ES Daily Plan | April 2, 2024

Today’s failed overnight breakout resulted in weakness and a move back to the highlighted support area, where the high volume node is located.

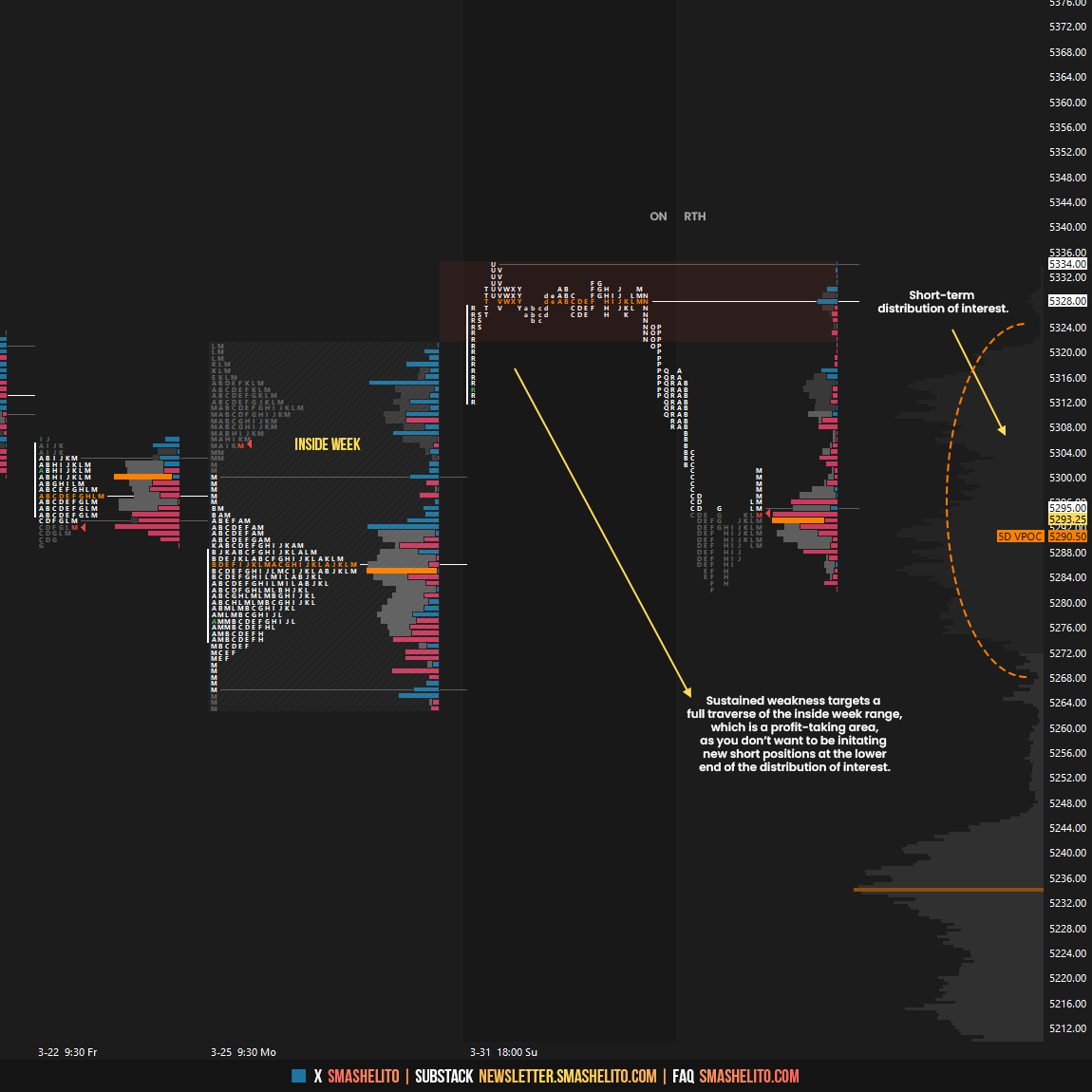

Visual Representation

For new followers, the yellow levels highlighted at the bottom are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final yellow upside target and shorts below the final yellow downside target. It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Contextual Analysis

During the overnight session, buyers wasted no time in initiating an inside week breakout, swiftly breaching the significant level of 5323, where we have unfinished business carried forward. The VIX did not support this breakout, as it remained above its resistance level of 13.52 throughout the entire session. Our attention quickly shifted to the 5323 level following the breakout, which buyers ultimately were unable to maintain during the European hours (Europe closed), resulting in weakness pre-RTH open. According to the general guidelines, we understand that a failed breakout can potentially trigger moves in the opposite direction.

In the RTH session, the immediate bounce observed encountered selling activity at the upper end of the previous week's inside week, thereby keeping the failed breakout scenario in play. During the opening sequence, the VIX retested its broken resistance level of 13.52 (LOD: 13.55), which was an interesting nuance. That said, the most favorable scenario for initiating longs today would involve a reclaim of 5323, with VIX returning below its resistance. The failure to do so removed my interest in long positions during the initial balance. Both the C and D-period formed single prints as the market saw a downside continuation. This resulted in a quick move down to the highlighted support area ranging from 5294 to 5284, which could be seen as a logical area for potential profit-taking, given the high volume node (HVN). This area stalled the downside momentum; however, the subsequent bounces lacked follow through, which left the two sets of single prints unfilled.

Today’s failed overnight breakout resulted in weakness and a move back to the highlighted support area, where the high volume node is located. Buyers aim to maintain this area, targeting fills of today’s structure, and a return to the upper end of the inside week, where unfinished business remains. Failure to do so would open the door for a full traverse of the inside week range—a general target in failed breakout scenarios. Today’s overnight high of 5333.50 remained untested in RTH, adding an additional layer of unfinished business.

For tomorrow, the Smashlevel (Pivot) is 5294, representing Wednesday’s M-period spike base. Break and hold above 5294 would target fills of today’s structure toward the resistance area from 5313 to 5323. Break and hold above 5323, indicating a successful breakout, would target the untested overnight ATH at 5333.50. Holding below 5294, signaling continued weakness, would target today’s lows at 5284, which is considered poor. Acceptance below 5284 would target the lower end of the inside week at 5263, completing a full traverse.

Levels of Interest

Going into tomorrow's session, I will observe 5294.

Break and hold above 5294 would target 5313 / 5323 / 5333

Holding below 5294 would target 5284 / 5263

Additionally, pay attention to the following VIX levels: 14.18 and 13.12. These levels can provide confirmation of strength or weakness.

Break and hold above 5333 with VIX below 13.12 would confirm strength.

Break and hold below 5263 with VIX above 14.18 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Weekly Plan

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Thank you for your great work 🌼

Excellent breakdown and plan! Thank you!