ES Daily Plan | April 15, 2025

Key Levels & Market Context for the Upcoming Session.

For new followers: The yellow levels highlighted at the bottom left of the chart are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final yellow upside target and shorts below the final yellow downside target. It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Make sure to review the Weekly Plan, which provides a broader perspective and highlights key levels of interest to observe in the upcoming week.

Visual Representation

Contextual Analysis

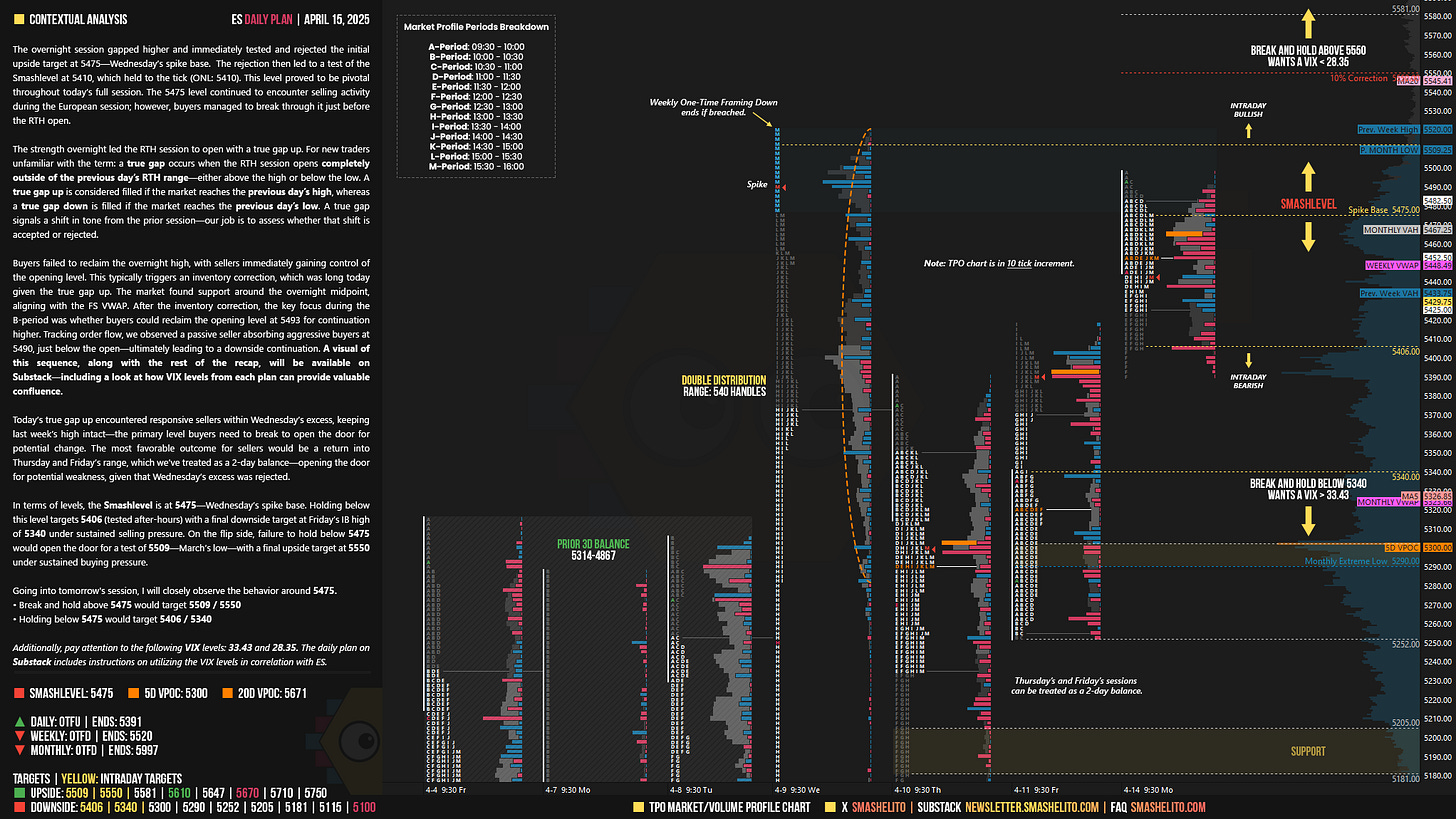

The overnight session gapped higher and immediately tested and rejected the initial upside target at 5475—Wednesday’s spike base. The rejection then led to a test of the Smashlevel at 5410, which held to the tick (ONL: 5410). This level proved to be pivotal throughout today’s full session. The 5475 level continued to encounter selling activity during the European session; however, buyers managed to break through it just before the RTH open.

The strength overnight led the RTH session to open with a true gap up. For new traders unfamiliar with the term: a true gap occurs when the RTH session opens completely outside of the previous day’s RTH range—either above the high or below the low. A true gap up is considered filled if the market reaches the previous day’s high, whereas a true gap down is filled if the market reaches the previous day’s low. A true gap signals a shift in tone from the prior session—our job is to assess whether that shift is accepted or rejected.

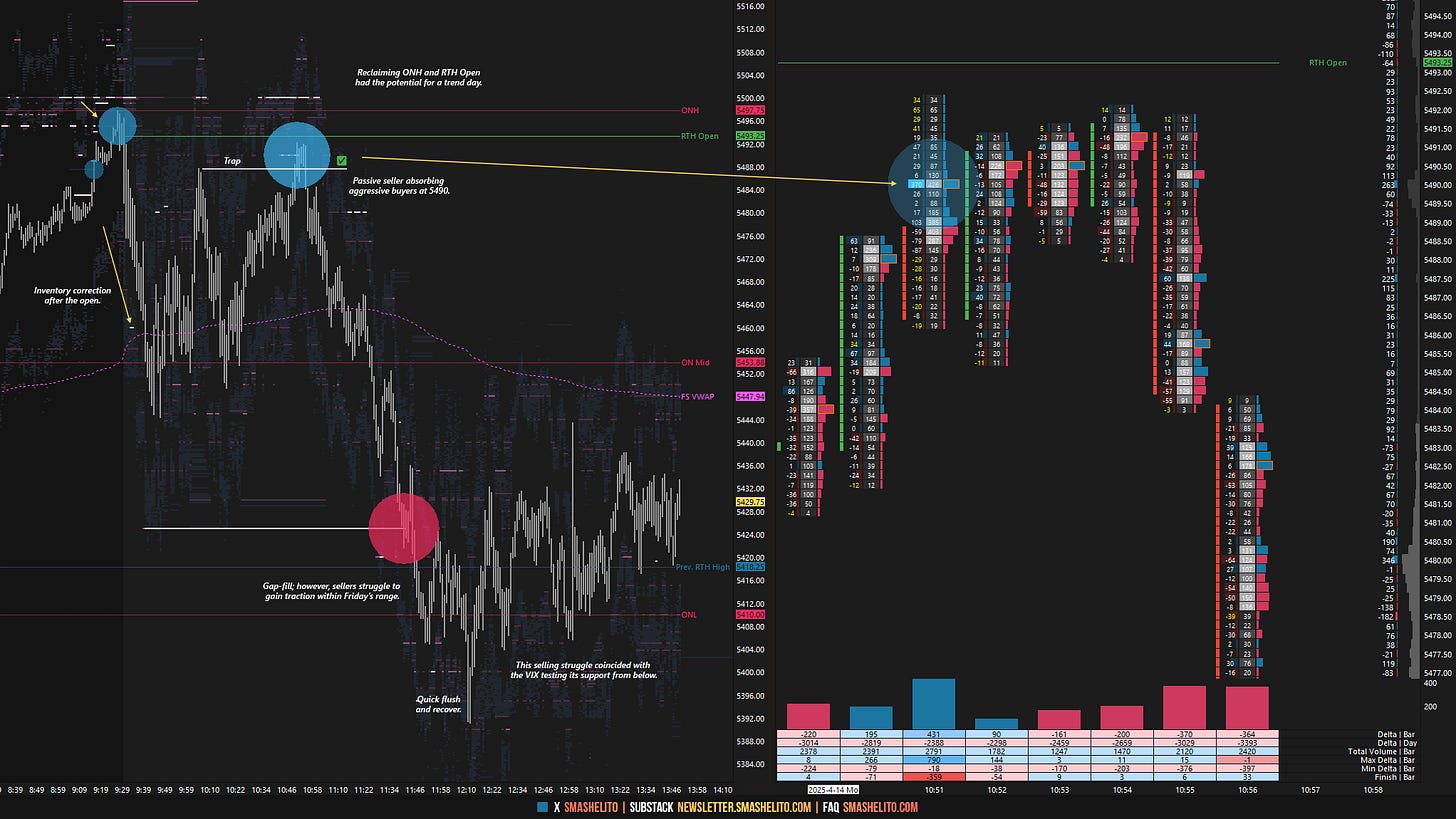

Buyers failed to reclaim the overnight high, with sellers immediately gaining control of the opening level. This typically triggers an inventory correction, which was long today given the true gap up. The market found support around the overnight midpoint, aligning with the FS VWAP. After the inventory correction, the key focus during the B-period was whether buyers could reclaim the opening level at 5493 for continuation higher. Tracking order flow, we observed a passive seller absorbing aggressive buyers at 5490, just below the open—ultimately leading to a downside continuation.

The gap was filled in the E-period (5418.25), stalling the downside momentum. Once the gap was filled, it became crucial to monitor whether sellers could gain traction within the previous day’s range, which would signal a bearish outcome. However, sellers struggled notably below the Smashlevel at 5410 after the F-period flush, which was quickly picked up.

Notably, the VIX held below its support level of 34.48 for nearly the entire session. An interesting aspect of the battle around 5410 was that the VIX retested its support from below, providing valuable confluence. In situations where the VIX holds below support and ES still has distance to its final upside target, I typically exercise caution with shorting due to the potential for continued strength, and I expect buyers to be active on dips. The market started grinding higher as the VIX held below support—indicating that sellers couldn’t gain acceptance within Friday’s range and suggesting caution with pressing potential shorts. The afternoon session revisited the 5475 level, which attracted sellers into the close.

Today’s true gap up encountered responsive sellers within Wednesday’s excess, keeping last week’s high intact—the primary level buyers need to break to open the door for potential change. The most favorable outcome for sellers would be a return into Thursday and Friday’s range, which we’ve treated as a 2-day balance—opening the door for potential weakness, given that Wednesday’s excess was rejected.

In terms of levels, the Smashlevel is at 5475—Wednesday’s spike base. Holding below this level targets 5406 (tested after-hours) with a final downside target at Friday’s IB high of 5340 under sustained selling pressure. On the flip side, failure to hold below 5475 would open the door for a test of 5509—March’s low—with a final upside target at 5550 under sustained buying pressure.

Levels of Interest

Going into tomorrow's session, I will closely observe the behavior around 5475.

Break and hold above 5475 would target 5509 / 5550

Holding below 5475 would target 5406 / 5340

Additionally, pay attention to the following VIX levels: 33.43 and 28.35. These levels can provide confirmation of strength or weakness.

Break and hold above 5550 with VIX below 28.35 would confirm strength.

Break and hold below 5340 with VIX above 33.43 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Fantastic stuff as always! Thank you Smash!

Really appreciate it.