Smash ES Weekly Outlook | November 14-18, 2022

🟩 Daily: OTFU

🟩 Weekly: OTFU

🟨 Monthly: BALANCE

Weekly Extreme High: 4135

Weekly Extreme Low: 3865

An in-depth daily plan will, as usual, be published tomorrow.

Monday's session broke out from the 2 day balance and closed back within the prior balance area and above previous week's level of interest 3805. We tagged the first upside target 3847 (20% correction level) on Tuesday, where selling activity was encountered. Tuesday's high was left unfinished as noted in Wednesday's plan. The daily one time framing up ended on Wednesday, where we closed out the session at the lows following a directional downward move away from value. Sellers needed to see a follow through on Thursday, meaning acceptance of these lower prices or value would act as a magnet. Lack of follow through combined with the market responding positively to the CPI numbers triggered a massive squeeze that resulted in a breakout from the 3 week balance and we cleared all weekly upside targets. The imbalance to the upside continued on Friday, leaving an unfinished high but also a poor low.

For this week, the main focus will be on whether the breakout from the weekly balance holds. The short-term level of interest is Thursday’s close 3960. Holding above 3960 would target 4020. Note the low volume area that starts above 4020. Fills of that poor structure is buyers main target if this rally has legs. Break and hold above 4020 would target the resistance area from 4090 to the Weekly Extreme High 4135. Note the multiple references we have there, MA200, unfilled daily gap 4103.50 and a monthly/weekly NVPOC 4140, meaning an area where selling activity can be expected. Break and hold below 3960 would target the breakout point 3920, which also is the weekly value area high. Failure to hold 3920 would target the Weekly Extreme Low 3865. The 3845 HVN will act as a downside magnet if the 3 week balance breakout fails, where buying activity can be expected.

Upside levels of interest: 4020 | 4090 | 4103 | 4135

Downside levels of interest: 3920 | 3865 | 3847 | 3825

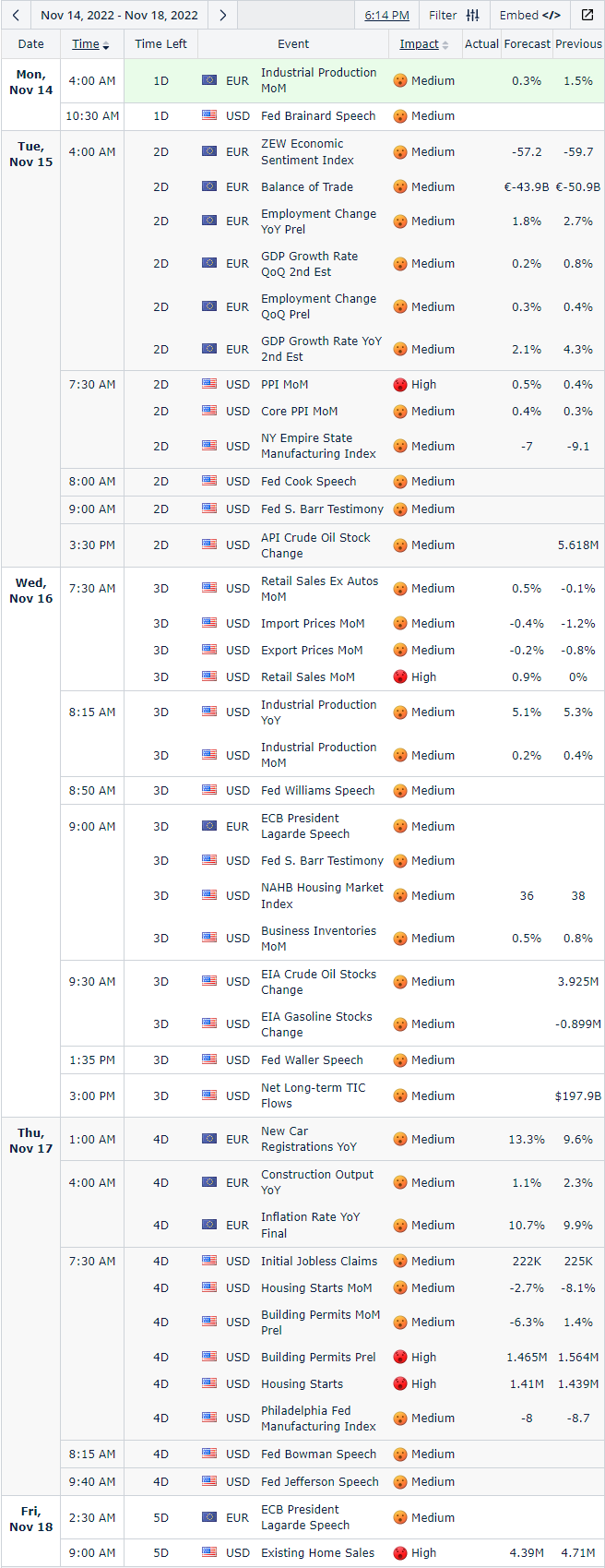

Economic Calendar: November 14-18 | Central Time (GMT -6:00)

Disclaimer: Futures and options trading involve high risks with the potential for substantial losses. The information contained in this communication is for informational purposes only and does not constitute a trade recommendation and should not be construed as such. The reader bears responsibility for any investment decisions and should seek the advice of a qualified securities professional before making any investments. Owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Twitter: @smashelito | FAQ: smashelito.com

I like the notes! Love the new format

Thank you Smash! I like that you added the commentary as text as well!