ES Daily Plan | April 11, 2024

The CPI data release triggered a directional downside move away from the highlighted battleground area. Moving forward, we will monitor whether today’s move will be accepted or rejected. PPI tomorrow.

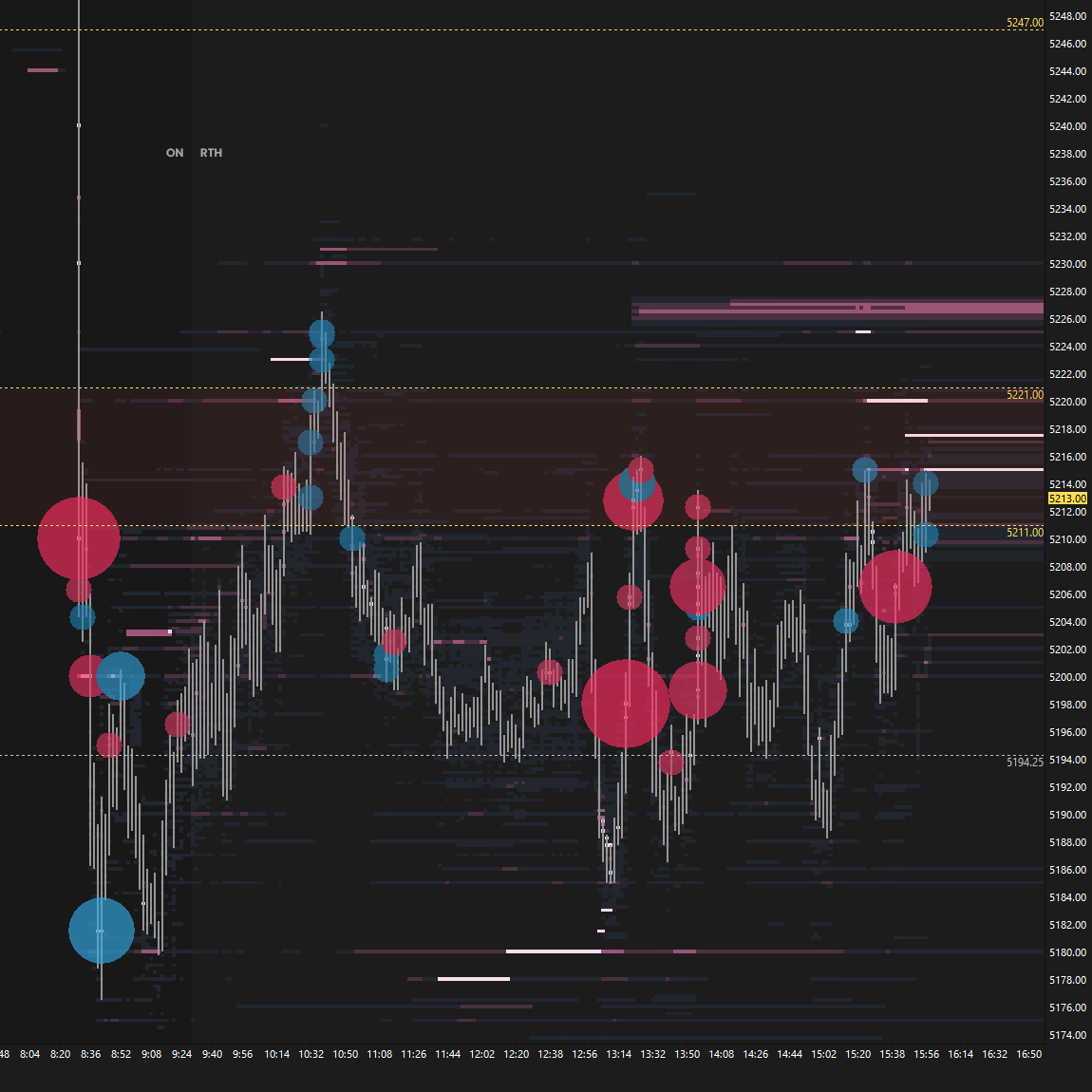

Visual Representation

For new followers, the yellow levels highlighted at the bottom are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final yellow upside target and shorts below the final yellow downside target. It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Contextual Analysis

The overnight session remained relatively quiet, marked by minimal activity, as market participants awaited the crucial release of the CPI data. The market demonstrated its usual volatility post-release, initially moving higher before quickly changing course and resulting in a nasty liquidation. This liquidation not only wiped out all intraday downside targets but also breached the 3-week balance low of 5194, where a distribution was established. Additionally, VIX breached its resistance level of 15.68.

The RTH session opened with a true gap to the downside, within the 3-week balance area. In my pre-open tweet, I highlighted that the 3-week balance low of 5194 serves as a crucial level for sellers to break and find acceptance below, triggering a shift in tone, as also discussed in the Weekly Plan. Buyers' main objective was to gain traction within the previous day’s range, specifically reclaiming the 5211-5221 area. Today’s session resulted in a value area contained between 5211 and 5194, with buyers active below 5194, and sellers defending the 5211-5221 area, providing setups in both directions. I wasn't particularly interested in long setups, especially considering the break of 5211, and with VIX confirming weakness by holding above 15.68 for the majority of the session. Conversely, short setups required discipline, given their trade location at the lower end of the 3-week balance area, making today’s RTH session challenging.

The break of 5194 shifts both the daily and weekly to one-time framing down, the latter being a significant achievement for sellers. However, the aggressive sellers below 5194 were unable to gain traction. It remains to be seen whether this was due to the overnight session already making a significant move or a lack of stronger sellers. Buyers managed to fill the gap and close within the weekly balance area but encountered difficulty gaining traction within Tuesday’s range, forming an excess high.

The CPI data release triggered a directional downside move away from the highlighted battleground area during the overnight session, while the RTH session saw reduced volatility, with prices balancing at the lower end of the weekly balance area. Moving forward, we will monitor whether today’s move will be accepted or rejected. I will use today’s excess high as a short-term reference point. Sellers currently maintain short-term control by staying below it, aiming to establish value within HVN #2 in an attempt for a downside continuation toward 5173 and 5155. Failure to do so, would target responsive activity back toward the 5247-5263 area. PPI on deck tomorrow.

For tomorrow, the Smashlevel (Pivot) is 5216, representing the initial balance high, afternoon rally high, and base of today’s C-period excess high. Break and hold above 5216 would target today’s high of 5226, coinciding with the weekly VWAP. Acceptance above 5226 would target a move back toward the highlighted battleground from 5247 to 5263. Holding below 5216 would target the 3-week balance low of 5194. Break and hold below 5194 would target a downside continuation toward 5173 and the weekly NVPOC at 5155.

Levels of Interest

Going into tomorrow's session, I will observe 5216.

Break and hold above 5216 would target 5226 / 5247 / 5263

Holding below 5216 would target 5194 / 5173 / 5155

Additionally, pay attention to the following VIX levels: 16.52 and 15.08. These levels can provide confirmation of strength or weakness.

Break and hold above 5263 with VIX below 15.08 would confirm strength.

Break and hold below 5155 with VIX above 16.52 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Weekly Plan

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Thank you for your guidance!

73.5 spike low........