Smash ES Plan | November 29, 2022

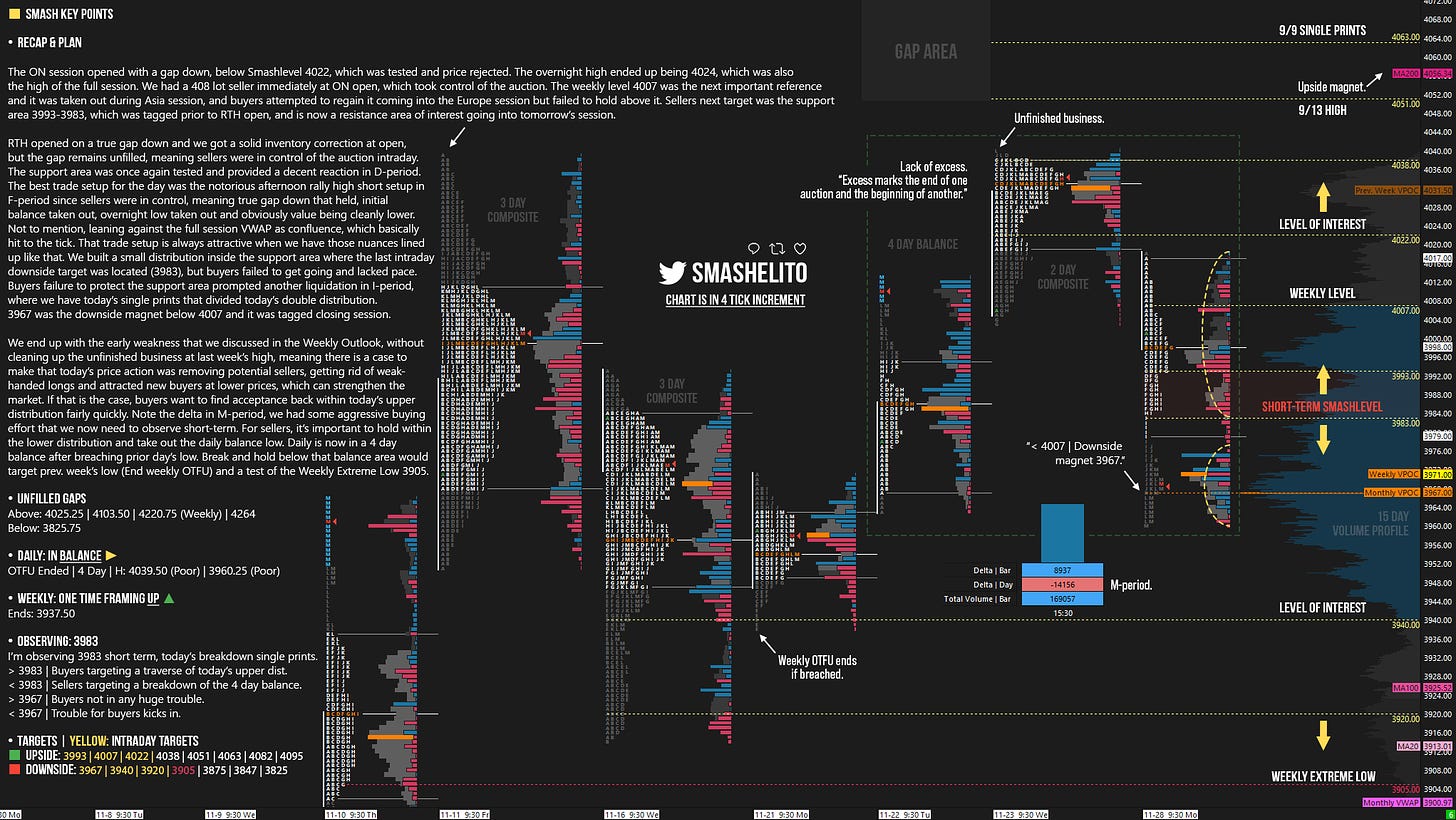

Double distribution with one set of single prints and daily back to balance, as we start the week with some weakness.

The lower distribution is of interest, where we had some buying effort into the closing session.

Recap & Plan

The ON session opened with a gap down, below Smashlevel 4022, which was tested and price rejected. The overnight high ended up being 4024, which was also the high of the full session. We had a 408 lot seller immediately at ON open, which took control of the auction. The weekly level 4007 was the next important reference and it was taken out during Asia session, and buyers attempted to regain it coming into the Europe session but failed to hold above it. Sellers next target was the support area 3993-3983, which was tagged prior to RTH open, and is now a resistance area of interest going into tomorrows session.

RTH opened on a true gap down and we got a solid inventory correction at open, but the gap remains unfilled, meaning sellers were in control of the auction intraday. The support area was once again tested and provided a decent reaction in D-period. The best trade setup for the day was the notorious afternoon rally high short setup in F-period since sellers were in control, meaning true gap down that held, initial balance taken out, overnight low taken out and obviously value being cleanly lower. Not to mention, leaning against the full session VWAP as confluence, which basically hit to the tick. That trade setup is always attractive when we have those nuances lined up like that. We built a small distribution inside the support area where the last intraday downside target was located (3983), but buyers failed to get going and lacked pace. Buyers failure to protect the support area prompted another liquidation in I-period, where we have today’s single prints that divided today’s double distribution. 3967 was the downside magnet below 4007 and it was tagged closing session.

We end up with the early weakness that we discussed in the Weekly Outlook, without cleaning up the unfinished business at last week’s high, meaning there is a case to make that today’s price action was removing potential sellers, getting rid of weak-handed longs and attracted new buyers at lower prices, which can strengthen the market. If that is the case, buyers want to find acceptance back within today’s upper distribution fairly quickly. Note the delta in M-period, we had some aggressive buying effort that we now need to observe short-term. For sellers, it’s important to hold within the lower distribution and take out the daily balance low. Daily is now in a 4 day balance after breaching prior day’s low. Break and hold below that balance area would target prev. week’s low (End weekly OTFU) and a test of the Weekly Extreme Low 3905.

Disclaimer: Futures and options trading involve high risks with the potential for substantial losses. The information contained in this communication is for informational purposes only and does not constitute a trade recommendation and should not be construed as such. The reader bears responsibility for any investment decisions and should seek the advice of a qualified securities professional before making any investments. Owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Twitter: @smashelito | FAQ: smashelito.com

I did notice the aggressive buying at the close, let's see what it brings! Thank you Smash!