ES Daily Plan | April 11, 2025

Key Levels & Market Context for the Upcoming Session.

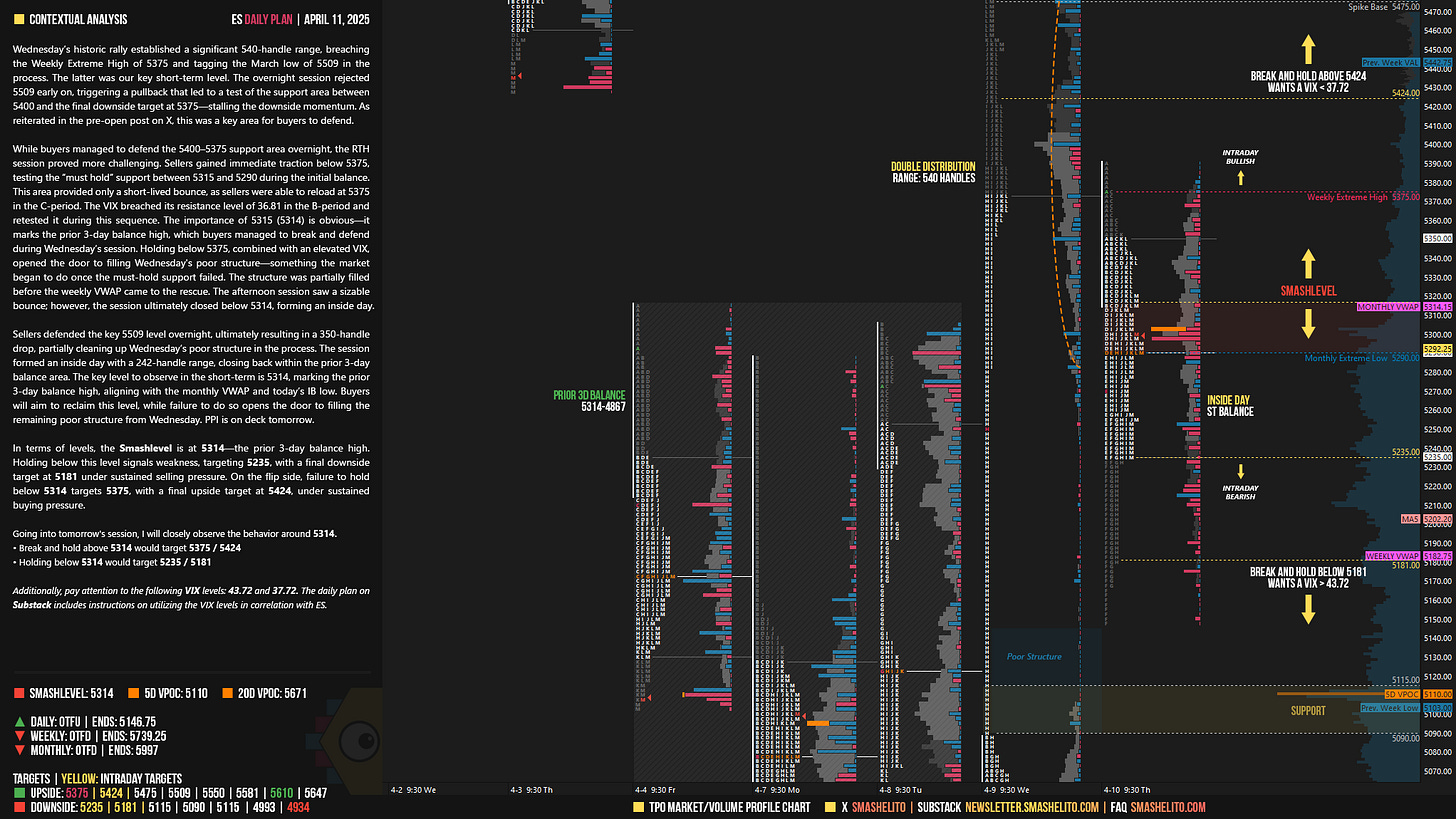

For new followers: The yellow levels highlighted at the bottom left of the chart are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final yellow upside target and shorts below the final yellow downside target. It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Make sure to review the Weekly Plan, which provides a broader perspective and highlights key levels of interest to observe in the upcoming week.

Visual Representation

Contextual Analysis

Wednesday’s historic rally established a significant 540-handle range, breaching the Weekly Extreme High of 5375 and tagging the March low of 5509 in the process. The latter was our key short-term level. The overnight session rejected 5509 early on, triggering a pullback that led to a test of the support area between 5400 and the final downside target at 5375—stalling the downside momentum. As reiterated in the pre-open post on X, this was a key area for buyers to defend.

While buyers managed to defend the 5400–5375 support area overnight, the RTH session proved more challenging. Sellers gained immediate traction below 5375, testing the “must hold” support between 5315 and 5290 during the initial balance. This area provided only a short-lived bounce, as sellers were able to reload at 5375 in the C-period. The VIX breached its resistance level of 36.81 in the B-period and retested it during this sequence. The importance of 5315 (5314) is obvious—it marks the prior 3-day balance high, which buyers managed to break and defend during Wednesday’s session. Holding below 5375, combined with an elevated VIX, opened the door to filling Wednesday's poor structure—something the market began to do once the must-hold support failed. The structure was partially filled before the weekly VWAP came to the rescue. The afternoon session saw a sizable bounce; however, the session ultimately closed below 5314, forming an inside day.

Sellers defended the key 5509 level overnight, ultimately resulting in a 350-handle drop, partially cleaning up Wednesday’s poor structure in the process. The session formed an inside day with a 242-handle range, closing back within the prior 3-day balance area. The key level to observe in the short-term is 5314, marking the prior 3-day balance high, aligning with the monthly VWAP and today’s IB low. Buyers will aim to reclaim this level, while failure to do so opens the door to filling the remaining poor structure from Wednesday. PPI is on deck tomorrow.

In terms of levels, the Smashlevel is at 5314—the prior 3-day balance high. Holding below this level signals weakness, targeting 5235, with a final downside target at 5181 under sustained selling pressure. On the flip side, failure to hold below 5314 targets 5375, with a final upside target at 5424, under sustained buying pressure.

Levels of Interest

Going into tomorrow's session, I will closely observe the behavior around 5314.

Break and hold above 5314 would target 5375 / 5424

Holding below 5314 would target 5235 / 5181

Additionally, pay attention to the following VIX levels: 43.72 and 37.72. These levels can provide confirmation of strength or weakness.

Break and hold above 5424 with VIX below 37.72 would confirm strength.

Break and hold below 5181 with VIX above 43.72 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Thank you very much!

Thank you!