Smash ES Plan | November 24/25, 2022

Price exploration to the upside continues.

Happy Thanksgiving to all who celebrate!

Recap & Plan

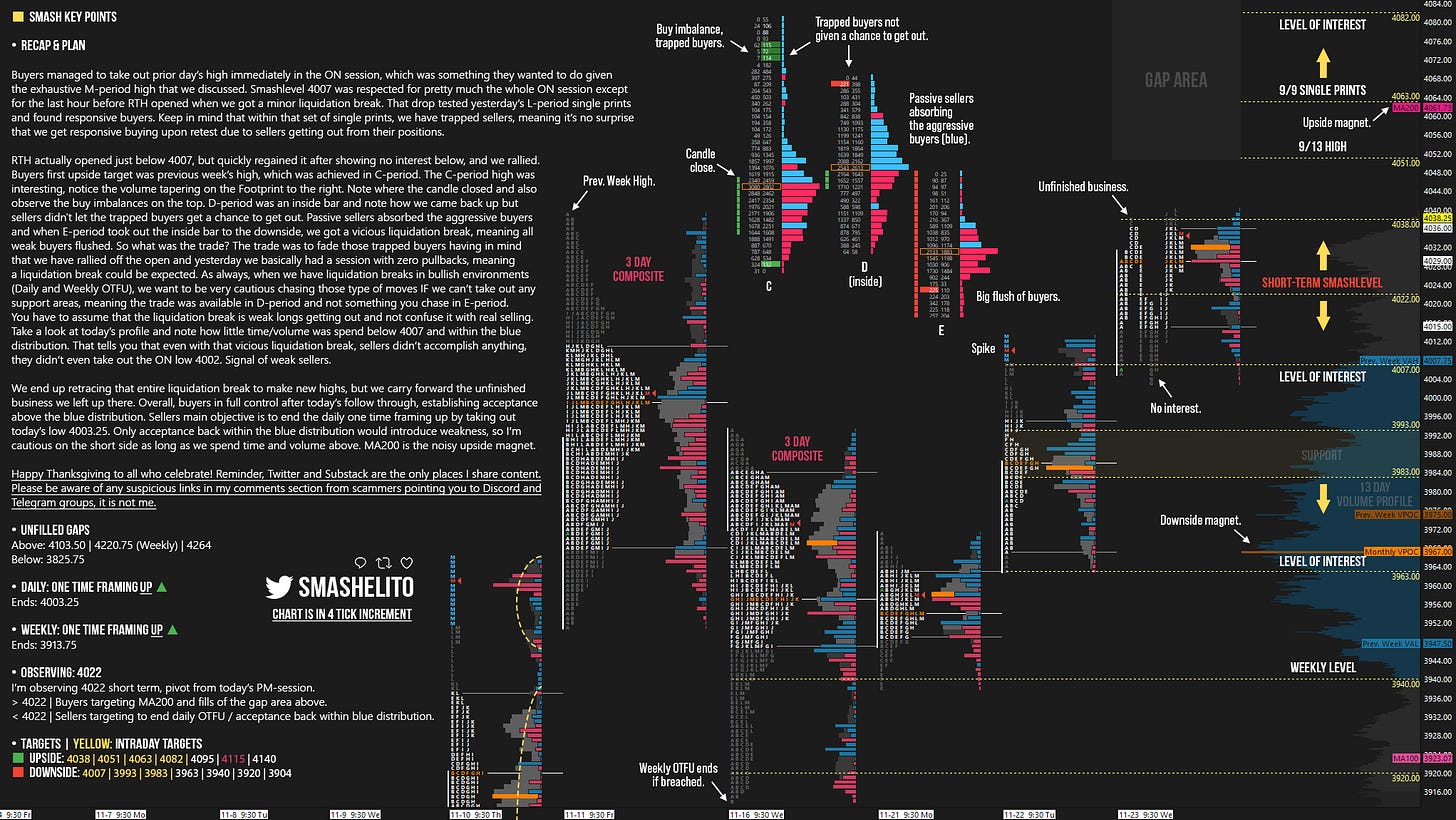

Buyers managed to take out prior day’s high immediately in the ON session, which was something they wanted to do given the exhaustive M-period high that we discussed. Smashlevel 4007 was respected for pretty much the whole ON session except for the last hour before RTH opened when we got a minor liquidation break. That drop tested yesterday’s L-period single prints and found responsive buyers. Keep in mind that within that set of single prints, we have trapped sellers, meaning it’s no surprise that we get responsive buying upon retest due to sellers getting out from their positions.

RTH actually opened just below 4007, but quickly regained it after showing no interest below, and we rallied. Buyers first upside target was previous week’s high, which was achieved in C-period. The C-period high was interesting, notice the volume tapering on the Footprint to the right. Note where the candle closed and also observe the buy imbalances on the top. D-period was an inside bar and note how we came back up but sellers didn't let the trapped buyers get a chance to get out. Passive sellers absorbed the aggressive buyers and when E-period took out the inside bar to the downside, we got a vicious liquidation break, meaning all weak buyers flushed. So what was the trade? The trade was to fade those trapped buyers having in mind that we have rallied off the open and yesterday we basically had a session with zero pullbacks, meaning a liquidation break could be expected. As always, when we have liquidation breaks in bullish environments (Daily and Weekly OTFU), we want to be very cautious chasing those type of moves IF we can’t take out any support areas, meaning the trade was available in D-period and not something you chase in E-period. You have to assume that the liquidation break is weak longs getting out and not confuse it with real selling. Take a look at today’s profile and note how little time/volume was spend below 4007 and within the blue distribution. That tells you that even with that vicious liquidation break, sellers didn’t accomplish anything, they didn’t even take out the ON low 4002. Signal of weak sellers.

We end up retracing that entire liquidation break to make new highs, but we carry forward the unfinished business we left up there. Overall, buyers in full control after today’s follow through, establishing acceptance above the blue distribution. Sellers main objective is to end the daily one time framing up by taking out today’s low 4003.25. Only acceptance back within the blue distribution would introduce weakness, so I’m cautious on the short side as long as we spend time and volume above. MA200 is the noisy upside magnet.

Disclaimer: Futures and options trading involve high risks with the potential for substantial losses. The information contained in this communication is for informational purposes only and does not constitute a trade recommendation and should not be construed as such. The reader bears responsibility for any investment decisions and should seek the advice of a qualified securities professional before making any investments. Owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Twitter: @smashelito | FAQ: smashelito.com

Happy Thanksgiving Mr. Smash! Have a great one with your family!

Happy Thanksgiving Smash! Thank you for everything you do!