ES Daily Plan | April 10, 2024

Will tomorrow's CPI data trigger a directional move, or will responsive activity within the weekly balance area continue?

Visual Representation

For new followers, the yellow levels highlighted at the bottom are the primary levels that I focus on intraday. My strategy for preventing impulsive decisions at unfavorable locations involves following a simple yet effective rule of exercising caution when initiating trades outside of the yellow levels. This implies that I am cautious chasing longs above the final yellow upside target and shorts below the final yellow downside target. It is crucial to understand that refraining from chasing a trade is not an automatic invitation to initiate a trade in the opposite direction.

Contextual Analysis

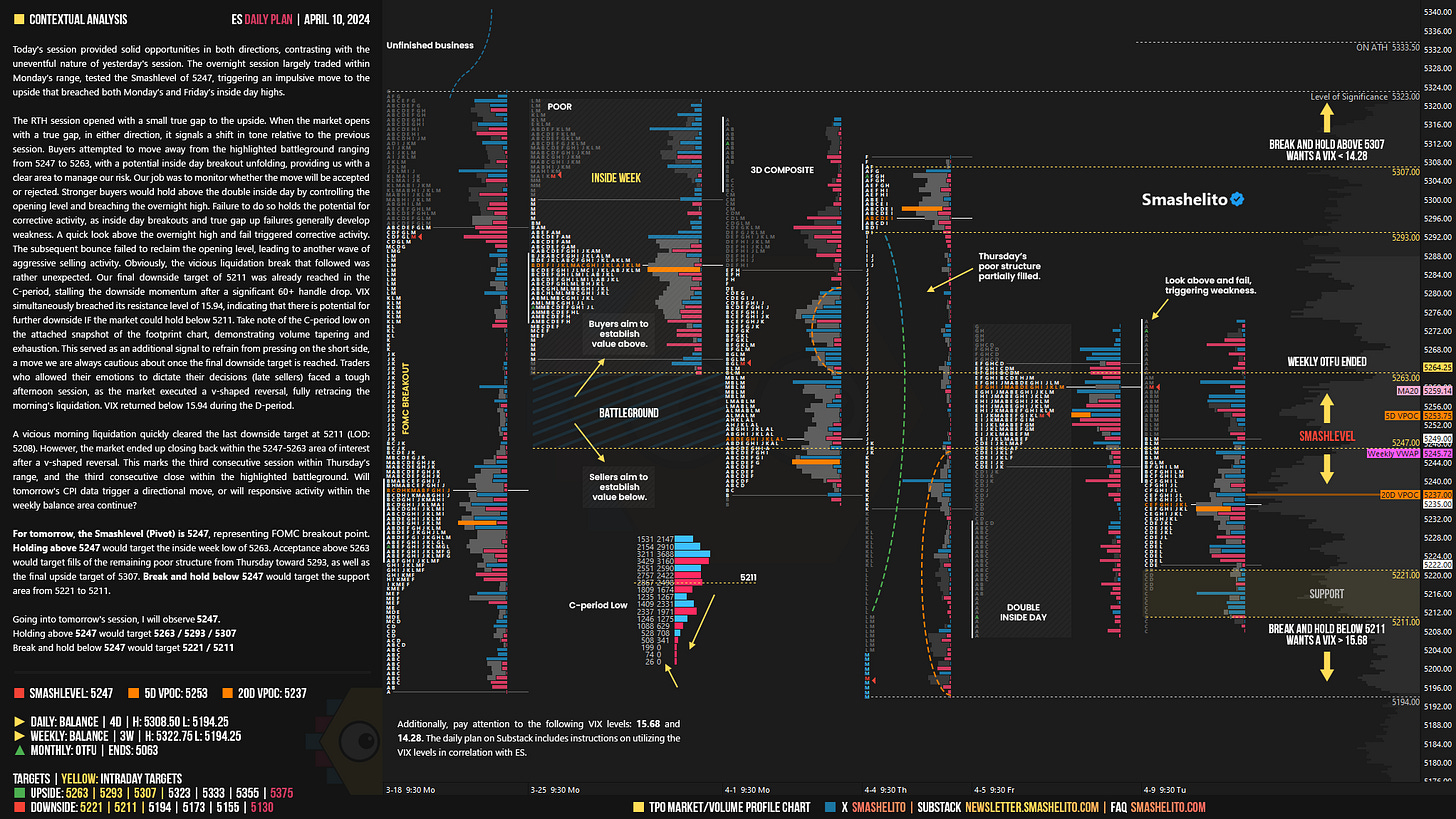

Today's session provided solid opportunities in both directions, contrasting with the uneventful nature of yesterday's session. The overnight session largely traded within Monday’s range, tested the Smashlevel of 5247, triggering an impulsive move to the upside that breached both Monday’s and Friday’s inside day highs.

The RTH session opened with a small true gap to the upside. When the market opens with a true gap, in either direction, it signals a shift in tone relative to the previous session. Buyers attempted to move away from the highlighted battleground ranging from 5247 to 5263, with a potential inside day breakout unfolding, providing us with a clear area to manage our risk. Our job was to monitor whether the move will be accepted or rejected. Stronger buyers would hold above the double inside day by controlling the opening level and breaching the overnight high. Failure to do so holds the potential for corrective activity, as inside day breakouts and true gap up failures generally develop weakness.

A quick look above the overnight high and fail triggered corrective activity. The subsequent bounce failed to reclaim the opening level, leading to another wave of aggressive selling activity. Obviously, the vicious liquidation break that followed was rather unexpected. Our final downside target of 5211 was already reached in the C-period, stalling the downside momentum after a significant 60+ handle drop. VIX simultaneously breached its resistance level of 15.94, indicating that there is potential for further downside IF the market could hold below 5211. Take note of the C-period low on the attached snapshot of the footprint chart, demonstrating volume tapering and exhaustion. This served as an additional signal to refrain from pressing on the short side, a move we are always cautious about once the final downside target is reached. Traders who allowed their emotions to dictate their decisions (late sellers) faced a tough afternoon session, as the market executed a v-shaped reversal, fully retracing the morning's liquidation. VIX returned below 15.94 during the D-period.

A vicious morning liquidation quickly cleared the last downside target at 5211 (LOD: 5208). However, the market ended up closing back within the 5247-5263 area of interest after a v-shaped reversal. This marks the third consecutive session within Thursday’s range, and the third consecutive close within the highlighted battleground. Will tomorrow's CPI data trigger a directional move, or will responsive activity within the weekly balance area continue?

For tomorrow, the Smashlevel (Pivot) is 5247, representing FOMC breakout point. Holding above 5247 would target the inside week low of 5263. Acceptance above 5263 would target fills of the remaining poor structure from Thursday toward 5293, as well as the final upside target of 5307. Break and hold below 5247 would target the support area from 5221 to 5211.

Levels of Interest

Going into tomorrow's session, I will observe 5247.

Holding above 5247 would target 5263 / 5293 / 5307

Break and hold below 5247 would target 5221 / 5211

Additionally, pay attention to the following VIX levels: 15.68 and 14.28. These levels can provide confirmation of strength or weakness.

Break and hold above 5307 with VIX below 14.28 would confirm strength.

Break and hold below 5211 with VIX above 15.68 would confirm weakness.

Overall, it's important to exercise caution when trading outside of the highlighted yellow levels. A non-cooperative VIX may suggest possible reversals i.e trade setups.

Weekly Plan

Be sure to check out the Weekly Plan, which provides a broader perspective and highlights significant levels of interest to watch in the coming week.

Disclaimer: Futures and options trading involves a high level of risk, with the potential for substantial losses. The information provided in this newsletter is for informational purposes only and is not intended to be a trade recommendation. It is the responsibility of the reader to make their own investment decisions and they should seek the advice of a qualified securities professional before making any investments. The owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Thank you! Tomorrow's session will be interesting to follow!

came over to follow you hear from Twitter/X. Great work - truly a pro. Thank you