ES Daily Plan | April 12, 2024

Today’s session saw another attempt to break below the 3-week balance low of 5194, which ultimately failed, triggering responsive activity.

Visual Representation

For new followers, the yellow levels highlighted at the bottom are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final yellow upside target and shorts below the final yellow downside target. It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Contextual Analysis

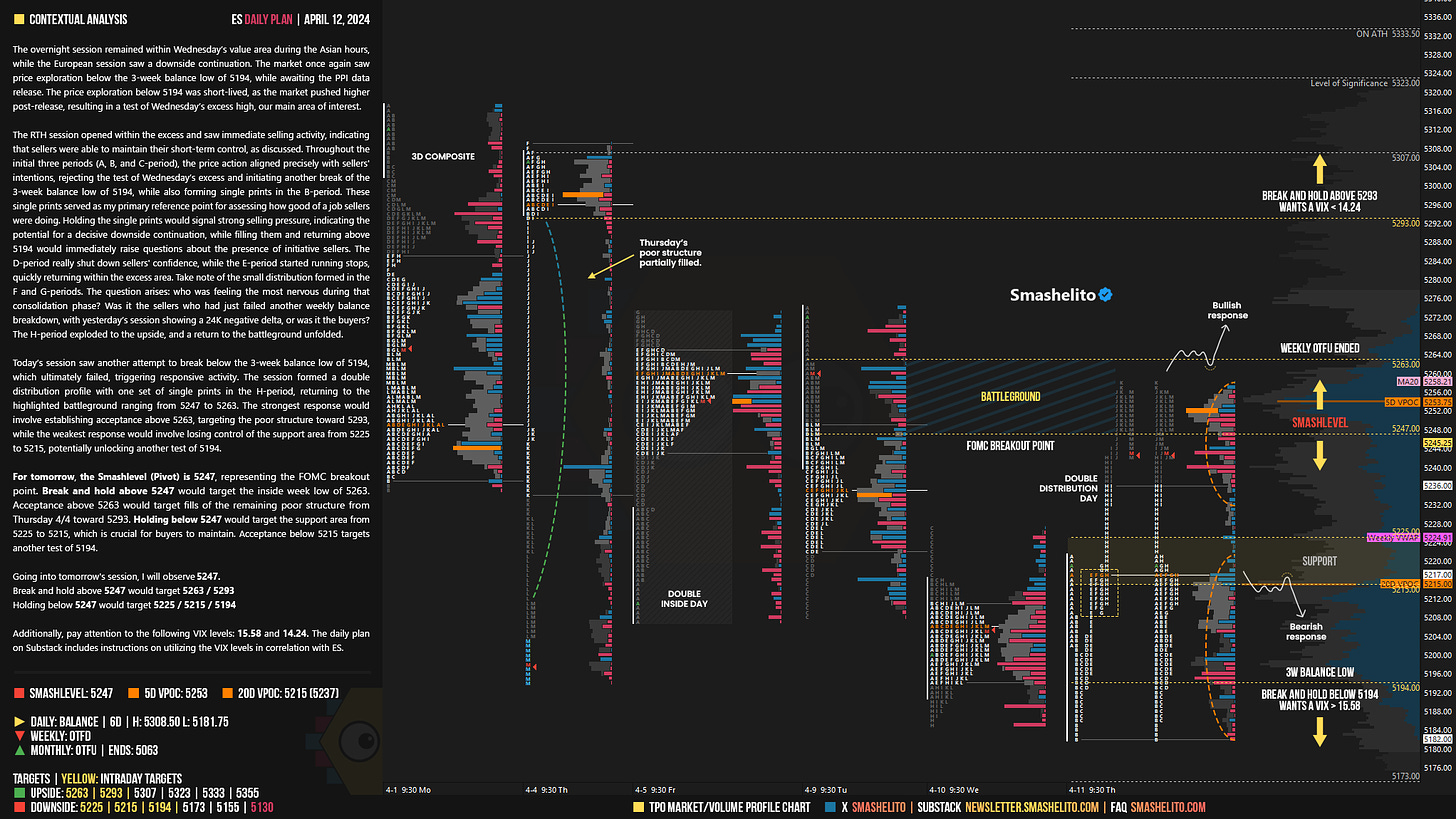

The overnight session remained within Wednesday’s value area during the Asian hours, while the European session saw a downside continuation. The market once again saw price exploration below the 3-week balance low of 5194, while awaiting the PPI data release. The price exploration below 5194 was short-lived, as the market pushed higher post-release, resulting in a test of Wednesday’s excess high, our main area of interest.

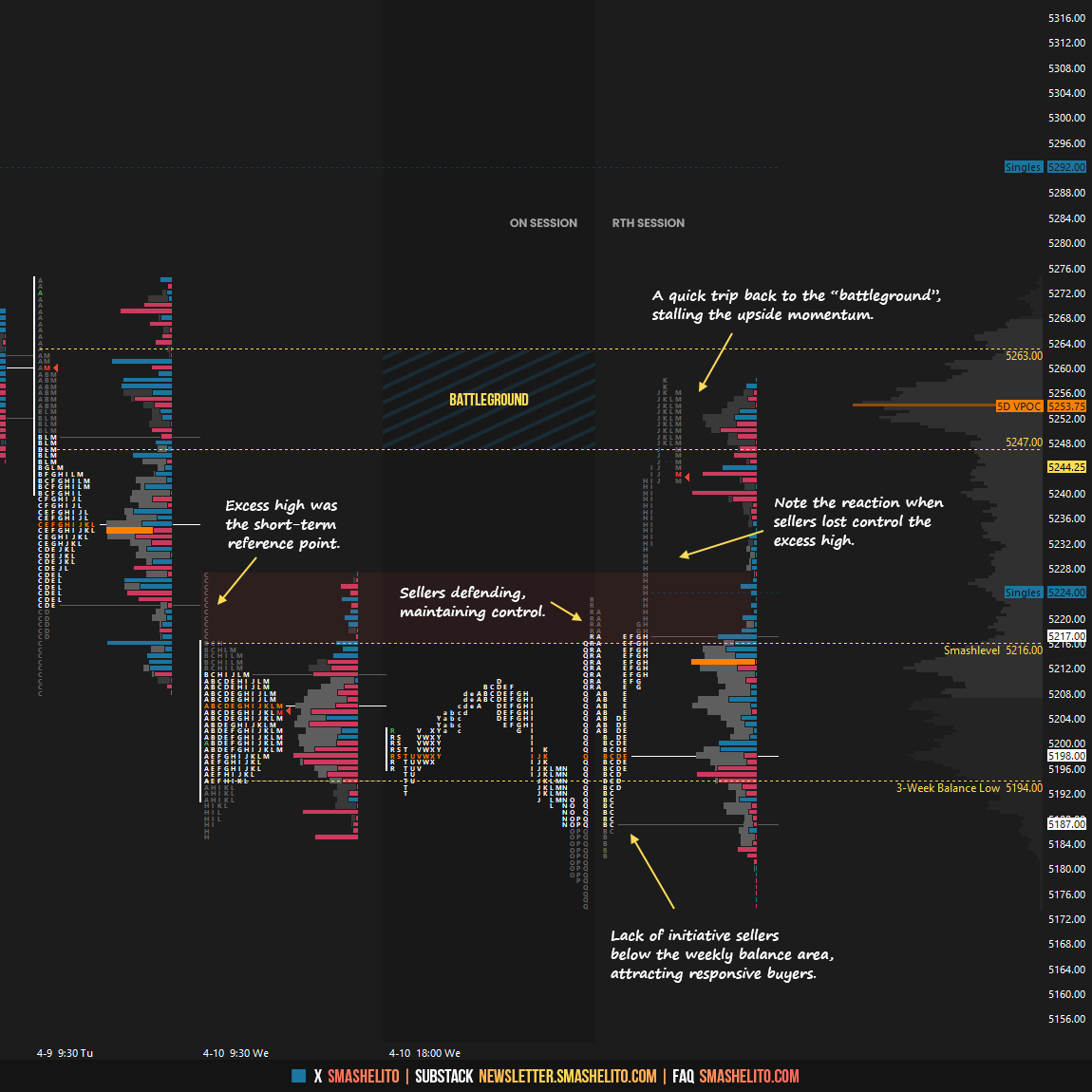

The RTH session opened within the excess and saw immediate selling activity, indicating that sellers were able to maintain their short-term control, as discussed. Throughout the initial three periods (A, B, and C-period), the price action aligned precisely with sellers' intentions, rejecting the test of Wednesday’s excess and initiating another break of the 3-week balance low of 5194, while also forming single prints in the B-period. These single prints served as my primary reference point for assessing how good of a job sellers were doing. Holding the single prints would signal strong selling pressure, indicating the potential for a decisive downside continuation, while filling them and returning above 5194 would immediately raise questions about the presence of initiative sellers. The D-period really shut down sellers' confidence, while the E-period started running stops, quickly returning within the excess area. Take note of the small distribution formed in the F and G-periods. The question arises: who was feeling the most nervous during that consolidation phase? Was it the sellers who had just failed another weekly balance breakdown, with yesterday’s session showing a 24K negative delta, or was it the buyers? The H-period exploded to the upside, and a return to the battleground unfolded.

Today’s session saw another attempt to break below the 3-week balance low of 5194, which ultimately failed, triggering responsive activity. The session formed a double distribution profile with one set of single prints in the H-period, returning to the highlighted battleground ranging from 5247 to 5263. The strongest response would involve establishing acceptance above 5263, targeting the poor structure toward 5293, while the weakest response would involve losing control of the support area from 5225 to 5215, potentially unlocking another test of 5194.

For tomorrow, the Smashlevel (Pivot) is 5247, representing the FOMC breakout point. Break and hold above 5247 would target the inside week low of 5263. Acceptance above 5263 would target fills of the remaining poor structure from Thursday 4/4 toward 5293. Holding below 5247 would target the support area from 5225 to 5215, which is crucial for buyers to maintain. Acceptance below 5215 targets another test of 5194.

Levels of Interest

Going into tomorrow's session, I will observe 5247.

Break and hold above 5247 would target 5263 / 5293

Holding below 5247 would target 5225 / 5215 / 5194

Additionally, pay attention to the following VIX levels: 15.58 and 14.24. These levels can provide confirmation of strength or weakness.

Break and hold above 5293 with VIX below 14.24 would confirm strength.

Break and hold below 5194 with VIX above 15.58 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Weekly Plan

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Got a few good short entries from 12.50 yesterday and today. C and D said don’t try that again. Lol. Thanks Smash.

The non stop aggresive buying shall make next week interesting!