ES Daily Plan | April 17, 2025

Key Levels & Market Context for the Upcoming Session.

For new followers: The yellow levels highlighted at the bottom left of the chart are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final yellow upside target and shorts below the final yellow downside target. It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Make sure to review the Weekly Plan, which provides a broader perspective and highlights key levels of interest to observe in the upcoming week.

Visual Representation

Contextual Analysis

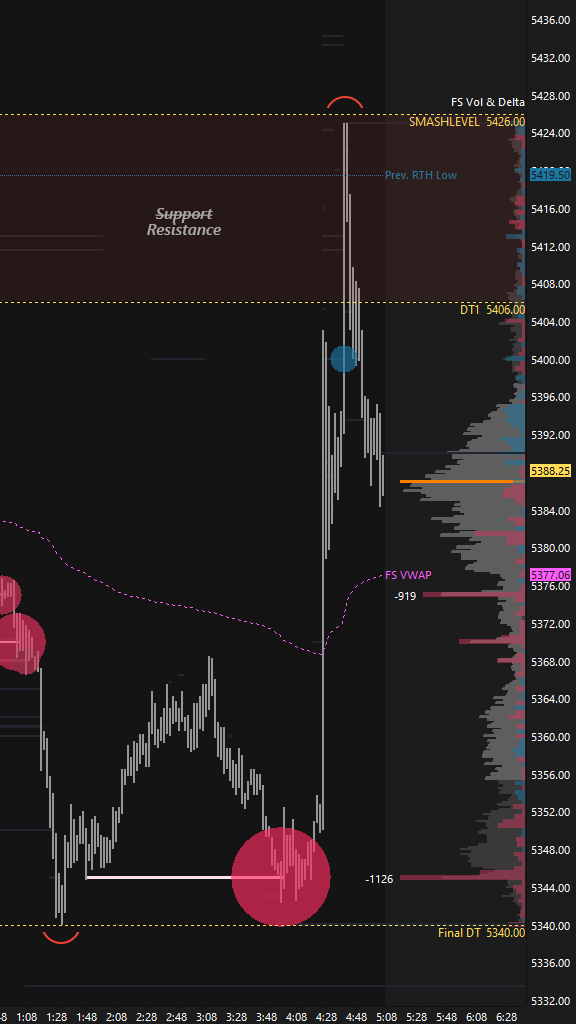

The overnight session was characterized by immediate weakness, gapping below the important support area between 5426 and 5406, which marked the lower end of the mini-balance established during Monday and Tuesday. The key question was whether the market was preparing for a potential breakout attempt, or if late buyers would be liquidated given the overall downtrend. Losing support suggested the latter—unless buyers could reclaim it. The final downside target was 5340, a level tagged to the tick prior to the European open.

During the European session, the market saw an impulsive move higher, filling the overnight gap and testing the broken support area in the process. This was a key area for buyers to reclaim, which they ultimately failed to do—opening the door for further weakness.

The RTH session opened with a true gap down, and the market started building value within Friday’s range. Buyers managed to defend the origin of the impulsive overnight move higher; however, once the initial balance high extension failed to fill the gap or reclaim the 5406 level, upside momentum stalled. Change took place in the I-period, as sellers extended the initial balance low, forming a double distribution and breaking the 5340 level. The downside continuation was accompanied by the VIX breaking its resistance shortly after, resulting in a full traverse of Friday’s range.

Monday’s and Tuesday’s longs were flushed today, as overnight weakness was followed by continued downside pressure after holding the true gap down. The market established a double distribution profile, forming a set of single prints in the I-period. A weak market would hold within the lower distribution or at least defend the entrance back into the upper distribution, favoring downside continuation. Buyers aim to reclaim 5346, but their main objective is to return within Monday’s and Tuesday’s range, filling the gap at 5419.50 in the process.

In terms of levels, the Smashlevel is at 5317—the upper end the lower distribution. Holding below this level targets today’s lows at 5255, with a final downside target at the support area between 5205 and 5181 under sustained selling pressure. On the flip side, failure to hold below 5317 targets the breakdown single prints at 5346, with a final upside target at the resistance area between 5400 and 5419 under sustained buying pressure.

Levels of Interest

Going into tomorrow's session, I will closely observe the behavior around 5317.

Break and hold above 5317 would target 5346 / 5400 / 5419

Holding below 5317 would target 5255 / 5205 / 5181

Additionally, pay attention to the following VIX levels: 35.30 and 29.98. These levels can provide confirmation of strength or weakness.

Break and hold above 5419 with VIX below 29.98 would confirm strength.

Break and hold below 5181 with VIX above 35.30 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Thank you very much!

Thank Smash!!