current environment is and how unattractive it is to chase shorts, despite sellers being in firm control. Unfortunately, none of the tariff pause headlines turned out to be true, resulting in a pullback. However, buyers managed to defend the 4991 level for the rest of the session.

Today's session established a spectacular 420-handle range with large excess on both extremes, after testing the weekly support area between 4880 and 4840—followed by a vicious upside move on tariff headlines, which was later retraced. The main focus continues to be on last week’s low of 5103, and I’ll continue to emphasize the importance of managing risk carefully and avoiding overstaying your welcome in trades—if trading at all.

In terms of levels, the Smashlevel is at 5103, last week’s low. Holding below this level signals continued weakness, targeting 5060, with a final downside target at the support area from 4991 and 4971 under sustained selling pressure. On the flip side, failure to hold below 5103 targets 5150, with a final upside target at the resistance area between 5205 and 5225 under sustained buying pressure.

Levels of Interest

Going into tomorrow's session, I will closely observe the behavior around 5103.

Break and hold above 5103 would target 5150 / 5205 / 5225

Holding below 5103 would target 5060 / 4991 / 4971

Additionally, pay attention to the following VIX levels: 51.36 and 42.60. These levels can provide confirmation of strength or weakness.

Break and hold above 5225 with VIX below 42.60 would confirm strength.

Break and hold below 4971 with VIX above 51.36 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Thank you Smash! Difficult conditions now, but levels on point!

Thank you very much! Excellent comments on risk management, as always.