Smash ES Plan | November 16, 2022

Daily back to a 3 day balance after sellers managed to take out prior day's low. I've highlighted the distribution of interest. I'm observing the low volume node from today's session short-term.

Recap & Plan

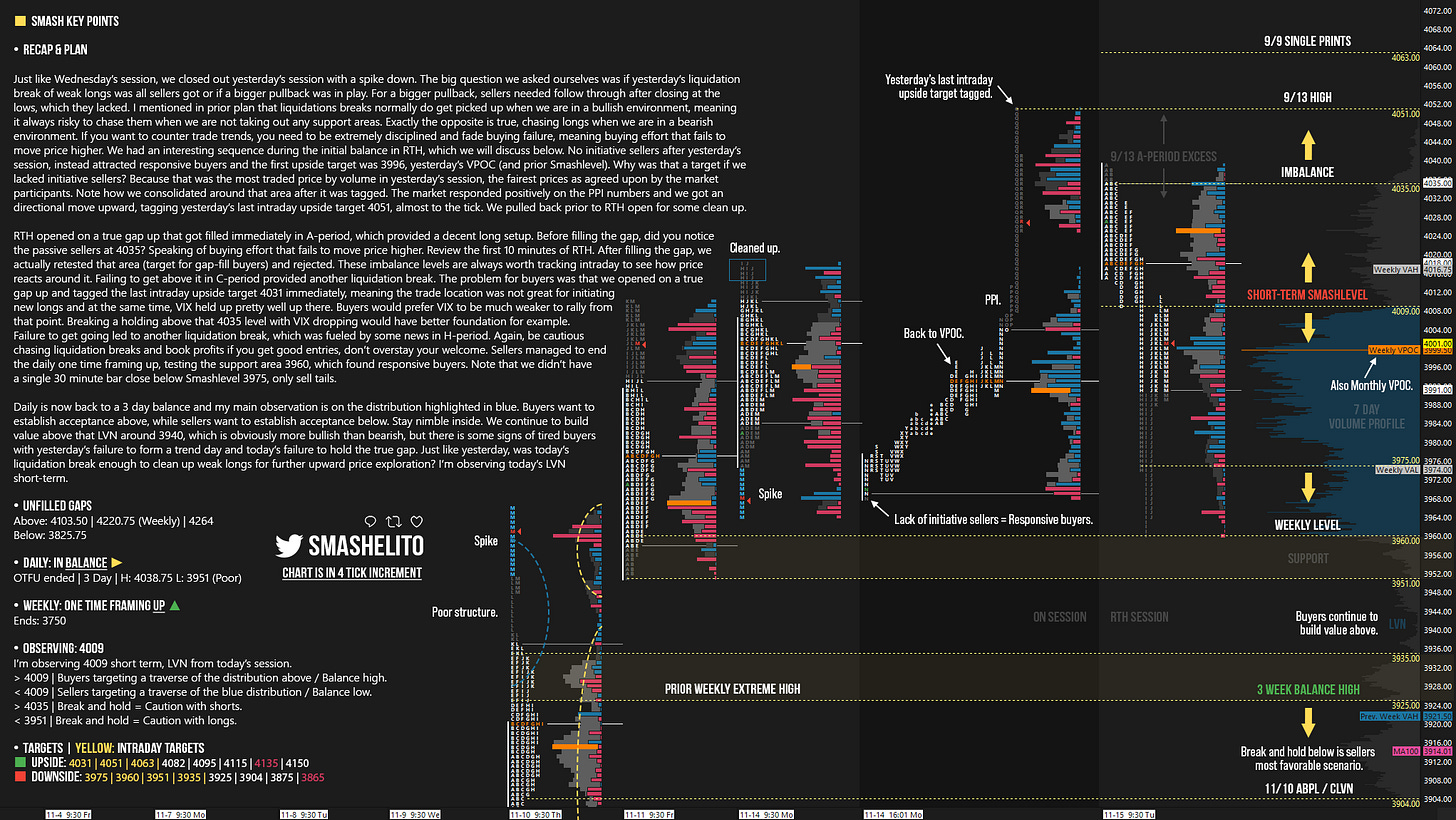

Just like Wednesday’s session, we closed out yesterday’s session with a spike down. The big question we asked ourselves was if yesterday’s liquidation break of weak longs was all sellers got or if a bigger pullback was in play. For a bigger pullback, sellers needed follow through after closing at the lows, which they lacked. I mentioned in prior plan that liquidations breaks normally do get picked up when we are in a bullish environment, meaning it always risky to chase them when we are not taking out any support areas. Exactly the opposite is true, chasing longs when we are in a bearish environment. If you want to counter trade trends, you need to be extremely disciplined and fade buying failure, meaning buying effort that fails to move price higher. We had an interesting sequence during the initial balance in RTH, which we will discuss below. No initiative sellers after yesterday’s session, instead attracted responsive buyers and the first upside target was 3996, yesterday’s VPOC (and prior Smashlevel). Why was that a target if we lacked initiative sellers? Because that was the most traded price by volume in yesterday’s session, the fairest prices as agreed upon by the market participants. Note how we consolidated around that area after it was tagged. The market responded positively on the PPI numbers and we got an directional move upward, tagging yesterday’s last intraday upside target 4051, almost to the tick. We pulled back prior to RTH open for some clean up.

RTH opened on a true gap up that got filled immediately in A-period, which provided a decent long setup. Before filling the gap, did you notice the passive sellers at 4035? Speaking of buying effort that fails to move price higher. Review the first 10 minutes of RTH. After filling the gap, we actually retested that area (target for gap-fill buyers) and rejected. These imbalance levels are always worth tracking intraday to see how price reacts around it. Failing to get above it in C-period provided another liquidation break. The problem for buyers was that we opened on a true gap up and tagged the last intraday upside target 4031 immediately, meaning the trade location was not great for initiating new longs and at the same time, VIX held up pretty well up there. Buyers would prefer VIX to be much weaker to rally from that point. Breaking a holding above that 4035 level with VIX dropping would have better foundation for example. Failure to get going led to another liquidation break, which was fueled by some news in H-period. Again, be cautious chasing liquidation breaks and book profits if you get good entries, don’t overstay your welcome. Sellers managed to end the daily one time framing up, testing the support area 3960, which found responsive buyers. Note that we didn’t have a single 30 minute bar close below Smashlevel 3975, only sell tails.

Daily is now back to a 3 day balance and my main observation is on the distribution highlighted in blue. Buyers want to establish acceptance above, while sellers want to establish acceptance below. Stay nimble inside. We continue to build value above that LVN around 3940, which is obviously more bullish than bearish, but there is some signs of tired buyers with yesterday’s failure to form a trend day and today’s failure to hold the true gap. Just like yesterday, was today’s liquidation break enough to clean up weak longs for further upward price exploration? I’m observing today’s LVN short-term.

Disclaimer: Futures and options trading involve high risks with the potential for substantial losses. The information contained in this communication is for informational purposes only and does not constitute a trade recommendation and should not be construed as such. The reader bears responsibility for any investment decisions and should seek the advice of a qualified securities professional before making any investments. Owners/authors of this newsletter are not certified as registered financial professionals or investment advisers.

Twitter: @smashelito | FAQ: smashelito.com