Smash ES Plan | November 30, 2022

Sellers breaking the 4 day balance to the downside, but failing to gain the same traction as yesterday. Weekly support area tested and held.

Buyers want to get back within the upper distribution of 11/28.

Recap & Plan

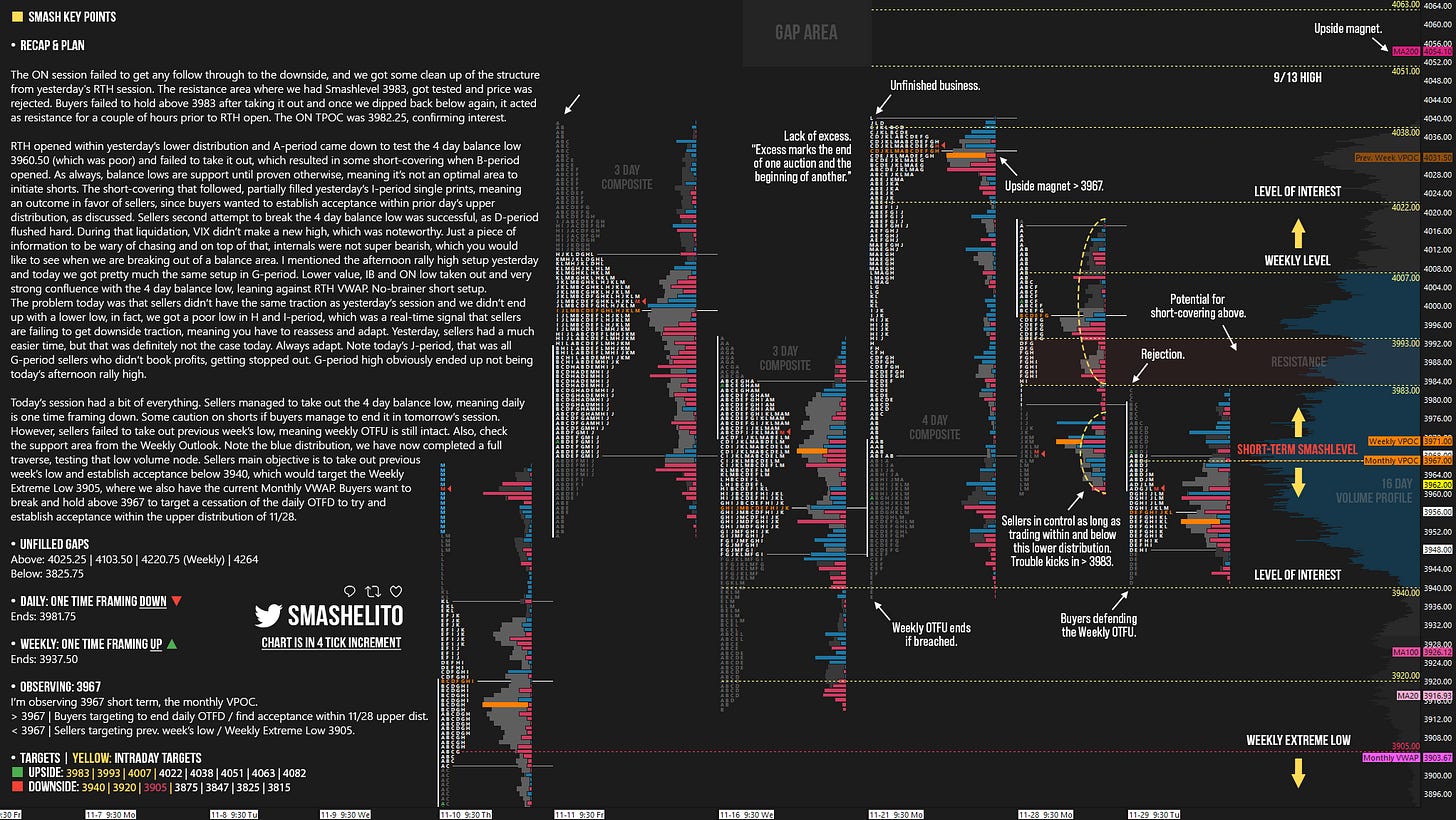

The ON session failed to get any follow through to the downside, and we got some clean up of the structure from yesterday's RTH session. The resistance area where we had Smashlevel 3983, got tested and price was rejected. Buyers failed to hold above 3983 after taking it out and once we dipped back below again, it acted as resistance for a couple of hours prior to RTH open. The ON TPOC was 3982.25, confirming interest.

RTH opened within yesterday’s lower distribution and A-period came down to test the 4 day balance low 3960.50 (which was poor) and failed to take it out, which resulted in some short-covering when B-period opened. As always, balance lows are support until proven otherwise, meaning it’s not an optimal area to initiate shorts. The short-covering that followed, partially filled yesterday’s I-period single prints, meaning an outcome in favor of sellers, since buyers wanted to establish acceptance within prior day’s upper distribution, as discussed. Sellers second attempt to break the 4 day balance low was successful, as D-period flushed hard. During that liquidation, VIX didn’t make a new high, which was noteworthy. Just a piece of information to be wary of chasing and on top of that, internals were not super bearish, which you would like to see when we are breaking out of a balance area.

I mentioned the afternoon rally high setup yesterday and today we got pretty much the same setup in G-period. Lower value, IB and ON low taken out and very strong confluence with the 4 day balance low, leaning against RTH VWAP. No-brainer short setup. The problem today was that sellers didn’t have the same downside traction as yesterday’s session and we didn’t end up with a lower low, in fact, we got a poor low in H and I-period, which was a real-time signal that sellers are failing to get downside traction, meaning you have to reassess and adapt. Yesterday, sellers had a much easier time, but that was definitely not the case today. Always adapt. Note today’s J-period, that was all G-period sellers who didn’t book profits, getting stopped out. G-period high obviously ended up not being today’s afternoon rally high.

Today’s session had a bit of everything. Sellers managed to take out the 4 day balance low, meaning daily is one time framing down. Some caution on shorts if buyers manage to end it in tomorrow’s session. However, sellers failed to take out previous week’s low, meaning weekly OTFU is still intact. Also, check the support area from the Weekly Outlook. Note the blue distribution, we have now completed a full traverse, testing that low volume node. Sellers main objective is to take out previous week’s low and establish acceptance below 3940, which would target the Weekly Extreme Low 3905, where we also have the current Monthly VWAP. Buyers want to break and hold above 3967 to target a cessation of the daily OTFD to try and establish acceptance within the upper distribution of 11/28.

Disclaimer: Futures and options trading involve high risks with the potential for substantial losses. The information contained in this communication is for informational purposes only and does not constitute a trade recommendation and should not be construed as such. The reader bears responsibility for any investment decisions and should seek the advice of a qualified securities professional before making any investments. Owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Twitter: @smashelito | FAQ: smashelito.com

Smash,

luv you man - just love you!

I cannot begin to tell you how much I am learning from your analysis.

Things are finally starting to make sense after 2 years and SEVERAL "gurus".

You are VERY much appreciated.

We also appreciate your mom for having you! :)

-Newb