ES Daily Plan | April 23, 2025

Key Levels & Market Context for the Upcoming Session.

For new followers: The yellow levels highlighted at the bottom left of the chart are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final yellow upside target and shorts below the final yellow downside target. It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Make sure to review the Weekly Plan, which provides a broader perspective and highlights key levels of interest to observe in the upcoming week.

Visual Representation

Contextual Analysis

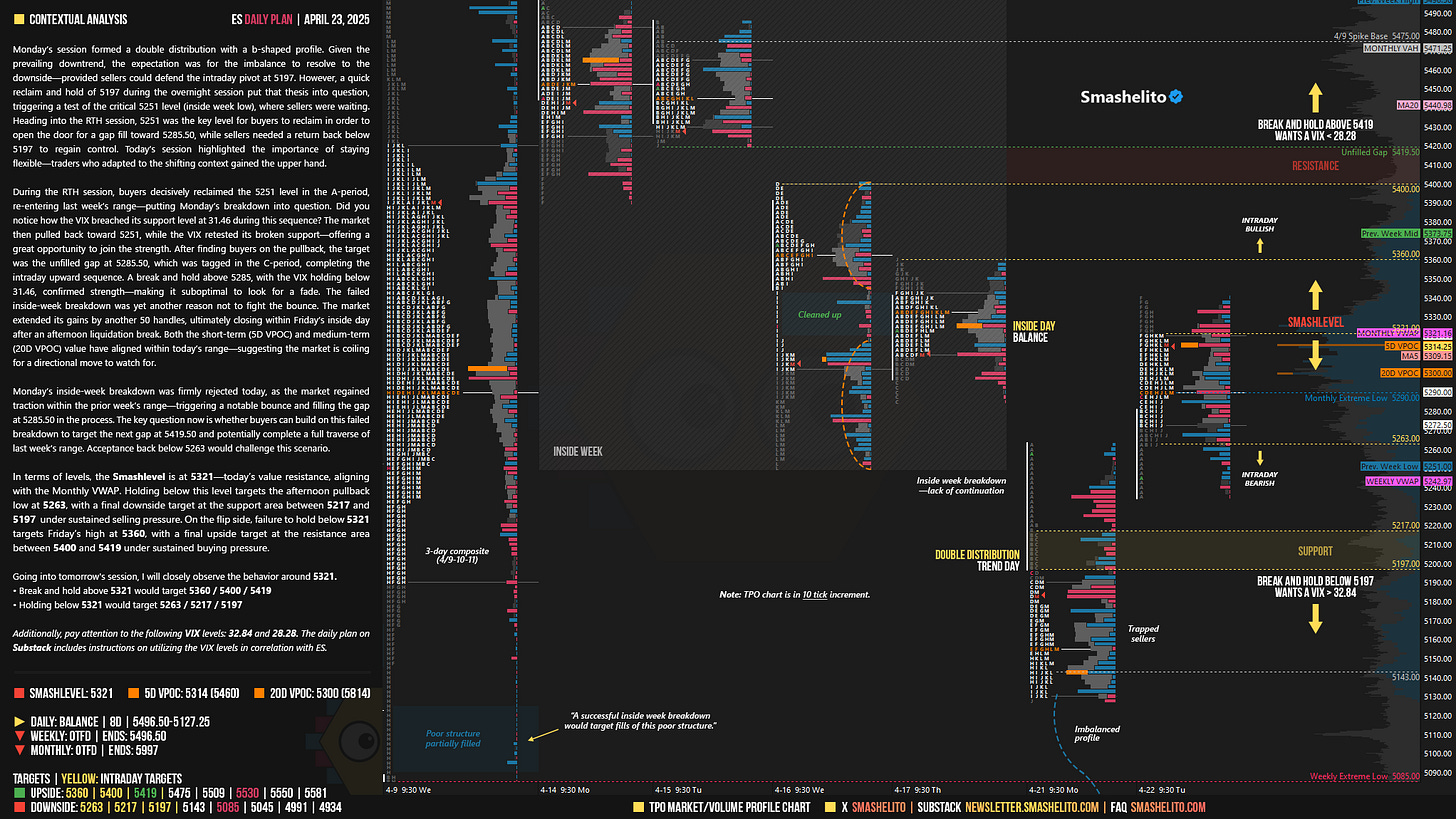

Monday’s session formed a double distribution with a b-shaped profile. Given the prevailing downtrend, the expectation was for the imbalance to resolve to the downside—provided sellers could defend the intraday pivot at 5197. However, a quick reclaim and hold of 5197 during the overnight session put that thesis into question, triggering a test of the critical 5251 level (inside week low), where sellers were waiting. Heading into the RTH session, 5251 was the key level for buyers to reclaim in order to open the door for a gap fill toward 5285.50, while sellers needed a return back below 5197 to regain control. Today’s session highlighted the importance of staying flexible—traders who adapted to the shifting context gained the upper hand.

During the RTH session, buyers decisively reclaimed the 5251 level in the A-period, re-entering last week’s range—putting Monday’s breakdown into question. Did you notice how the VIX breached its support level at 31.46 during this sequence? The market then pulled back toward 5251, while the VIX retested its broken support—offering a great opportunity to join the strength. After finding buyers on the pullback, the target was the unfilled gap at 5285.50, which was tagged in the C-period, completing the intraday upward sequence. A break and hold above 5285, with the VIX holding below 31.46, confirmed strength—making it suboptimal to look for a fade. The failed inside-week breakdown was yet another reason not to fight the bounce. The market extended its gains by another 50 handles, ultimately closing within Friday’s inside day after an afternoon liquidation break. Both the short-term (5D VPOC) and medium-term (20D VPOC) value have aligned within today’s range—suggesting the market is coiling for a directional move to watch for.

Monday’s inside-week breakdown was firmly rejected today, as the market regained traction within the prior week’s range—triggering a notable bounce and filling the gap at 5285.50 in the process. The key question now is whether buyers can build on this failed breakdown to target the next gap at 5419.50 and potentially complete a full traverse of last week’s range. Acceptance back below 5263 would challenge this scenario.

In terms of levels, the Smashlevel is at 5321—today’s value resistance, aligning with the Monthly VWAP. Holding below this level targets the afternoon pullback low at 5263, with a final downside target at the support area between 5217 and 5197 under sustained selling pressure. On the flip side, failure to hold below 5321 targets Friday’s high at 5360, with a final upside target at the resistance area between 5400 and 5419 under sustained buying pressure.

Levels of Interest

Going into tomorrow's session, I will closely observe the behavior around 5321.

Break and hold above 5321 would target 5360 / 5400 / 5419

Holding below 5321 would target 5263 / 5217 / 5197

Additionally, pay attention to the following VIX levels: 32.84 and 28.28. These levels can provide confirmation of strength or weakness.

Break and hold above 5419 with VIX below 28.28 would confirm strength.

Break and hold below 5197 with VIX above 32.84 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Outstanding work as always!

Thank you Smashie!