Smash ES Weekly Outlook | November 21-25, 2022

🟨 Daily: BALANCE

🟩 Weekly: OTFU

🟨 Monthly: BALANCE

Weekly Extreme High: 4115

Weekly Extreme Low: 3830

An in-depth daily plan will, as usual, be published tomorrow.

The market basically took a breather last week, which was not surprising since we are within an area of prior balance. Note the stacked weekly VPOC’s to the left. The biggest event was the liquidation break on Thursday, that retested the weekly breakout and found buyers (trapped sellers got a chance to get out). That liquidation break cleaned out weak longs and failed to bring in new selling activity, meaning we closed out the week back at the weekly VPOC, which acted as a magnet in the lack of downward continuation.

For this week, the main focus will be on the 3 day balance. The balance high 3992.75 is weak, meaning there should be plenty of stops above. Note that the balance low 3913.75 is also the weekly low and if breached, the weekly one time framing up ends, meaning a very important reference next week.

The short-term level of interest is the LVN 3940. Holding above 3940 would target a breakout of the 3 day balance to target 11/15 NVPOC 4025. Break and hold above 4025 would target the resistance area from 4070 to the Weekly Extreme High 4115. Note the multiple references we have there, MA200, unfilled daily gap 4103.50 and a monthly/weekly NVPOC 4140, meaning an area where selling activity can be expected.

Break and hold below 3940 would target a breakdown of the 3 day balance to target the support area from 3875 to the Weekly Extreme Low 3830. Note the multiple references we have there, 20% correction level, HVN and unfilled gap 3825.75. The 3845 HVN will act as a downside magnet in case of a breakdown of the daily balance, where buying activity can be expected.

Upside levels of interest: 3992 | 4025 | 4070 | 4115 | 4140

Downside levels of interest: 3913 | 3875 | 3847 | 3830 | 3800

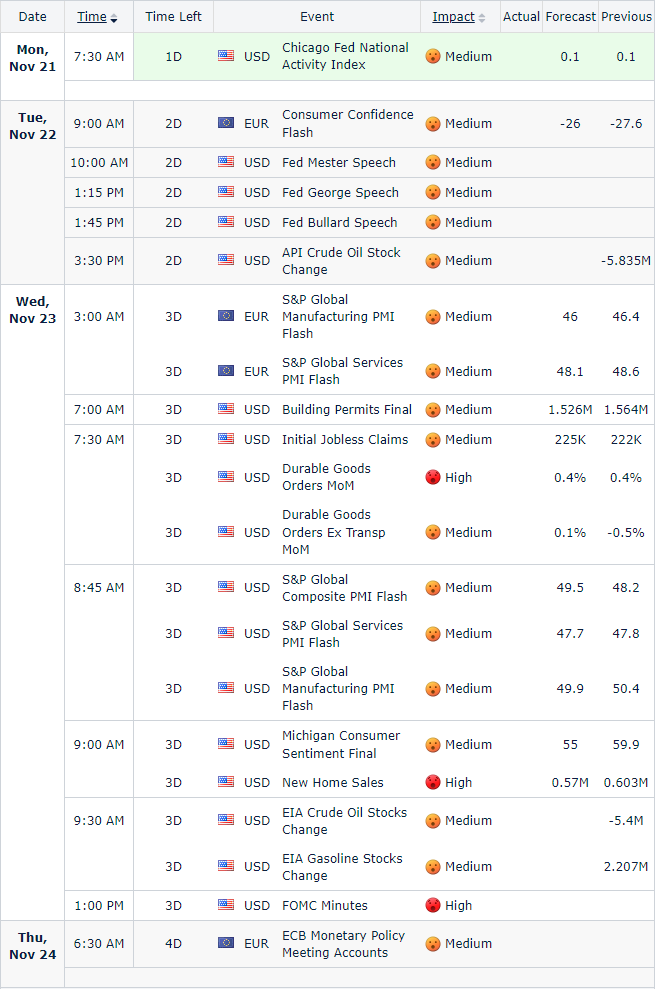

Economic Calendar: November 21-25 | Central Time (GMT -6:00)

Disclaimer: Futures and options trading involve high risks with the potential for substantial losses. The information contained in this communication is for informational purposes only and does not constitute a trade recommendation and should not be construed as such. The reader bears responsibility for any investment decisions and should seek the advice of a qualified securities professional before making any investments. Owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Twitter: @smashelito | FAQ: smashelito.com