Smash ES Plan | November 22, 2022

Not much has changed after today's session, which was pretty uneventful. The market remains in balance waiting for more market generated information, meaning stay nimble until resolved.

Recap & Plan

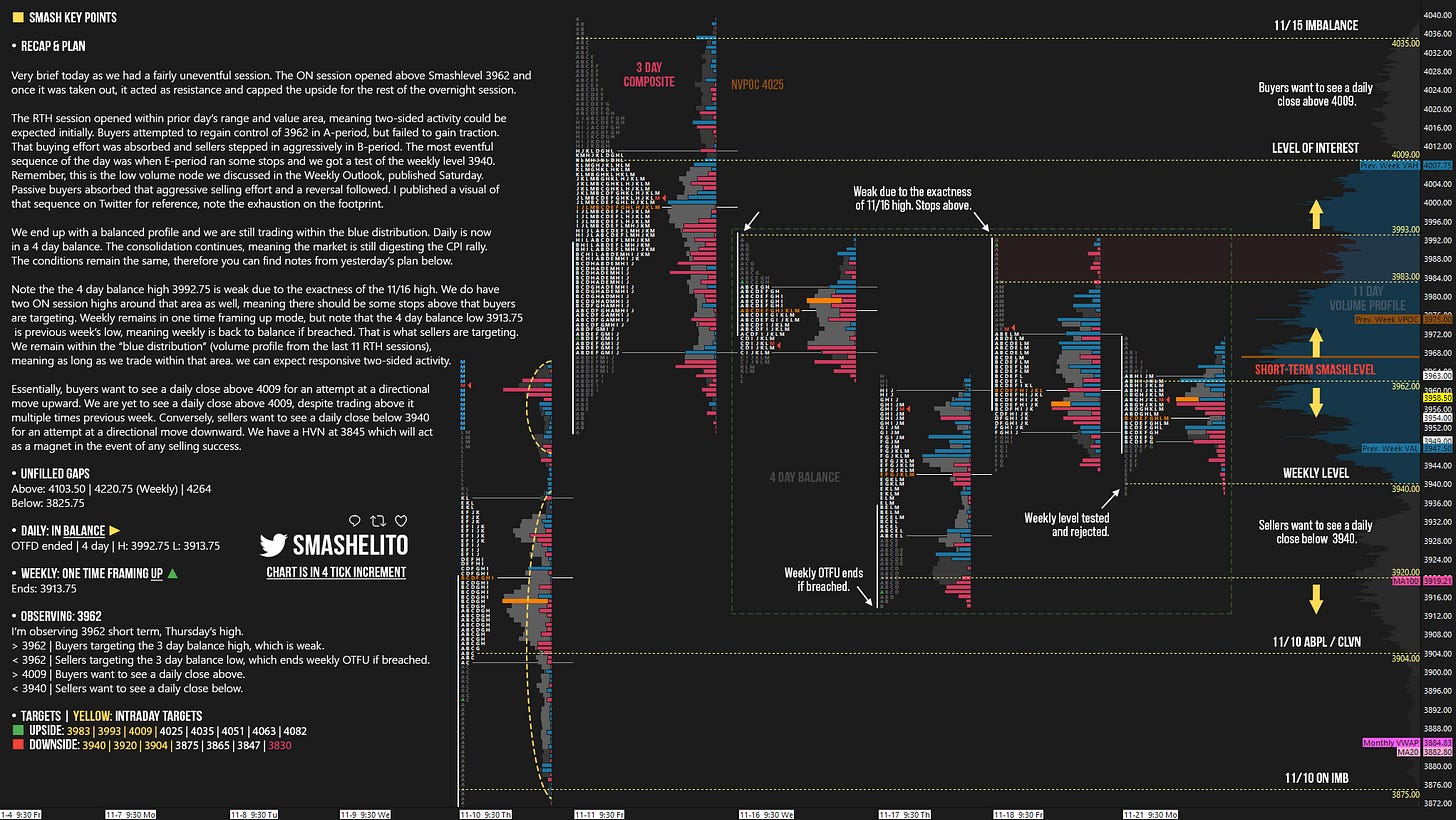

Very brief today as we had a fairly uneventful session. The ON session opened above Smashlevel 3962 and once it was taken out, it acted as resistance and capped the upside for the rest of the overnight session.

The RTH session opened within prior day’s range and value area, meaning two-sided activity could be expected initially. Buyers attempted to regain control of 3962 in A-period, but failed to gain traction. That buying effort was absorbed and sellers stepped in aggressively in B-period. The most eventful sequence of the day was when E-period ran some stops and we got a test of the weekly level 3940. Remember, this is the low volume node we discussed in the Weekly Outlook, published Saturday. Passive buyers absorbed that aggressive selling effort and a reversal followed. I published a visual of that sequence on Twitter for reference, note the exhaustion on the footprint.

We end up with a balanced profile and we are still trading within the blue distribution. Daily is now in a 4 day balance. The consolidation continues, meaning the market is still digesting the CPI rally. The conditions remain the same, therefore you can find notes from yesterday’s plan below. Note the the 4 day balance high 3992.75 is weak due to the exactness of the 11/16 high. We do have two ON session highs around that area as well, meaning there should be some stops above that buyers are targeting. Weekly remains in one time framing up mode, but note that the 4 day balance low 3913.75 is previous week’s low, meaning weekly is back to balance if breached. That is what sellers are targeting. We remain within the “blue distribution” (volume profile from the last 11 RTH sessions), meaning as long as we trade within that area. we can expect responsive two-sided activity.

Essentially, buyers want to see a daily close above 4009 for an attempt at a directional move upward. We are yet to see a daily close above 4009, despite trading above it multiple times previous week. Conversely, sellers want to see a daily close below 3940 for an attempt at a directional move downward. We have a HVN at 3845 which will act as a magnet in the event of any selling success.

Disclaimer: Futures and options trading involve high risks with the potential for substantial losses. The information contained in this communication is for informational purposes only and does not constitute a trade recommendation and should not be construed as such. The reader bears responsibility for any investment decisions and should seek the advice of a qualified securities professional before making any investments. Owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Twitter: @smashelito | FAQ: smashelito.com

3940 was a brilliant level!