ES Daily Plan | April 30, 2025

Key Levels & Market Context for the Upcoming Session.

For new followers: The yellow levels highlighted at the bottom left of the chart are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final yellow upside target and shorts below the final yellow downside target. It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Make sure to review the Weekly Plan, which provides a broader perspective and highlights key levels of interest to observe in the upcoming week.

Visual Representation

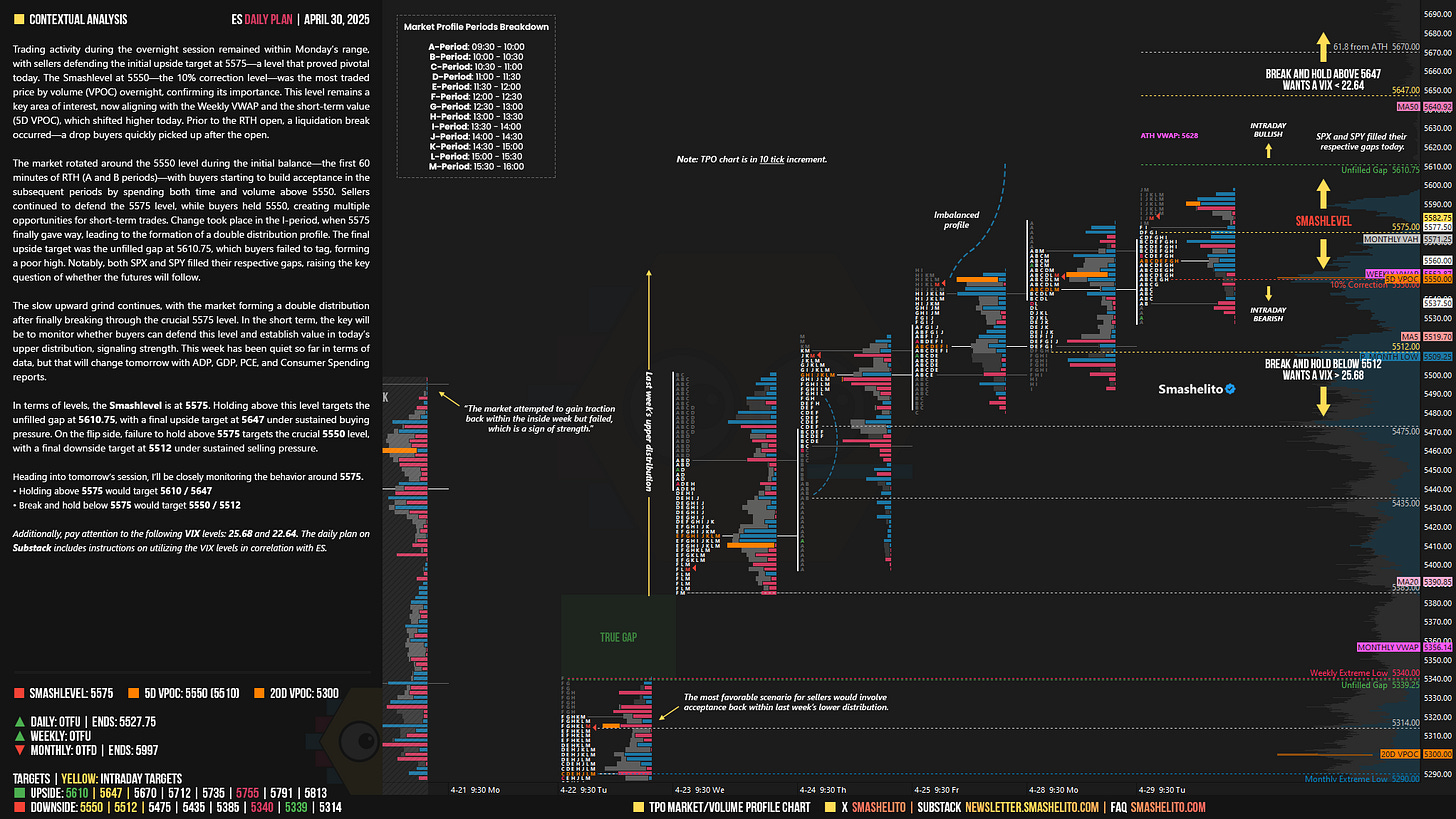

Contextual Analysis

Trading activity during the overnight session remained within Monday’s range, with sellers defending the initial upside target at 5575—a level that proved pivotal today. The Smashlevel at 5550—the 10% correction level—was the most traded price by volume (VPOC) overnight, confirming its importance. This level remains a key area of interest, now aligning with the Weekly VWAP and the short-term value (5D VPOC), which shifted higher today. Prior to the RTH open, a liquidation break occurred—a drop buyers quickly picked up after the open.

The market rotated around the 5550 level during the initial balance—the first 60 minutes of RTH (A and B periods)—with buyers starting to build acceptance in the subsequent periods by spending both time and volume above 5550. Sellers continued to defend the 5575 level, while buyers held 5550, creating multiple opportunities for short-term trades. Change took place in the I-period, when 5575 finally gave way, leading to the formation of a double distribution profile. The final upside target was the unfilled gap at 5610.75, which buyers failed to tag, forming a poor high. Notably, both SPX and SPY filled their respective gaps, raising the key question of whether the futures will follow.

The slow upward grind continues, with the market forming a double distribution after finally breaking through the crucial 5575 level. In the short term, the key will be to monitor whether buyers can defend this level and establish value in today’s upper distribution, signaling strength. This week has been quiet so far in terms of data, but that will change tomorrow with ADP, GDP, PCE, and Consumer Spending reports.

In terms of levels, the Smashlevel is at 5575. Holding above this level targets the unfilled gap at 5610.75, with a final upside target at 5647 under sustained buying pressure. On the flip side, failure to hold above 5575 targets the crucial 5550 level, with a final downside target at 5512 under sustained selling pressure.

Levels of Interest

Going into tomorrow's session, I will closely observe the behavior around 5575.

Holding above 5575 would target 5610 / 5647

Break and hold below 5575 would target 5550 / 5512

Additionally, pay attention to the following VIX levels: 25.68 and 22.64. These levels can provide confirmation of strength or weakness.

Break and hold above 5647 with VIX below 22.64 would confirm strength.

Break and hold below 5512 with VIX above 25.68 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Thanks! Feels like a larger liquidation break could set up if we get back below 5550.

Thank you Smash